DS Smith wraps up 2018 with a good set of results

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

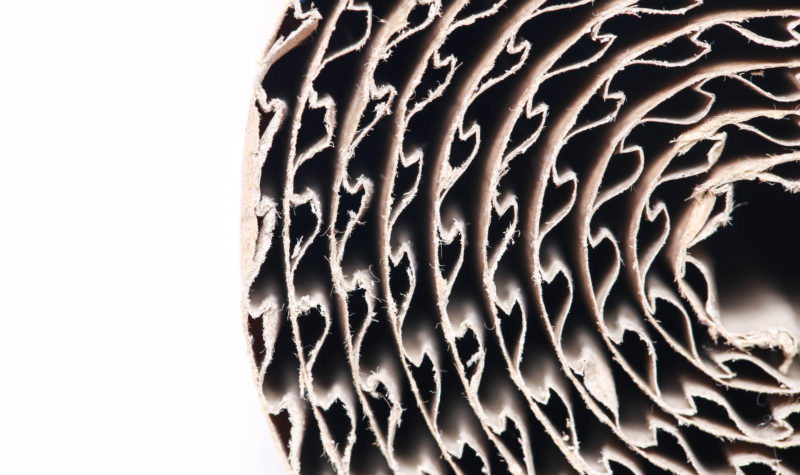

Shares in FTSE 100 packaging firm DS Smith (LON:SMDS) rallied 6.56% to 365.70p (as of 12:45 BST) after the company reported a 35% improvement in profits before taxation for the year ended 30th April. Revenues were up by 12%, as the company saw volume growth across all segments and successfully completed the acquisition of Europac.

CEO Miles Roberts commented: “This strong set of results from DS Smith demonstrates the company’s growing scale and strategic progress in key markets. We are continuing to gain market share throughout Europe, particularly among more resilient FMCG customers, and our US business is performing well following our recent acquisition there.

“I am very pleased to be able to raise our medium-term return on sales target, up to 10 – 12 per cent, as well as adding to our cost synergy estimate following successful initial progress in integrating Europac, which we acquired during the year. DS Smith is increasingly well-placed to capitalise on rising consumer demand for sustainable corrugated packaging as well as greater convenience from both e-commerce and more traditional retail channels.

“The underlying drivers of demand for sustainable corrugated packaging and our differentiated offering give us confidence in ongoing volume and market share growth. We saw some volume weakness in certain export-led markets in the second half of 2018/19, including Germany, but we expect this to improve during the current year. While volatility in the macro-economic environment and input costs remains, our focus on pricing discipline, operating efficiencies and cash flows supports our expectations of further good progress in the coming year“.

Comments (0)