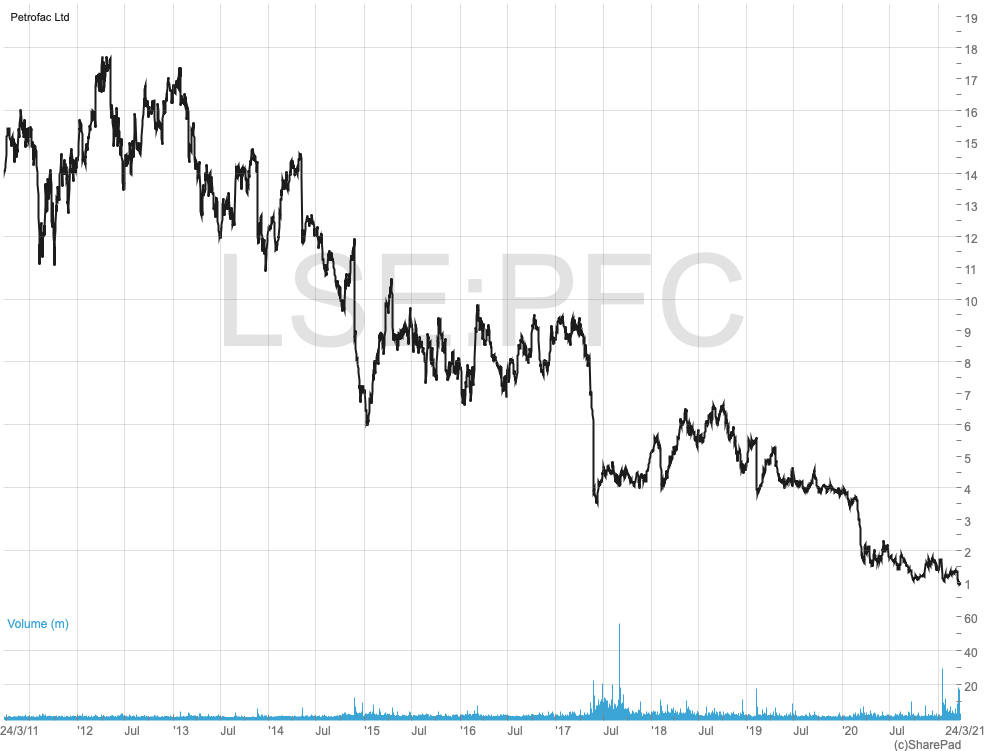

Petrofac: is it time to buy into this battered stock?

Shares in oilfield services provider Petrofac (LON:PFC) plunged yet further last week after a former executive pleaded guilty to attempting to influence the award of contacts in the United Arab Emirates which then barred the company bidding for future contracts.

The stock is down a whopping 47% in the last 12 months and reached a year low of 95.46p after this latest chapter in a bribery scandal that has been rocking the company since 2017 and also involves contracts in Iraq and Saudi Arabia.

What investors have to consider now is whether the company, which has otherwise done much to try to improve its fundamentals in the last year, will be able to draw a line in the sand and move on from the affair and whether it’s now therefore a buy.

UAE bidding ban will hurt

Former executive David Lufkin pleaded guilty to 14 charges of bribery brought by the UK’s Serious Fraud Office. The UAE contracts are worth $3.3 billion. In Iraq the SFO said the contracts were in excess of $730 million while in Saudi Arabia they were in excess of $3.5 billion.

The UAE accounts for almost a third of the company’s bidding pipeline. The suspension is subject to review so there’s hope for Petrofac that it’s not permanent. It’s also allowed to continue on two small projects in the UAE but in sum this is going to hurt and damages visibility on its pipeline.

Concerning Saudi Arabia and Iraq, these countries are not yet included in its bidding pipeline but losing a $3.5 billion contract and a consequent loss of orders from Saudi Arabia and Iraq has already dragged down overall orders in 2019 (Lufkin pleaded guilty to charges related to contracts in those countries in February 2019).

Company results reflect lower orders

In its 2020 outlook, Petrofac said the market was improving but that it expected to see a decrease in group revenue reflecting low new order intake in recent years. It has postponed its results announcement to April from February because of auditing complications as a result of the pandemic.

Let’s not forget the pandemic. The company has of course suffered along with everyone else in the industry. It said in a December trading update that orders were down, clients were adopting tough commercial conditions and that profitability would be down on 2019.

At the same time though, Petrofac has launched a cost-cutting process and what it calls “right-sizing” program in light of the lower orders. It said it has strengthened its balance sheet, although there are some one-off outflows from the sale of its Mexican assets, and improved liquidity.

SFO investigation continues

The SFO has yet to close its case. It said its “investigation into the activities of Petrofac, its officers, employees and agents for suspected bribery, corruption and money laundering continues.” We can at least expect fines (although the market has likely priced these in by now).

Last year, Fitch gave a BBB- outlook negative on Petrofac but it did say “we believe that the potential one-off payment related to the Serious Fraud Office (SFO) investigation is mitigated by sufficient liquidity headroom and expected disposal proceed.”

Analysts have been lukewarm on the stock. Barclays cut it to ‘equal weight’ from ‘overweight’ in December because of a weaker-than-expected 2021 outlook and gave a target price of 230. Morgan Stanley had earlier in the month raised its target price to 155.

With the sharp falls last week, Petrofac definitely becomes more interesting and penalties concerning the contracts should be priced into the stock already. Given the detail in its December trading update, there shouldn’t be any nasty surprises in the April results either.

This article was brought to you in partnership with The Armchair Trader.

Emma Portier

Emma Portier has more than 20 years’ experience as a financial journalist, starting out as a regulatory correspondent for Euromoney and then joining the Financial Times group as a wealth management writer. She has spent several years as a financial markets reporter for AFX News in Stockholm and then as an EU antitrust reporter in Brussels where she then joined Reuters.

Emma’s core expertise is following EU regulatory developments and how these affect financial markets. She set up the climate change and energy news service for the regulatory risk news agency MLex and then worked as a special EU correspondent for the Bureau of National Affairs. Emma has advised key players in Brussels on their media relations strategy and provides content to a range of private and institutional clients.

Comments (0)