The best funds to protect your income

Nick Sudbury takes a look at the impact of missed dividend payments and assesses which funds and trusts might perform better than others.

The majority of companies are in survival mode and are having to do whatever they can to conserve cash. Many have had no choice but to stop their dividends, while others have been unable to honour their debt obligations and are struggling to survive.

London-listed stocks that have cancelled or postponed their dividends include hard-hit companies such as Rightmove, Meggitt, Domino’s Pizza and Provident Financial. The largest income providers have also been affected, with banks told to suspend dividends to protect their capital and insurers coming under pressure to follow suit.

As a result of these cuts, two thirds of the total dividend for the year from the FTSE 100 index is likely to come from just 10 companies. These include: under-pressure oil majors Shell and BP; British American Tobacco; Glaxo; Rio Tinto; and AstraZeneca.

Analysts believe that total UK dividends could be reduced by about £30bn, which is equivalent to a third of the FTSE 100’s projected income for the year. This would be similar in scale to the impact of the Spanish flu pandemic that occurred after World War I, but not as severe as the impact of the Great Depression, when dividends dropped by as much as 55%.

Other sources of income have also been badly affected, with Real Estate Investment Trusts (REITs) having to accept tenant rent holidays and bond-fund investors being exposed to missed coupons and other possible defaults.

Equity income investment trusts

The sheer scale of dividend cuts means that it is almost inevitable that income levels will fall over the next 12 months as companies look to preserve cash and weather the storm.

“A finger in the air guess could be that a cut of anything from 25% to 50% is reasonable based on last year’s payments,” says Ryan Hughes, head of active portfolios at AJ Bell:

“So these moves are material. Investment trusts have a far better chance than OEICs of minimising the impact, given their ability to use their revenue reserves to boost the income level.”

Hughes therefore recommends Troy Income & Growth (LON:TGIT), which focuses on higher-quality companies that should in themselves be able to minimise the impact on dividends.

As he explains: “The trust has income reserves equivalent to around seven months’ payment that gives it some scope to top up the dividend level when it comes to the next declaration. However this isn’t an inexhaustible fund and the board will still need to be prudent in its approach. It is currently yielding around four percent and even if that falls to three percent it would still represent an attractive level of income relative to where cash rates are.”

For those looking for a global exposure, Hughes suggests the Scottish Investment Trust (LON:SCIN). It is paying an attractive yield of over three percent and is committed to increasing its dividend in excess of inflation. The trust has three years of dividend reserves, which gives it a fantastic opportunity to support its dividend through even the most challenging of circumstances.

Dividend heroes

The team at Winterflood have analysed the 21 members of the AIC’s ‘dividend heroes’ category, which comprises investment trusts that have grown their dividends for 20 consecutive years or more. Having looked at the numbers, they think that the likelihood of any of them not sustaining their dividend growth records is low at present, given the level of revenue reserves.

In terms of the best value opportunities they highlight: Perpetual Income and Growth (LON:PLI), which is available on a 13% discount and has a historical yield of 6.9%; Alliance Trust (LON:ATST), six percent discount, two percent historical yield; F&C (LON:FCIT) that offers a seven percent discount and 1.9% historical yield and Brunner (LON:BUT) with its five percent discount and 2.6% yield.

Equity income funds

Open-ended funds like OEICs and unit trusts do not have revenue reserves to fall back on, which makes their income more vulnerable. This is especially relevant given that the dividend cuts have only just started and there could be many more to come.

However, Adrian Lowcock, head of personal investing at Willis Owen, suggests that one possibility would be Threadneedle UK Equity Income:

“Manager Richard Colwell is well-regarded and looks to deliver a capital return along with a steady income. The portfolio contains a blend of high-quality companies with strong cash generation and out-of-favour companies with recovery potential, some of which may not pay a dividend.”

For an international exposure, he recommends Fidelity Global Dividend, managed by Dan Roberts since its launch in 2012. Roberts focuses on quality companies that can offer a good degree of capital protection during market downturns. This also means that their dividends are more reliable.

Darius McDermott, MD of Chelsea Financial Services, prefers M&G Global Dividend, which focuses on companies with stable and rising dividends, as he says:

“Manager Stuart Rhodes provided an update at the end of March in which he said that after undertaking a thorough review of the portfolio he expected no more than five of his companies to suspend or cut dividends. The fund has a current yield of 2.5%.”

Property trusts

Many REITs have been severely derated because of concerns about the impact of the coronavirus on asset valuations and rental income. The UK commercial property sector has moved from a 0.6% premium at the start of 2020 to a discount of 28% based on the now outdated NAVs and there could be material uncertainty about the valuations for some time to come.

One of the main problems is the level of debt that these funds hold; if the valuations fell far enough they could potentially breach their loan-to-value covenants. This seems unlikely, however, as most would need to see falls of 50% or more before this was an issue and the banks would probably be fairly accommodating anyway.

The more pressing concern is the level of income, as tenants of all types are likely to be asking their landlords for help during this period. Most funds will come under a lot of pressure to provide rent-free periods and this will probably lead to temporary income suspensions and some longer-term cuts.

The Winterflood team believes that a lot of this risk has already been factored in and that there are some value opportunities for long-term investors. They particularly highlight: BMO Commercial Property (LON:BCPT), on a 49% discount, Tritax Big Box (LON:BBOX), which is available at a discount of 23% and UK Commercial Property REIT (LON:UKCM), on a 32% discount. All of these funds have seen significant price falls this year despite the fact that they own some prime real-estate assets.

Bond funds

Long-dated government bond funds have been some of the best performing assets this year because of their perceived safe-haven status and the cut in interest rates, but they pay a pitifully low yield. Corporate and strategic bond funds, which hold a mixture of government and corporate debt, have typically experienced smaller gains, but they pay a more attractive level of income.

Lowcock particularly likes Janus Henderson Strategic Bond, which has historically had a bias to corporate bonds, as he explains:

“Managers John Portello and Jenna Barnard are a strong and experienced team. They look to add value through asset allocation as well as stock-specific analysis and have demonstrated an aptitude for interpreting the drivers of the economic cycle and positioning the portfolio accordingly.”

Hughes says that the sweet spot in the fixed income market might be investment-grade bonds, which have fallen sharply and now yield back above three percent. For those who agree, he suggests TwentyFour Corporate Bond. He says this is a solid core fund for UK corporate-bond exposure.

McDermott recommends the riskier Man GLG High Yield Opportunities that is currently yielding an eye watering 10%:

“We spoke to the manager at the start of April and he said that the markets are pricing in company defaults in the high teens (15-19%) each year for the next four years. He thinks that is too much and expects it to be around 10-14%. If you do the company research well, you should be able to avoid the losers and pick the winners.”

Infrastructure trusts and funds

Another good option for income seekers is infrastructure, which normally generates a reliable stream of dividends that tend to rise in line with inflation. The open-ended funds that operate in this area typically invest in infrastructure stocks and have suffered heavy falls this year along with the wider equity market.

McDermott and Lowcock both recommend First State Global Listed Infrastructure. It benefits from an experienced management team and invests all over the world in different sorts of infrastructure companies. It has been hurt by airport closures and the slowdown in construction, but it also has a large exposure to utilities (almost half the fund), which are continuing to see demand as we all stay at home. The current yield is 3.5%.

Hughes prefers Legg Mason Global Infrastructure Income. It has a current yield of six percent and even if some of the underlying companies have to cut their dividend, it would still look attractive:

“The fund is managed by infrastructure experts in Australia and has a big focus on utility companies with over 80% of the portfolio invested in stocks that produce or supply gas, electricity or water. These areas should be less impacted by the global shutdown, which should give some protection to their dividends, making it an interesting option for income seekers.”

Infrastructure investment trusts are different as they mostly invest in the underlying physical assets. These tend to be more resilient than their open-ended counterparts, although they have still been affected by the sell-off.

Investec has buy recommendations on three trusts that provide investors with diversified exposures to core infrastructure assets. It believes that these funds offer sustainable and growing dividends that are underpinned by stable and predictable cash flows.

All three fell by between 25% and 30% during the initial sell-off, but have since recovered more than half of the losses. They are: BBGI (LON:BBGI), HICL Infrastructure (LON:HICL) and International Public Partnerships (LON:INPP). HICL and INPP are trading on small premiums to the last reported NAVs and yielding five percent and 4.9% respectively, while BBGI looks more expensive on a 21% premium and a yield of 4.5%.

Companies are in survival mode and are looking to save cash wherever they can with many having to cancel or suspend their dividends. This is having a knock-on effect on the funds that invest in them, so it is essential that those who rely on this income pick the most resilient options.

FUND OF THE MONTH

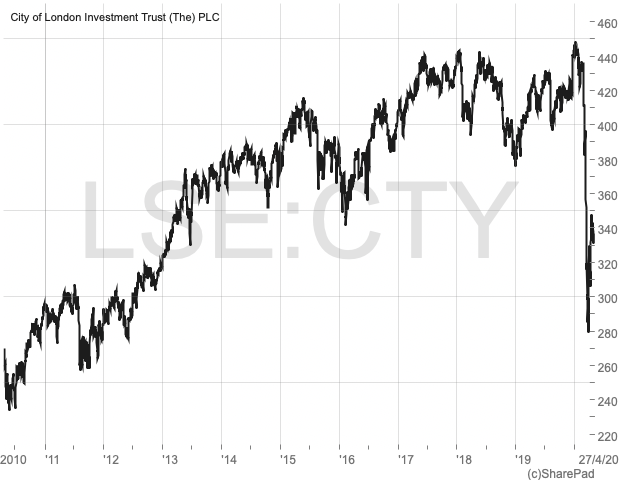

City of London (LON:CTY) aims to provide long-term growth in income and capital by investing in UK equities, with a bias towards the large multinational companies found in the FTSE 100. It has been recommended by McDermott, who says that it has been run by a very experienced manager, Job Curtis, for almost three decades.

“He has a conservative and thoughtful approach, which I think is reassuring in this environment. Having increased the trust’s dividend for the past 53 consecutive years, the board has said that they will commit to a fifty-fourth year with the revenue reserves being used if necessary. The fund has a current yield of 5.7%.”

City pays a quarterly dividend and has reaffirmed that it will make the fourth payment after its 30 June year-end. By the second of April, around a fifth of its portfolio by value had announced dividends cuts, so this final distribution will partly have to be paid out of its revenue reserves.

After adjusting for the payment it is thought that the reserves will go down to £40.4m, which would be equivalent to 0.6 years’ of dividends. This gives it a healthy cushion to support future distributions.

Over the last 10 years, City has clearly outperformed the FTSE All-Share index, although it has pretty much tracked it lower during the sell-off. The fund is consistently in high demand, with the board issuing new shares to keep the price in line with its NAV, but it remains to be seen whether a yield of 5.7% is sustainable.

Comments (0)