Renewi – real money from waste makes its shares highly attractive

Less waste and contamination, a smarter use of raw materials, a reduction in carbon emissions and helping to slow global warming – that is just what this group is all about.

And, at the same time, it makes money for its shareholders.

The business

Founded way back in 1880, the company, which was formerly known as the Shanks Group, changed its name to Renewi in February 2017.

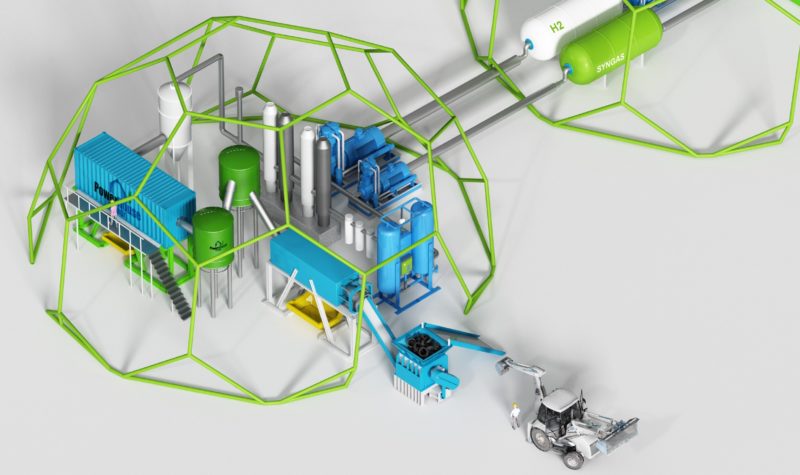

Today the European group is a leading waste to product company, which turns its residual materials into secondary raw materials.

The group draws upon innovation and the latest technology to turn waste into useful materials – paper, metals, plastics, glass, wood, building materials, compost and energy.

It employs over 6,500 people, spread across 165 operating sites in 6 countries across Europe and the UK.

The company is recognised, not only as a market leader in Benelux, but also as a regional European leader in recycling.

What it does

Last year it recycled 2.7bn bottles, it recycled 2.2bn newspapers into paper and card, and recycled rubble into enough material to build 15,000 new homes, while it also treated some 900m litres through water treatment.

The group’s vision is to be the leading waste-to-product company in the world’s most advanced circular economies.

By opting to recycle, the company avoids emissions of more than 3m tonnes of CO2 and as a result it plays a part in contributing to a sustainable society, transitioning to a circular economy and driving the progress needed to halt climate change.

Not only does it provide its waste-to-product services in the UK, but also in the Netherlands, Belgium, France, Germany, Hungary, Portugal, Canada, and Luxembourg.

The company operates through three main segments – Commercial Waste, Mineralz & Water, and Specialities.

It is involved in the collection and treatment of commercial waste; industrial cleaning and treatment of hazardous waste; and operation of waste management facilities under long-term municipal contracts.

The company also produces materials from waste streams, such as glass bottles, discarded electrical and electronic equipment, food waste, source separated organics, minerals, and incinerators’ bottom ashes.

In addition, it provides clean water and soil, and inert ash.

Renewi serves factories, offices, hospitals, retail, shops, and restaurants; heavy industry, petrochemical sites, oil and gas production, and the food industry; and building and construction markets.

Such a useful process

It recycles over 65% of that really is putting something back in sense – for Renewi their slogan is ‘waste is a state of mind, an opportunity’ – you cannot argue with such principles.

And, as I stated earlier, it makes real money in the process.

The Equity

There are some 80m shares in issue.

The larger holders include Notz, Stucki Europe (5.95%), Paradice Investment Management (5.81%), SPICE ONE Investment Cooperatief UA (5.00%), BNP Paribas Asset Management Netherlands (4.32%), Avenue Europe Management (3.74%), Bank of America Private Banking (3.37%), Citigroup Global Markets Investment Management (3.23%), Henderson Global Investors (3.22%), ACTIAM (3.04%), Farringdon Netherlands (2.95%), and Beach Point Capital Management (2.44%).

The January Trading Update

At the end of January, the group declared its Third Quarter Trading Update, stating that overall, it had seen continued strong business, helped significantly by high recyclate trade prices.

It led to material upgrades in market expectations for the year to the end of this month.

Latest Update

On Wednesday of this week the group issued a Pre-close Trading Statement. It stated that for the period up to 31 March, trading had remained strong and it anticipated reporting ahead of market expectations.

It also declared that the group’s management remained confident in both the medium and the long-term outlook, with its strategic growth programme being on track to deliver significant additional earnings over the next three years and beyond.

“We continue to see positive structural growth drivers as Dutch and Belgian regional governments progressively tax carbon emitters, incentivise recycling over incineration, and promote the use of secondary materials.

This translates to positive growth opportunities across Renewi’s markets as we assist our customers in recycling more and in using our high-quality secondary materials.”

Broker’s View

On the back of that update and subsequent views, analyst Colin Smith, at brokers Arden Partners, is now estimating that group sales will rise from €1.69bn to €1.86bn, almost doubling adjusted pre-tax profits in the process.

He goes for €94.7m against €47.4m, jacking earnings up from 45.1c to 89.8c per share, helping a return to dividends this year of 4.5c (nil), that is to end March 2022.

Arden Partners rates the shares as a ‘buy’ looking for 900p in due course.

My View

I just love this company, it has been a real winner for readers since my first profile on the company seventeen months ago, and it continues to look undervalued.

In the last year the shares have been up to 855p, last night they closed at around 684p, at which level I really do consider that they are still offering significant upside.

Hold very tight, its finals are due to be declared in mid-to-late May.

I now set a new Target Price of 850p, which I consider is easily achievable within the next year or so.

(Profile 09.10.21 @ 240p set a Target Price of 350p*)

Comments (0)