Polypipe shares drop as profits disappoint

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

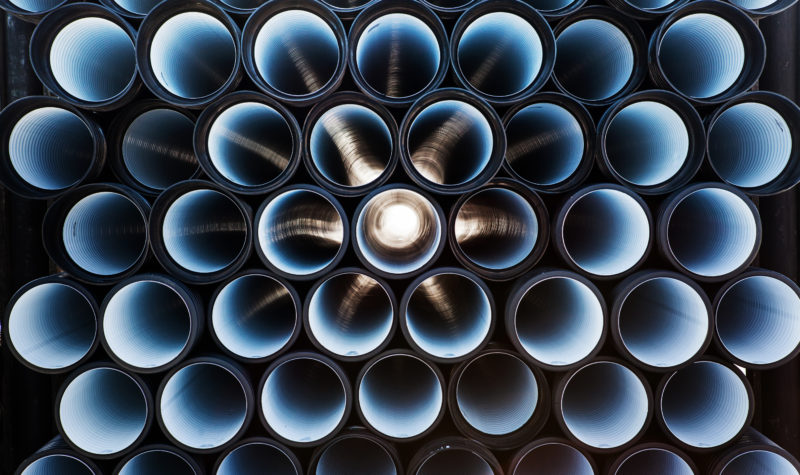

FTSE 250 water and climate management products firm Polypipe (LON:PLP) reported a 4.7% improvement in pre-tax profits for the year ended 31st December which failed to meet some analysts’ profit forecasts. Revenues for the period climbed by 5.2% despite difficult market conditions, driven by strong residential systems growth.

Chief executive officer Michael Payne commented: “We are delighted to report another record performance, despite a backdrop of challenging market conditions. Our second half of the year was strong, and we completed two significant acquisitions as part of our strategy to broaden our market offering. Both Manthorpe and Permavoid are performing in line with expectations and we look forward to further progress. We continue to see strong cash generation, and the long-term growth drivers of legacy material substitution and legislative tailwinds, together with our strong balance sheet, position us well for the future“.

Polypipe’s share price fell by 5.94% to 406.89p (as of 15:30 GMT).

Comments (0)