IQE shares take a hit after difficult 2018

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

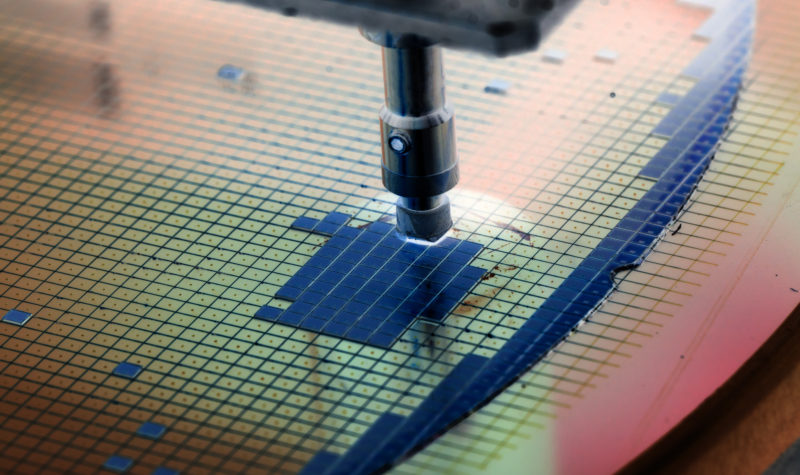

AIM-listed semiconductor firm IQE (LON:IQE) has announced that EBITDA for the year ended 31st December dropped by 28.9% as it faced currency headwinds and a larger portion of its revenues came from lower margin wireless products. Profits before taxation fell by 43% to £14 million.

Chief executive Dr Drew Nelson commented: “2018 was a very difficult and challenging year for IQE group from many perspectives; including the tragic and untimely death of Phil Rasmussen. Our disappointing 2018 financial performance was materially impacted by a very substantial VCSEL inventory correction in the first half of 2018 and the sudden disruption in a highly significant supply chain causing greatly reduced short-term demand for VCSEL wafers during the last two months of the year. Compounding this is the current well-heralded softness in the smartphone market.

This overshadows and disguises the excellent position and prospects of IQE which should not be defined by this short-term impact on our growth trajectory and profitability. Revenue increases in 2019 will be driven by the return to strong growth of our photonics business and emerging opportunities in 5G and will be soundly based on operational improvements, rationalisation and capacity expansions that have been in progress for the last two years and which will complete in H1 2019“.

The price of IQE shares had declined by 6.71% to 77.80p as of 12:50 today.

Comments (0)