John’s Mining Journal: Place your bets…

Veteran mining analyst John Cornford reviews some of the more interesting plays in the junior mining sector…

As I suggested a fortnight ago, Solgold’s (LON:SOLG) ‘log-jam’ might take longer to free than some hoped after the BHP lock-in ended last week. The shares initially retraced from a strong 40-42p chart resistance level going back three years, despite the promise that Solgold’s new ‘discovery’ at Porvenir will add substantially to the value it already has at Alpala.

As I see it, however, that old jam hasn’t been freed at all. It is still there in the form of the key shareholdings (Newcrest, BHP, Cornerstone, Black Rock) which would have to be ‘unlocked’ before enough are freed for anyone else to think of bidding. Otherwise, there would seem to be no hurry for any interested bidder to do anything, while Solgold shoulders the cost of further exploration drilling.

So perhaps my warning that investors would start to focus on that cost some time next year wasn’t so premature. Meanwhile, Solgold’s Nick Mather promises that the forthcoming Alpala PFS, and news of ‘conditional’ funding for Alpala, will further improve his defences.

So far, however, any share price improvement is stemming from the initial drilling success at Porvenir. More might come with news from another ‘promising’ target, closer to and possibly even larger than, Alpala or Porvenir, Rio Amarillo, where drilling is just starting.

But, as for Mather’s strategy to take his discoveries to production rather than selling them off at financing stage in order to fund further exploration, I think it is increasingly being seen by others, as well as by me, as ‘for the birds’.

So maybe things will start to happen in smoke-filled rooms behind closed doors. What I don’t think will happen is any public bidding war. More likely is a farm-in by a major to participate in funding Alpala. Such development, I think, would give a more permanent boost to the shares.

If not that, there might be a two-way pull on them during the next six months between drilling success and fears of the next fund raise. And any news would have to be pretty significant to break through that 42p level.

I mentioned Emmerson (LON:EML), who are developing a potash fertiliser project in Morocco, in September, when I thought the shares, then 4.6p, might break out from their 3.5p-5.5p trading range. But they haven’t quite managed to do so, despite more news, delivered and expected, and despite a very bullish and comprehensive review a month ago by potash fertiliser specialist Shore Capital.

As I described some time ago, it was Shore who covered itself in bullish fertiliser back in 2016 with its grossly exaggerated share price targets for Sirius Minerals. Not that there is much of that this time – Sirius was quite unique in its size, cost, and ambitions to create an almost entirely new market for its product, so scepticism was always going to be strong.

As it is, Shore now highlights EML’s attractions within its peer group of more standard producers, its attractions stemming from a shallow deposit and nearness to potential markets. According to Shore’s estimates, this will place EML among the highest margins and lowest capital cost producers, while being relatively small and therefore easier to finance.

But it is the financing that is the key (as it was for Sirius) to the share price. Shore ‘targets’ over 20p by 2026 (much too far ahead to be any reliable guide now and, in any case, dependent on an NPV, which in my book renders it worthless unless halved).

But, nearer at hand it suggests 7p on a conservative assumption that only 55% of the $411m capital cost will be met through cheap project financing, with more expensive equity raised from shareholders at only around the present share price.

Investors will only know if that can be bettered once a finance package is agreed around the middle of next year. However, the CEO is talking of institutional investors arriving soon, which should mean they are happy that all the other necessary steps, such as permits, are in train, and that they think EML is cheap now.

But that is speculative at the moment, and in my usual prudent habit I would say it is probably too early to expect that 5p trading ceiling to be breached either soon, or very decisively. Any pullback would, naturally, be an opportunity.

Instead of looking at fertilisers as an inflation hedge, investors might prefer to believe some major banks’ forecasts that gold will eventually break out strongly from its current trading range. In that case, some of my goldies (and many of other commentators’ too) will see better medium term returns than EML. Cases in point reporting recently are Shanta Gold (LON:SHG) and Hummingbird (LON:HUM), while Scotgold (LON:SGZ) has a new presentation as I write.

KEFI’s (LON:KEFI) shares still have a long way to go once a new, complete financing package recently announced, is signed off, and their recent pullback on uncertainty how long that will take is giving another buying opportunity.

Shanta Gold has also proved to be a better short-term performer than I thought, even though my recommendation was because its acquisition, now complete, of Barrick’s high grade gold projects in West Kenya, ushers in a new era of growth and improved attraction to investors.

To help finance West Kenya and expansion of its existing mines, Shanta has just got away with a cheeky, larger than anyone expected but over-subscribed, £32m fund raise, expanding issued shares by 23%. That has set them back only modestly to the 16.5p issue price, against a recent trading range down to 15p. While subscribers ‘flipping’ their placing shares might slow them for a time, the recently announced scoping study for West Kenya (which will double Shanta’s historic gold production), showing an IRR above 100%, should keep them in the forefront of investors’ gold choices.

Anglo-Asian (LON:AAZ), which I advised avoiding a year ago even though it appears to be generating (temporarily) a lot of cash, might have been unfairly struck down by the Armenia-Azerbaijan fighting over part of its territory, and so might present a short-term recovery opportunity if fighting stops. But AAZ’s medium term need to replace its diminishing gold resources will stop a recovery at some point.

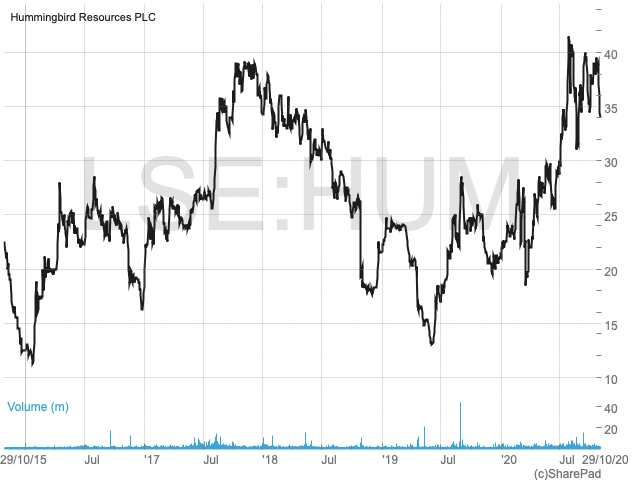

As for Hummingbird, I first commented (elsewhere) in Feb 2018 when I recommended selling, while certain analysts were strongly buying but omitting to mention (or to realise) that HUM’s relatively high grade Yanfolila mine was about to run out of gold. That was almost exactly the same situation as AAZ now finds itself in.

But unlike AAZ, HUM (which I was still recommending to avoid in MI’s September 2019 ‘Gold Thoughts’) turned its prospects around for the better in June this year with the acquisition of the 1Moz Kouroussa Gold project in Guinea and the divestment of some of its spending burden on the less profitable Dugbe gold project. Kouroussa could be producing 100,000 oz p.a. by 2022, generating some $350m of cash over the following five years (at $1,800/oz gold) in return for an up-front cost around $100m.

The shares responded with an immediate 50% rise on the news, but have stalled subsequently, as costs on HUM’s current Yanfolila operations are reported as rising due to Covid-19 and other operational problems. There is no detailed recent broker research that I know of to throw light on what will be HUM’s quite complicated finances over the next few years of spending on Kouroussa and Dugbe, and I don’t have the necessary time. So the shares might continue flat, but look like a buy on any weakness.

Comments (0)