A possible buying opportunity: Woodford Patient Capital Trust

Neil Woodford is one of the most highly regarded fund managers operating in this country, but despite all his skill and experience his Woodford Patient Capital Trust (WPCT) has generated a negative return over its first nine months of existence.

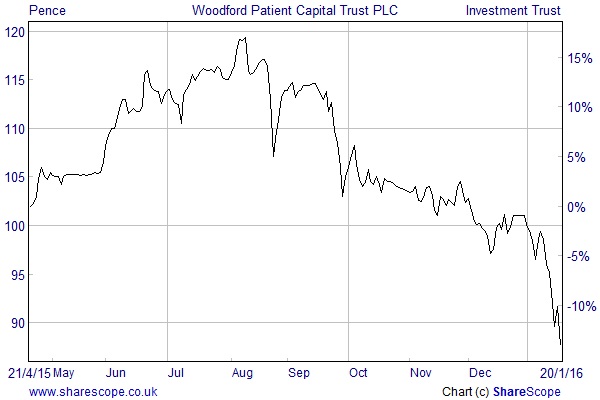

WPCT was launched on April 21st 2015 and quickly rose above the issue price of a pound a share, hitting a peak of 119 pence in August. Unfortunately it has been all downhill since then with the sell-off gaining momentum in January as the shares fell below 90p and the initial premium to Net Asset Value (NAV) was all but wiped out.

The investment trust aims to achieve long-term capital growth by investing in a portfolio that mainly consists of quoted and unquoted UK companies. It will attempt to produce a return of more than 10% per annum over the longer term, although this is only a target and is not guaranteed.

Woodford has put together an interesting portfolio with 30% invested in mature mid and large cap listed stocks with significant growth opportunities, a further 23% has been allocated to early growth shares, while the balance has gone into early stage companies. About two-thirds of the £800m fund is held in quoted stocks, with the rest in unquoted shares.

The basic idea is that the lack of financing for the early growth and early stage companies means that there is significant upside potential, although investors will need to be patient as it will take time to realise a profit from these sorts of holdings.

It is quite a concentrated portfolio with the ten largest positions making up 40% of the fund. Eight of these are Healthcare stocks, which is by far and away Woodford’s favourite sector of the market and accounts for 64% of the assets.

Another unusual aspect is the fee structure. There is no annual management charge whatsoever, which is why the ongoing charges of 0.2% are about the same as what you would pay for an ETF. In its place there is a performance fee of 15% of any excess return over a 10% cumulative hurdle rate per annum, subject to a high water mark.

It has recently been announced that there is a substantial ongoing pipeline of investment opportunities and that the Board is considering different options for raising additional capital at some point in 2016. There will be a consultation with investors before this happens.

In spite of the recent poor performance the shares still trade close to the underlying NAV, which is probably due to Woodford’s reputation and reflects the faith that investors have in his talents. If it was run by anyone else it would probably be trading at a large discount.

The investment trust team at Winterflood think that the WPCT strategy is a natural extension of the approach that Woodford has honed over the course of his career. They also point to the unusual fee structure and suggest that this shows his confidence in the fund and incentivises the managers to make a success of it.

Woodford Patient Capital Trust has had a difficult start but the recent sell-off has wiped out the large premium to NAV that accompanied the launch. For risk-tolerant, long-term investors this could be a decent buying opportunity.

Comments (0)