A REIT mess: the fallout from the not so mini budget

The impact of the recent ‘mini budget’ was fast and furious with gilt yields spiking sharply higher and the pound dropping like a stone. There was a real risk of contagion, so the Bank of England had no option but to intervene and although it has calmed things down the damage had already been done.

If the government continues with its growth plan – minus the cut in the 45p tax band − the markets are going to have to get used to the idea of higher than expected interest rates. This will push up the discount rate used to value risk assets, hence the recent sharp falls in the equity and bond markets.

There have been some particularly interesting moves in the investment trust sector. Looking at the period from close on Thursday 22 September, the day before the mini budget, to close on Friday 301 there have been lots more fallers than risers with some of the more noteworthy examples highlighted below.

REITs take a tumble

One of the most interest rate sensitive areas are the Real Estate Investment Trusts (REITs) with those more exposed to the domestic economy taking a bit of a battering. Two of the biggest casualties are the Warehouse REIT (LON: WHR) and Urban Logistics REIT (LON: SHED) with share price falls of 19.6% and 16.5% respectively.

According to the broker Winterflood, they are now trading on massive discounts to the last published NAVs at the end of March of 38% and 31%. This suggests that there is a lot of bad news priced in, especially if they can maintain their distributions and sustain the near six percent yields.

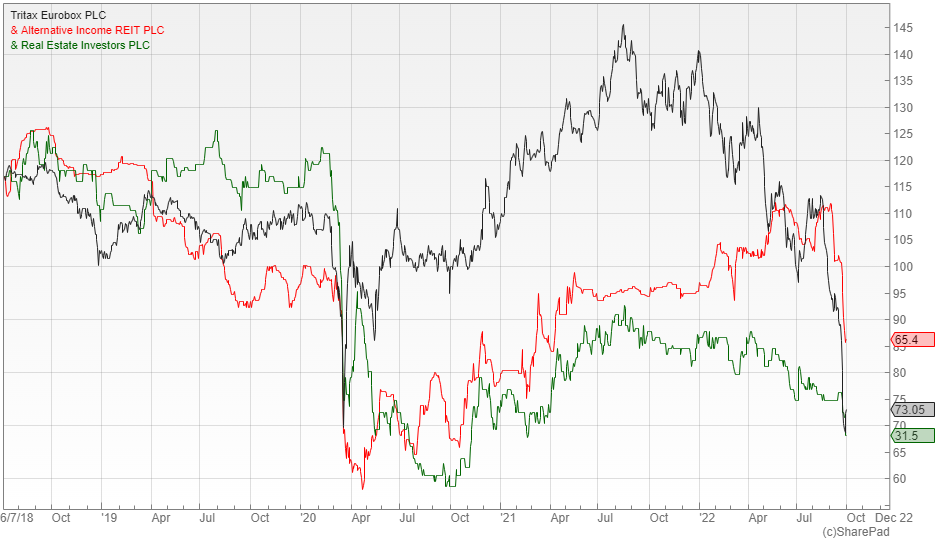

Other REITs that are down more than 10% since the mini budget include: Tritax Eurobox (LON: BOXE) with a fall of 16%, Alternative Income REIT (LON: AIRE) down 14.5% and Real Estate Investors (LON: RLE) 10.6%. These are now trading on discounts to the last published NAVs of 49%, 32% and 50% respectively.

Infrastructure and music royalty trusts

Investors in some of the infrastructure trusts have also been badly affected, although they have recovered some of their losses. The Renewables Infrastructure Trust (LON: TRIG) was down 13.3% by close last Friday, Octopus Renewables Infrastructure (LON: ORIT) 10.3% and Greencoat UK Wind (LON: UKW) 8.95%.

These sorts of investments are particularly vulnerable to higher discount rates resulting from the spike in gilt yields. Even normally steady performers like HICL (LON: HICL) have been caught up in the volatility with an initial fall of more than 10%, albeit that it has now clawed back most of the decline.

The music royalty trusts that supposedly offer a less correlated source of income have been far from immune with the increase in the discount rate undermining the attractiveness of their returns. Round Hill Music (LON: RHM) shares are down 10.8% in the period and now trade on a discount to the last published NAV of 28%, while Hipgnosis Songs (LON: SONG) has declined 11.1% and is available on a discount of 37%.

These are volatile times and when government policy lacks credibility almost anything can happen. Only time will tell if these large discounts will turn out to be a good buying opportunity or if there is worse still to come.

1 All returns data from Sharepad.

Comments (0)