Twitter: An Undervalued Growth Play?

Twitter looks like an undervalued growth play, especially after Microsoft’s acquisition of LinkedIn.

Summary

– Twitter is currently trading at $16.34, down 26% after my recommendation in Jan 2016. However my fundamental thesis from Jan 2016 remains intact.

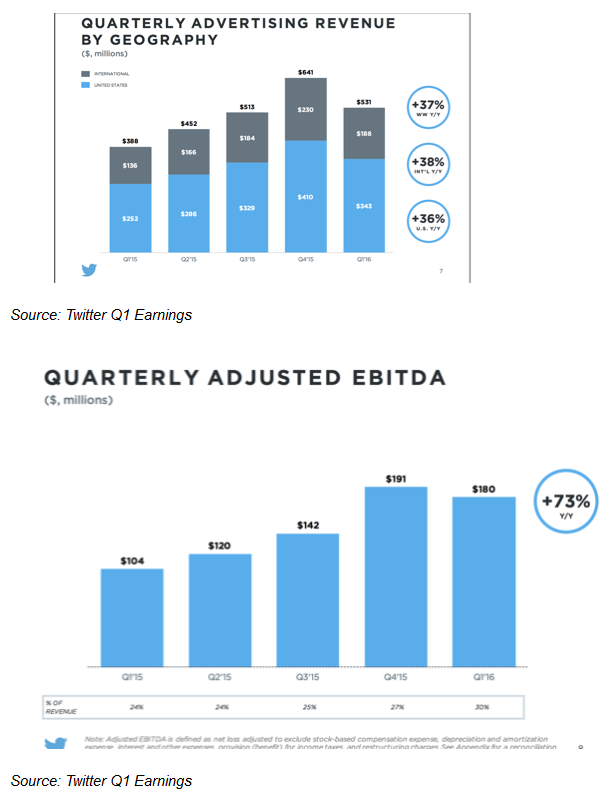

– While user growth has been stagnant, resulting in the decline of the stock, the company continues to grow revenue at 35% YoY, and EBITDA at 73% (Source: Q1 results). The company also generated net cash from operations of about $400m in 2015.

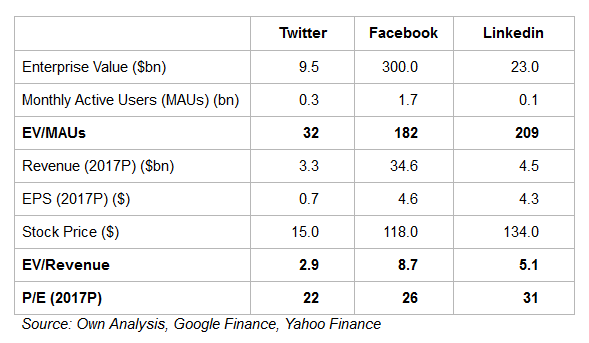

– The stock currently has an Enterprise Value of $9.5bn, and with a 2017 forecasted EV/Sales ratio of less than 3 times, it appears attractive from a value perspective.

– The company trades at a much lower valuation than several private companies, who have yet to even prove significant revenue and net cash from operations – Uber ($68bn), Airbnb ($25bn), SnapChat ($22bn), WeWork ($16bn), Dropbox ($10bn).

– Microsoft recently paid $26bn for LinkedIn, a 49% premium to LinkedIn’s stock price. Goldman Sachs have predicted a 15% probability of seeing the strategic acquisition of Twitter. Twitter’s stock has already rallied more than 15% after LinkedIn’s acquisition.

– I do have some concerns – a part-time CEO, poor curation of tweets, and automation on the site.

– You can track real-time and relevant financial news and tweets for Twitter on our FinTech platform CityFALCON.

Disclosure

I’m Long Twitter, and I have a business relationship with Twitter through my FinTech start-up CityFALCON.

Limitation of Analysis

Data has been accumulated from different sources, which may have varying definitions of financial metrics, and hence, this analysis should be considered as indicative, and investors should conduct their own due diligence before making any investment decisions.

Twitter is down 77% from its high of $69.00 in January 2014

The majority of this decline can be attributed to changes in market sentiment due to stagnating user growth, and overall market depreciation as a result of slowing Chinese growth and other global macroeconomic factors. The overall market has recovered from this volatility, but the stock has struggled to recover in line with the market.

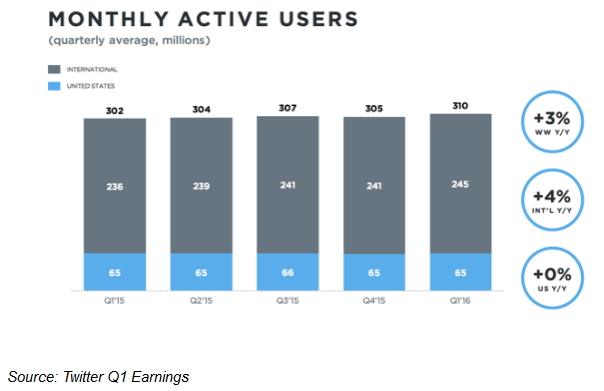

Growth in monthly active users has stagnated…

…however the Company is still growing revenue and EBITDA

Twitter remains relatively inexpensive, when compared to Facebook and Linkedin

In summary, with an EV of $9.5bn, most inherent risks have already been factored into the price and the downside remains limited. I’ll continue to add more of the stock on declines as long as my fundamental thesis remains valid.

Comments (0)