Should you invest in coal-to-power?

The risks are high and the rewards are slow to materialise, but the rewards are sometimes large. It’s only partly a matter of timing when it comes to coal-to-power, writes John Cornford.

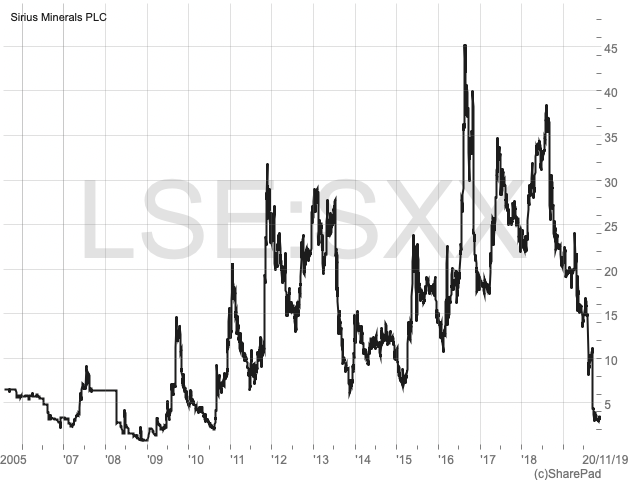

Engineering projects, infrastructure projects, and junior miners – they’re the same really, only named differently. One of my first ‘mining’ articles in 2015 covered the coal-to-power projects, just then coming to attention on AIM through Oracle Power (LON:ORCP), Kibo Energy (LON:KIBO), and Ncondezi Energy (LON:NCCL) (re-named subsequently to reflect their switch from a pure coal miner to a power station developer, when their external coal markets fell away). Later, I discussed Sirius Minerals (LON:SXX) and its dangers.

Developers not owners

These companies are ‘developers’, and not ‘owners’ – the cause of much misconception. Even professional investors and analysts find it hard to understand them, let alone AIM’s private investors. Their attraction is that they are in charge of (ie hold licences for) very big ‘projects’ with completed values orders of magnitude larger than their own usually modest market caps. Surely some of that will rub off on them?

The description ‘sponsor’ (they never call themselves that, even though it is the correct legal term – they’d rather investors think of them as ‘owners’) is accurate, because before a spade is in the ground there is nothing to own – only plans and licences and permissions, and later perhaps, contracts with world-class builders and, increasingly in Africa, Chinese banks. Their projects will only have a value when everything, including the funds to build, comes together and construction completes. Up to that point there is nothing, unlike a mine which might still have something ‘in the ground’.

But even when completed, a ‘sponsor’ won’t ‘own’ the value of its project. That can only happen if it puts up a meaningful proportion of its much larger capital cost which, generally, is provided by those world-class builders and bankers, which is why they are known as the ‘backers’.

| Master Investor Magazine

|

The sponsor, meanwhile, if the project goes ahead, will be credited, as a deemed contribution to the cost, with the value of the planning work it has done, and perhaps some element of a fee. And in addition – and only if the completed value of the project is sufficient – the backers might award the sponsor a ‘development premium’, being a share of any ‘profit’ on completion. (But see later.)

So, while a sponsor doesn’t probably know what value it will end up with, it almost never knows what costs (for development, and to cope with the inevitable delays) it will incur before getting there. And if the sponsor doesn’t know that, how can an investor know what value to put on the sponsor’s shares?

Without a clear view of value, and how much will flow through to them, investors might refuse to cough up funds to keep the sponsor going (the investor all the while seeing his shares being diluted), and the sponsor will go bust.

And although you’d think the builders hoping to build, and a government wanting a power station it can’t afford, won’t allow that to happen, they sometimes do, and pick up the assets (work done so far and maybe the attached coal mine and the licence it has awarded on condition the sponsor delivers the power station) cheaply themselves.

It’s for that reason that I compare such ‘sponsor’ companies to a tiny dinghy, which has somehow attached a cable to a supertanker in distress and is therefore is in line for eye-watering salvage money, but at the risk of a slight alteration in tide or wind (aka market conditions and cost over-runs) blowing the tanker over to crush it.

So it is that the inexperienced are led astray (often by the ‘sponsor’, desperate to get in the cash to keep going). Sometimes they are led to think that the whole value of the completed project (its NPV – ie net present value) will belong to them, which it won’t do unless they have put up all the cost.

Beware analyst’s ‘target’ prices

Analysts pushing the shares (always on behalf of the sponsors – there is no source of objective and unbiased opinion available for main market shares, let alone on AIM) often put up a pretence of estimating what proportion of ownership the sponsor will end up with, so as to produce a ‘target’ share price. (But see my past coverage of Sirius Minerals to understand why that is wrong.)

And in order to produce an attractive looking ‘target price’, they will minimise the sponsor’s costs and the shares it needs to issue to get there, although, with one dishonourable exception, most of these companies have vaguely warned investors to expect unknowable share dilution.

In fact, I have seen no credible calculations yet, by any broker, of the share price a developer might expect once his project is complete. That applies to all such projects, including Infrastrata (LON:INFA), the relative newcomer hoping to develop a large gas storage project in Northern Ireland. Sometimes, they display little knowledge of the business environment regarding, for example, power stations in Africa, using methods that may be appropriate for an oil exploration company (‘risked’ values, and ‘recovery probabilities’), or to estimate a ‘development premium’ that the sponsor will earn on top of any credit for its work, as was possible for a UK property developer in the up-to-now booming UK market, when it could sell its completed project at a large profit.

Unfortunately, power stations that depend on governments to guarantee their incomes, are ‘built down’ to those incomes, so it’s not worth anyone else other than the original backers buying unless they have ready cash and are happy to accept a lower return.

Investors’ perceptions of these risks verses rewards play out in sponsors’ share price charts. Spikes when unwary investors pile into what they think is a way to ‘own’ a valuable project (usually after some sponsor presentation) are followed inevitably by sharp reverses. See the charts for the companies we mention, and add GCM Resources (LON:GCM) (formerly Global Coal Management), ‘sponsoring’ what could be a giant power project in Bangladesh.

| Master Investor Magazine

|

The risk has of course come home to Sirius Minerals, while Kibo Energy’schart is saying it might be going the same way.

In the case of Sirius Minerals, although a revised down-sized project plan is being mooted, the shares are saying that Sirius, the original ‘sponsor’, will go bust, losing present shareholders everything. But as a potentially attractive project, who knows – maybe someone with deeper pockets will step in to revive it, while leaving the present shareholders out in the cold.

The rewards are still out there – if you know where to look

However, large rewards for investors can still be there. Two out of four of my original coal-to-power plays look on track for salvage money (Oracle Power some way away and Ncondezi Energy relatively soon). But Kibo Energy, in my view, not only has failed to keep its investors informed about all aspects and costs of its projects, so that they have lost faith, but has made the classic mistake of taking on too many at once. Which means any value per share that its first project to complete would have delivered on its own will have been diluted down by the shares needed to develop its follow-on projects, damaging the share price when raising further funds, and causing a self-inflicted downward spiral.

After years of false starts, Kefi Minerals (LON:KEFI) also now looks like delivering, and with all agreements in place should see its shares rise up to first gold production some time in 2021 (let’s say 2022). If gold stays at $1.500/oz, the latest company estimate is that Kefi’s 45% share of its Tulu Kapi project (there are others) is for an 8% NPV of $137m at start of production (ie after capex is spent) – equal to10p per the near 1bn current shares after the recent conversion of all outstanding loan notes.

However, readers will know I don’t believe a theoretical NPV per share is ever fully achieved. Researcher Edison forecasts share values more logically by projecting the dividends Tulu Kapi will be able to pay, which they say justifies a share price more like 4p. I, personally, have sold some of mine at 1.8p to await a lull which I expect once the current upward surge temporarily runs out of steam.

Ncondezi Power,which was the pick of my four coal-to-power shares back in 2015 (Kibo was the least attractive) could also now be on the verge of delivering its reward, with all the necessary financial and construction backers and government approvals almost signed up for the first 300MW stage of its planned 1,200MW power station in Mozambique.

Ncondezi has suffered its share of delays and the accompanying need to raise funds to keep going, but it started out better capitalised with stronger institutional backing than did Kibo, as well as having spent more on developing its one key project without the same ballooning shares. So the substantial sum, larger than its present market cap, that it stands to receive in repayments of its costs when all is finally signed up by end 2020, will not only earn it a larger share of its completed project, but will be worth more to the share price.

However, changes to Ncondezi’s design and to how its coal mine will be financially integrated with the power station have meant investors have little up-to-date information about the plant economics and the profits likely to flow through to them, so no capable analyst has yet made forecasts. That is likely to change, the company having promised to release more such information soon. My own estimate for what it is worth is that the shares currently are between 1/4 and 1/3 their likely price once the deal is signed next year. Meanwhile, the company still needs some funding to keep going, details of which may be announced at the forthcoming November 29th AGM. I am holding on to my not insignificant (for me) shareholding.

Never miss an issue of Master Investor Magazine –

Never miss an issue of Master Investor Magazine –

Comments (0)