Cutting positions or taking a loss

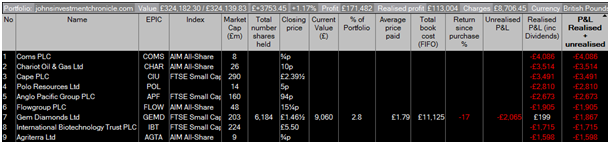

Since launching the JIC Portfolio in January 2012 the portfolio is up 114.5% as of Friday 19th June 2015. I have had some losses along the way but in general I have tried to cut losses before they inflict too much damage. The table below shows the nine worst losses in the JIC Portfolio since inception in January 2012. Apart from Gem Diamonds, which I still hold, all the others were sold, or cut, crystallising a loss.

My approach to “cutting” positions

“It’s not a member of the family!”

The biggest obstacle to cutting a position and taking a loss is our own psychological frailties. In general we hate to admit we are wrong and thus find it painful contemplating taking a loss; I find that once I cut a holding from the portfolio, that I have been fretting over for days or weeks, I actually get an enormous sense of relief; I don’t have to stare at it anymore with it taking up a disproportionate amount of my time and sapping my energy. The most important thing to me is the performance of the overall portfolio; that’s all that matters, not what one individual stock does. Don’t get emotionally involved, after all, as one of my old colleagues says “it’s not a member of the family!”

My view, learned through bitter experience, is that you are best cutting losses quickly. Conversely you should let your winners run; as Warren Buffet said “cut out your weeds and water your flowers”! All too often we are tempted to do the opposite. We add to our losers as it reinforces our original decision to buy it: “I was right to buy it at 100p so I must be even more right to buy more at 85p, after all it’s cheaper. Oh, and I will fund my purchase by selling part of my holding in another stock which is doing really well!”

I think it’s best to sell and move on; it saves a lot of emotional heart ache as well as money. The only stocks I really worry about are the stocks that I hold, after all they are the only ones that can damage my wealth should their share prices collapse. Stocks that are going up that I do not hold are purely “opportunities lost”. In other words, if I cut a holding because it looks like it is going to damage the overall portfolio, I do not beat myself up if it bounces afterwards!

When to cut; “When my information changes, I change my mind. What do you do?”

If things change: If you bought a stock because you thought the market was underestimating the potential growth in the business and that earnings would be upgraded and then suddenly it starts to disappoint and earnings start to slip. As the great economist and investor John Maynard Keynes reportedly said after being criticised for changing his view, “When my information changes, I change my mind. What do you do, sir?”

Profit warnings: If I am unfortunate enough to hold a stock that issues a profit warning I tend to get out. Humans are generally optimists and management rarely communicate how bad things really are, either because they cannot see how bad it is or because they have an innate optimism that things will get better, or that they can make them better. Things normally get worse before they get better and as the old saying goes “profit warnings are like buses – they come in threes.”

Change in share price trend: One of the triggers I use is when the trend in the share price clearly looks as though it has changed from moving upwards to downwards. A few years back a City chartist showed me a simple rule which I quite liked; if you put a share price chart up on the wall and step back to the other side of the room, you can get a pretty good idea what the trend in the share price is. If it looks like it has rolled over then that’s time to ask yourself why you are holding this stock.

Gut feel; sometimes it just does not feel right. The worst that can happen is that the stock goes up!

Automatic stop losses

I do not put automatic stop losses on with my online broker; I like to have control of when I sell and in any case I tend to look at the closing price each day. I don’t like being taken out by an intra-day spike down in the share price which proves temporary.

What happened to each of the nine stocks subsequently?

Coms PLC, sold in November last year has fallen another 80%!

Chariot Oil & Gas, sold in December 2012 has fallen a further 64%

Cape PLC, sold in August 2012 has been volatile but is up 36%, (however the JIC Portfolio has pretty much doubled since then).

Polo Resources, sold in December 2013, along with Anglo Pacific and Agriterra is down a further 73%. Anglo Pacific has halved and Agriterra has dropped 64%.

FlowGroup, cut on the 8th May this year is down 46% after last week’s profit warning

International Biotechnology Trust is up a lot but I decided at that time to focus my exposure to biotechnology through the Biotech Growth Trust, which has also performed extremely well.

Run your winners

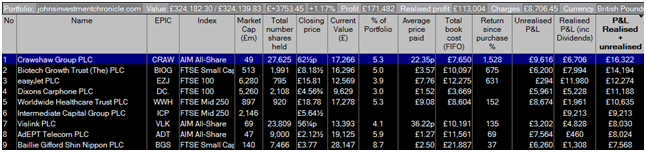

Just for completeness, and because the list of losers makes pretty depressing reading, I have shown below the nine most profitable holdings in the JIC Portfolio since inception; of the nine, eight are still in the Portfolio. “Run your winners!”

About Me

I manage my website, www.JohnsInvestmentChronicle.com in which I show my portfolio and all transactions. I blog within an hour of trading, with an explanation, and send an alert email to my subscribers. I do not pretend to have all the answers but I hope my portfolio, and the trades, provides food for thought both for experienced investors and those who are new to managing their own portfolios.

I think what I do is unique. There are plenty of tipsters out there who will remind you of the good ones and quietly forget the duffers; I do not have that luxury as the portfolio is there for all to see. I have to confront my mistakes and deal with them. A tipster also does not show how a tip fits into the context of an overall portfolio. My portfolio of up to 30 holdings has different holding sizes based on my conviction behind the stock and how it fits into the overall risk profile of the portfolio.

In September 1984, I left university with a degree in Zoology and started work in the City of London. Over the next twenty five years most of my career involved managing UK equity portfolios with Fleming Investment Management and Henderson Global Investors, for corporate and local authority defined benefit pension schemes as well as the reserve fund of a well-known charity. During 2009 I left full time employment and decided to take time out to consider the next stage of my career, whilst putting my years of experience to good use investing the family savings. I have thoroughly enjoyed the freedom of investing from home and in January 2012 I set up I set up www.JohnsInvestmentChronicle.com.

Comments (0)