Is AMC a Cast Away or a Titanic?

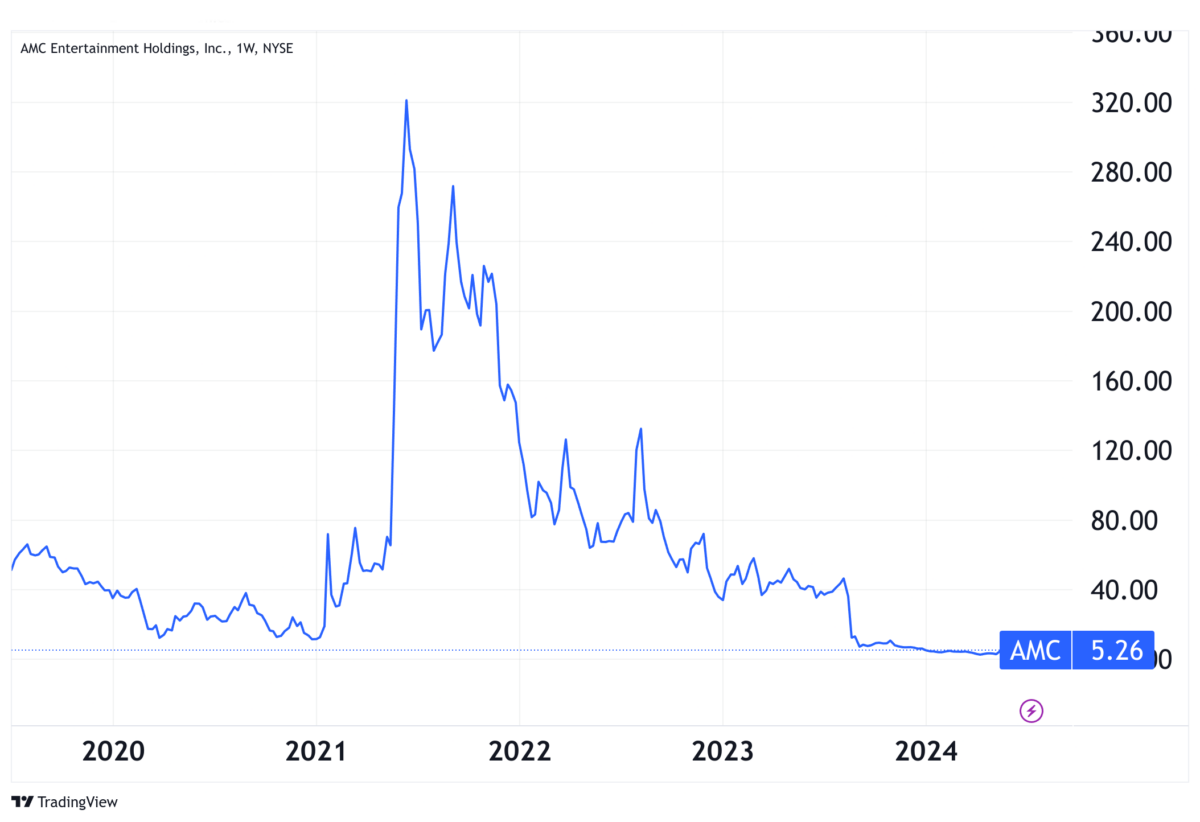

Is the cinema exhibition business over or will it be revived? Can AMC shed its huge debt load and return to profitability? These are some of the questions that have been on my mind lately, to which there are no easy answers. But, ultimately, I don’t think we should write off AMC. If it has survived so far, it will probably continue to do so. At $5.26, the shares are tempting, although they carry a lot of risk.

When short-listing stocks, I often use metrics to capture good fundamentals based on current profits and growth, financial health and some enterprise value multiples. Stocks that live on sky-high future projections make up a very small part of my selections, as I often feel uncomfortable thinking that the slightest downward revision will lead to a big drop in the price of these stocks. I prefer value to growth, I have to admit, not because there’s anything wrong with growth, but because growth is often too expensive. Today, however, I’m going to take a long shot on something that might not currently be considered either value or growth – AMC (NYSE:AMC). It’s not value because the company currently lacks the intrinsic value that other companies have, as it accumulates a huge debt load on a negative net asset value. It’s not growth either, because the expected growth looks more like a reversal of the pandemic than an optimistic forecast for the business. However, when the dust settles, I still think AMC has a good chance of reversing the terrible impact of the pandemic and returning to growth as before, albeit not at spectacular rates. Its current price of $5.26 is tempting, even taking into account the not inconsiderable odds of bankruptcy and the shareholder dilution that has occurred in the recent past and may continue to occur in the future.

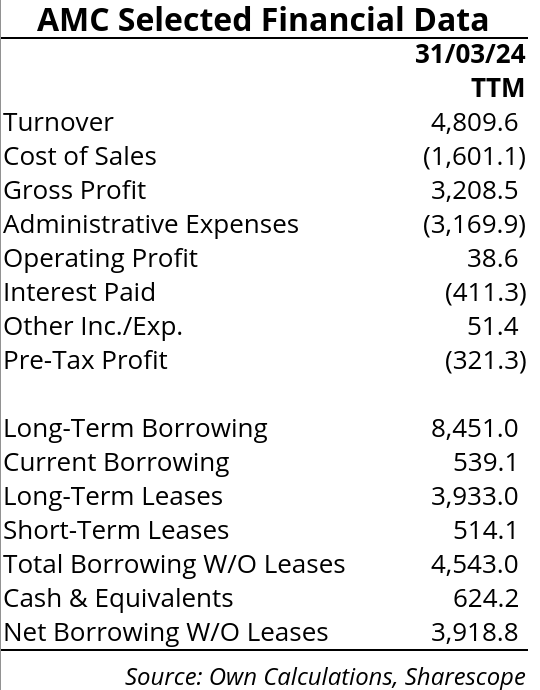

The numbers behind AMC have been pretty ugly since 2020. Revenue of $5,471m in 2019 turned into $1,242m in 2020, and the company ended the year with a net loss of $4,530m. In the following two years, the company accumulated a further net loss of $2,251 million. Such a gigantic loss left AMC’s balance sheet with a negative net asset value and put the stock at the forefront of short sellers’ interest.

I have to say that while the Covid crisis hit AMC hard, the debt problem started earlier. Net debt increased from $1.9b in 2015 to $4.5b in 2016 and again from $5.1b in 2018 to $10.1b in 2019, but this time due to an increase in long-term capital leases. Since 2016-2017, interest expenses have been eating into profits, making the company highly vulnerable to any contraction in demand. However, AMC shares traded above $300 in 2017 and close to $75 before the pandemics, while they now trade at a fraction of those prices, offering a good investment opportunity. Nevertheless ,we can’t ignore the company’s debt burden. Long-term debt now stands at $8.5b. This figure compares with a market capitalisation of $1.6b and total assets of $9b. However, if we rearrange the debt by subtracting capital leases and adding net cash, net debt falls to $3.9b, still a huge figure but less than half the initial number. It is undeniable that the bankruptcy risks here are significant, but the recent improvements are encouraging at current prices. The likes of Tesla, Nvidia and many tech stocks usually trade on too much optimism. But here the opposite seems to be the case, too much pessimism.

In 2021, AMC was a meme stock target, with retail investors led by the “Roaring Kitty” pushing the price above $300. The same wave has happened a few other times. But the price has stabilised and appears to be recovering from a low. This meme frenzy saved AMC by allowing it to refinance some of its debt and issue more shares.

Looking at the past, it’s hard to believe that AMC can ever grow its audience to the levels of the early 2000s. Looking forward, however, it’s easy to see audiences growing from recent levels, even before the pandemics, as the company has been able to make some interesting deals. In recent quarters, the company has been able to deliver positive surprises, with EPS coming in above estimates (lower losses). At the same time, sales and operating profit have been growing gradually.

My thesis on the stock is that if the company continues to improve its balance sheet, reaches agreements with debt holders to extend its debt maturities in order to postpone its current difficulties (which the company has managed to do so far), and improves its sales, profits and cash flow, the stock will rebound massively. A significant rebound, supported by improving fundamentals, would be further boosted by the large short interest in the stock, as price rises force short sellers to cover their positions.

The Positives:

- Operating profit has recovered each quarter.

- The company has managed to reduce debt and extend maturities.

- Production studios are realising that there’s more profit to be made by keeping films in theatres longer.

- The company has been able to strike some very profitable direct deals, such as with Taylor Swift for her Eras tour.

- Some of AMC’s debt is for capital leases, which don’t count in bankruptcy.

- Interest rates are falling, which could help the company refinance its debt at lower rates.

The Negatives:

- Huge debt load and interest payments.

- Recent record of shareholder dilution through new share issues.

- Struggles to achieve revenue diversification despite recent efforts.

- Cinema audiences are on a downward trend since long ago.

Comments (0)