Gold miners to play the bull market

John Cornford revisits some of the more interesting gold stocks now that the gold bull market appears to be in full swing.

I’ve been asked how the gold stocks I’ve covered stack up, now that gold seems determined to keep rising.

Most of my coverage, however, tends to be about miners not yet in production so most are not necessarily directly exposed at this moment, except the larger ones like the ‘streamers’ (WPM, FNV and RGLD), established ones like PAF and others exposed to gold. These are more easily flagged up by, for example, Investopedia, with its access to the multiple broker forecasts that can (though in my view not very reliably) rank larger mining stocks according to some broker-forecast criteria.

It is because my stocks are not so well (and often not at all) covered, and not so easily forecastable, that I select them. Mine will come into focus only at a later stage of the market’s search for gold beneficiaries.

I also avoid stocks listed in North America, where most developing gold miners are based, because I don’t have reliable access to their up-to-date news or broker coverage.

In the meantime, here are updated thoughts on some of my list, including one (Ariana Resources) that I haven’t discussed for some years, and an early flag for two new ones (Katoro Gold and Scotgold). In February, I flagged up Condor Gold’s attractions. Investors are now waiting for the funding of its La India mine which, with gold so strong, shouldn’t be a problem.

While my coverage is detailed at the time of writing, in smaller developing miners the detail changes all the time − not least recently due to the effects of Covid-19. Only now are share charts settling down after the mid-March panic sell-off, when investors temporarily lost their faith in gold as a store of wealth. But who knows what will be the effect on the market if lockdowns continue, and disruption afterwards is worse than anticipated?

But, with out-of-control government borrowing, and practically all fiat (paper) currencies heading for real bankruptcy, and possible government debt cancellation, gold’s defensive value is back, with some banks forecasting a $3,000/oz price. Commenting on that is above my pay grade.

But why discriminate? Won’t a higher gold tide float all gold miners’ boats?

Well not exactly, because some boats might have holes in them; some are still on the slipway; and others are due a bottom scrub or engine overhaul. And it is very important to note that those currently weighed down with large costs will be buoyed up more by a rising tide. That is, the margin between their gold sale price and cost of production will increase more for them than it will for low-cost miners.

Ariana Resources (LON:AAU)

One low-cost ‘boat’ that seems about to re-launch with an expanded sailing programme is Ariana Resources, which since my last cautious mention has proved me wrong. By returning progressively better results from its 50% owned Kiziltepe gold mine in Turkey than anyone had forecast, it is on track to have completely repaid the $33m bank loan for its initial cost during the current half-year, while only two-thirds of the way through its probable life.

I was initially cautious that because Ariana needed to spend so much on exploration to extend Kiziltepe’s life, the resulting share issues would seriously dilute whatever profits it would earn. I was proved correct up to 2018 when Ariana’s shares in issue reached nearly four times the number reached when Kiziltepe (and its forecast earnings per share) was first promoted to investors some eight years before. And I stayed cautious when Ariana bought out its partner Eldorado Gold in the Salinbas copper-gold prospect (in northeast Turkey) which Eldorado had thought too expensive to develop.

From late 2018, however, that began to change, with good exploration results along with better-than-expected Kiziltepe profits. But a major catalyst sparked up last November, when a memorandum of understanding was announced with an unnamed, large, Turkish construction group proposing to buy out part of Salinbas and part of the Kiziltepe project (known as Zenit). That will (if confirmed) leave Ariana in receipt of $30m in cash (compared with its current £36m market value) and with a 17% share in a new company owning both projects, which would also have injected up to $16m to advance Salinbas to definitive feasibility study (DFS) phase.

So, while having $30m to spend on widening its exploration portfolio, including into Cyprus (and possibly to return some cash to shareholders), AAU will be left with 23% (compared with its current 50%) of Kiziltepe’s remaining life’s cash returns, and 23.5% of a much better financed Salinbas project.

Forecasting the financial effect of the change is too complex and depends on timing. Very crudely however, Ariana’s share of Kiziltepe’s estimated 18,000 oz per annum gold production that might last until 2026 would be worth $6.8m pa at a $1,650/oz gold price, which after production costs of around $600/oz and tax, could total $18m net. After its exploration spending and repayments of the Kiziltepe loan, Ariana held very little other assets in its last balance sheet, of June 2019 but the $30m cash, and remaining Kiziltepe value explains why the company’s shares are now 40% higher than before the announcement.

Depending how it uses that cash, and given that it has a ‘free carry’ in Salinbas up to DFS stage, plus an ongoing $3m per annum from Kiziltepe for the next five years at least, I would expect AAU’s shares to continue on upwards for a time. But I think their biggest rise has already been seen. In the longer term, Salinbas’s ‘target’ is for around 1m gold ounces which, if proved to be economically mineable, should have an eventual pre-production value in the $30m region, worth $7m to Ariana or another 0.5p per share.

Kefi Minerals (LON:KEFI)

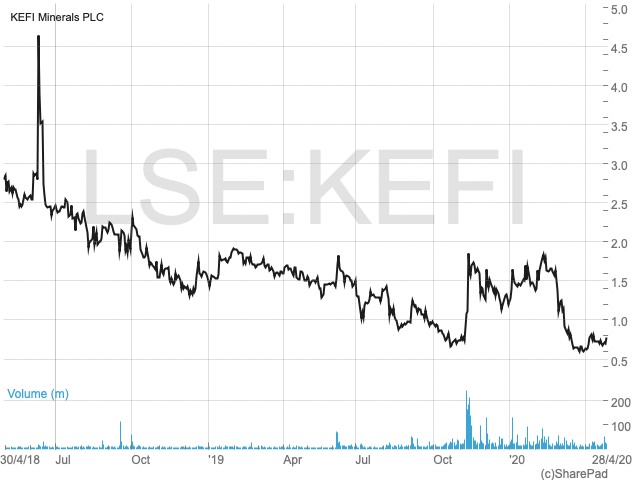

I last mentioned Kefi in December and it remains, ‘on paper’, the most cheaply valued of my list. But as the chart shows, its roller-coaster ride has continued.

Since an encouraging progress update on 6 March, there has been a further, unexplained delay in the initial $9.5m cash contribution due from Kefi’s major partner and mine builder, ANS Mining, which is necessary to unlock the remaining finance to build its Tulu Kepi gold mine. This is now due to start this November, and preliminary work was due to start in January but has been delayed for the same reason.

Whether this is because ANS is concerned that a Covid lockdown will interrupt the resettlement of population in way of the mine, or whether its own finances have been impacted, has not been explained. A recent company update reassured that all paperwork and partnerships are in place, but it was perhaps inadvertently disturbing, as it stated that if ANS failed to come up with its contribution, the Ethiopian government has promised to step in.

That has added to the unease of a few investors, who have become increasingly prone to (in my view) unwarranted conspiracy or fraud theories which have been depressing the shares. In view of likely pressures on all governments after Covid-19, they are currently asking how Ethiopia can afford to pay up.

Readers must decide the truth, but my view remains that, regardless of possible delays, Ethiopia needs the revenues Tulu Kepi will generate, especially if gold keeps rising. But shareholders will have to accept (which some have not understood so far) that, until it gets a dividend from its 45% share of Tulu Kepi’s forecast average $50m or so annual cash flow at a $1,580/oz gold price, Kefi plc will still have to issue shares to keep itself afloat. That revenue share will be over £20m per annum (compared with Kefi’s current £9m market cap) and its share of the nine-year NPV will be around £150m.

While NPVs considerably exaggerate any market share price, that discrepancy looks too much for me. Thrown in for free is Kefi’s encouraging Hawiah copper project in Saudi Arabia which, although early-stage, the company hints could be as valuable as Tulu Kepi.

Solomon Gold (SOLG)

I mention Solgold here because, while its current flagship project in Ecuador is mostly copper, it is exposed to gold in a number of other ways. I described last year − Solgold’s shares then having marked time around 40p − how I believed it would eventually have to separate out its 13 other promising gold and copper exploration prospects in Ecuador from its key Alpala discovery, when each became feasible (and financeable), as separate companies. In that way their exploration funding needs would not detract from Alpala’s value to the shares.

And it is exactly that issue that has been affecting the shares, which up to mid 2017 had been propelled to what, at 40p, I believe was a fair value for Alpala at that stage of its development.

Unfortunately, a falling copper price subsequently (copper accounting for nearly 80% of Alpala’s value then, with gold the rest) served to halve the shares over the next six months to last October, hindering the company’s bid to raise those necessary funds. As a result, Solomon Gold has concentrated instead on fast-tracking Alpala to where it would itself gain value. It didn’t help that a small $17m subscription from major shareholder BHP in December was at a depressed 22p per share − not enough to last more than a few months.

That explains why the shares have lagged gold, and why the company has been promoting Alpala to prospective financiers, while continuing to spend heavily on its development towards construction.

With regard to financiers, Solomon has been successful (up to a point) in attracting potential buyers of Alpala’s copper concentrates once in production (hopefully from end 2025). This is of such purity that practically all the world’s copper refiners are jostling to take it, and offering terms better than the firm had expected.

Some (probably including streamers and commodity dealers) are also offering to help fund Alpala’s forecast $2.7bn capital cost further in the future. Solomon says they are offering up to $150m now, to help fund the preliminary work and more detailed economic studies that are still needed before any final decision to build the mine.

That, of course, is good news, but there are still too many unknowns in my view to justify pushing the shares back much above 22p where, until a shareholder presentation last week, they looked stuck.

One unknown is that only a preliminary economic analysis (PEA) has been completed so far for Alpala, the necessary one, to more detailed bankable standards, isnot due until early next year.

With regard to the shares, there is still an ‘elephant in the room’ on the subject of funding to resume Solomon’s 13 other promising prospects throughout Ecuador. None have been drilled as yet, even though many rigs had been expected to be operating there by now.

The $150m preliminary funding for Alpala cannot legally be devoted to that other exploration, which has been cut by two thirds to $5m in the current half-year, on top of $23m planned to be spent at Alpala, with other company costs having been drastically cut. That reduced spending alone would have swallowed the $23m cash that Solomon had in its balance sheet at the end of December.

The wider market is therefore waiting for confirmation of the funding position. Some investors are suggesting that Solomon should sell off Alpala, and are speculating about the price, based on the NPV of last year’s PEA. But its sale, after tax (and well below its NPV if a buyer is to make a profit) would raise less than its value to Solomon in the long term, explaining why the company discounts the possibility.

For the record, the PEA NPV (at 8%) was $4.2bn (£2.15 per current Solomon share) for a $2.7bn capital cost (£1.38 per share). But, as I’ve explained previously, those figures are misleading as a guide to real value, if only because the NPV is earned mostly over the next 15 years, while the capital cost is incurred up front. My valuation on that NPV per current shares is less than 40p, taking account of shares needing to be issued.

Not only that, but that NPV assumed copper at $3.3/lb and gold at $1,330, and with copper (78% of sales revenue at the PEA) now at $2.3/lb and gold at $1,650/oz, a current figure would be halved. On my calculations, gold would need to reach $3,000/oz to recover the original NPV, assuming copper stays low.

Other speculation is that someone will bid for the whole of Solomon − ie for Alpala and its exploration targets − which would not suffer the gains tax in Ecuador as would be the case if Alpala were to be sold off separately. But there are too many key shareholders now in control of Solomon for any bidder to build a sufficient stake as a platform and for any bid to be agreed among them. So I believe Solomon must − as Churchill used to say − just “KBO”. Obviously, the shares are cheap for the long term, but that funding hurdle must be jumped first.

Pan African Resources (LON:PAF)

I recommended Pan African for its recovery from production problems at its Evander mine in South Africa, and its scope to resume a large dividend this year, with an even larger one the next. Following the 14.4p spike in the shares which followed, they fell back again in September when South Africa’s chronic power shortages threatened output, but not below the previously rising trendline. That took them back to above 12p before they were again knocked back under 9p by the coronavirus panic, but they have now rebounded sharply, along with most other similar streamers.

The latest half-year results to December reinforced the recovery story, with a 126% pre-tax increase over the previous first half, prompting Edison to increase its forecast for the full year to June, to $69m compared with $37.1m last year. With a further near-doubling forecast to June 2021, the expected 2 cents dividend for that year puts the shares at 14.5p on a prospective 11.2% yield and a price-earnings ratio (PER) under four times.

That is not the only factor making the shares one of the more attractive to benefit from stronger gold. Its production costs (at over $1,000/oz) are on the high side, so the gold margin on a higher price will increase more than lower-cost miners. And, lastly, the reservations affecting some other South African miners concerning power shortages don’t affect Pan African so much, with power consumption by its above-ground operations considerably less than for underground miners.

Shanta Gold (LON:SHG)

I recommended (not particularly strongly) Shanta Gold last August at 10p for its medium-term expansion prospects, and to benefit from the planned listing of its 1Moz Singida mine on Tanzania’s stock exchange in order to raise its build cost.

Subsequently the shares rose to 11p before a February announcement that the company was to acquire Barrick’s Lake Victoria gold prospects for $15.5m − half in Shanta’s shares, plus a net smelter royalty. That pushed them higher to 12p, only for the March Covid-19 scare to knock them, temporarily, back to 7p. They are now,at the time of writing, 11.25p.

The Barrick (formerly Acacia) project has one of the highest grading gold resources in Africa, and the purchase consideration at $13/oz of an inferred 1.2 Moz looks historically very cheap, especially given its proximity to the Tier One North Mara and Geita gold mines, explaining investors’ enthusiasm.

More spending is needed before any decision to build a mine, but with the average grade at 12.6 g/t (three times that of most gold mines these days) the chances look high, in which case Shanta will have trebled its mineable gold inventory to over 3Moz in only a year (taking in Singida). Together with good 2019 full-year results also announced in February (which, encouragingly, showed a reduction in Shanta’s net debt by 55%) this should raise its profile among gold investors, as well as its rating.

There is no news as yet regarding the Singida listing (although Shanta still expects to finance it, one way or another this year) but if it arrives, I’d expect it to further improve the share price. Shanta remains a good ‘bottom-drawer’ share even though it may not replicate, yet, the spectacular rises being seen among the gold majors.

Streaming companies

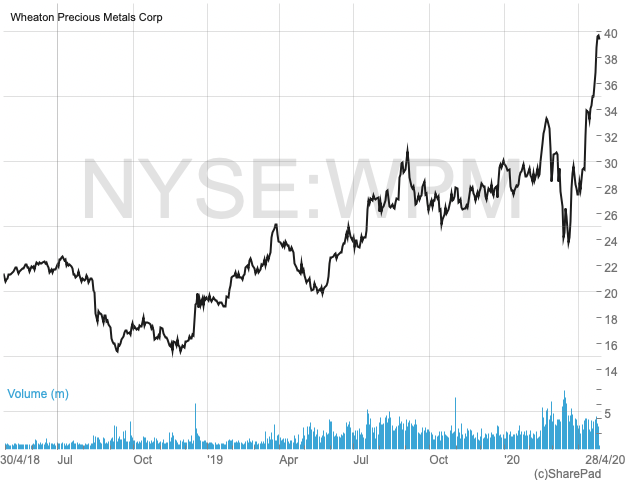

I reviewed these last July, having described in detail in January 2016 their attractions in relation to ordinary miners. Last July I picked Wheaton Precious Metals (NYSE:WPM) as the best at around 27p. The shares are now 39p, having suffered a smaller Covid glitch than most other miners, which might be surprising given that its client miners’ output (of which it has a share) might be affected.

I don’t pretend to follow or forecast Wheaton’s progress in detail, because its revenues stem from a large variety of other mining companies and their own fortunes. Luckily Edison Research does, and its latest update reported that while some of WPM’s clients’ mines were closed temporarily, its forecast current-year earnings per share was nevertheless increased thanks to higher metal prices. It now expects $0.76, up from $0.56 last year and a 19% dividend increase to $0.43.

At the current NYSE share price of $40, the prospective yield is 1.8% and the PER 25 times, which is historically low. Obviously, the extent to which the upward momentum continues depends on the lockdowns and the gold price. For perspective, WPM’s revenues stem over 91% from gold, and the rest from silver and palladium.

Look at Transiberian Gold, EPIC : TSG, pays a nice dividend and has not been affected by CV19.

Much more potential IMHO, than those companies covered in your article.

View recent RNS: Number : 8848K , 27 April 2020