CML Microsystems – Fresh Developments

A more connected world is fuelling the insatiable appetite for data consumption – driving growth across communications markets globally.

This group’s vision is to be the first-choice semiconductor partner to technology innovators, together transforming how the world communicates.

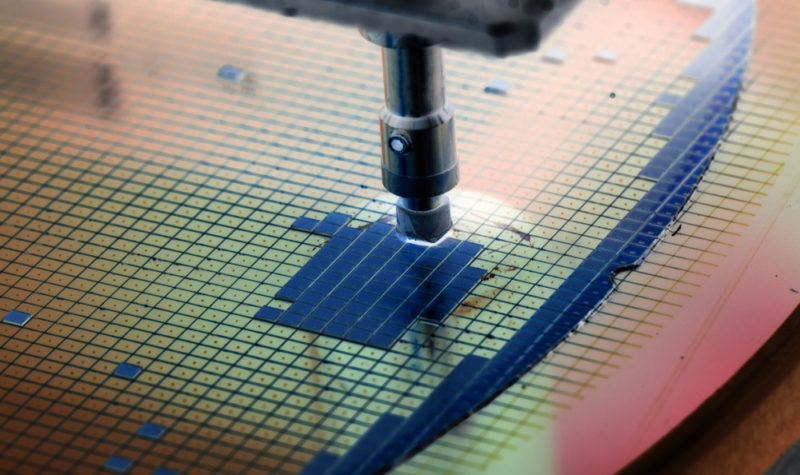

CML Microsystems (LON:CML) develops mixed-signal, RF and Microwave semiconductors for the global communications markets.

Importantly, I consider that the news just ten days ago from the Maldon-based group will undoubtedly help it to boost its vision.

Planning Approvals

The Maldon District Council has granted planning approval for the group to utilise a 13-acre chunk of its 29-acre site located at Oval Park, Maldon in Essex.

CML has owned the total area for over 20 years and the part of its site that is looking to sell off is totally excess to its own requirements.

I understand that it already has two separate sale contracts signed to kick-off its plans to develop a ‘state of the art’ business hub on the site.

Providing the cornerstone of the development of Oval Park involves the relocation of two world-leading organisations – Tecniq and Maldon Crystal Salt.

Tecniq is the Witham, Essex-based premium British design and manufacturing business, which provides prestige automotive marques with high quality vehicle interiors, bodies, components and systems.

The Maldon Crystal Salt pyramid flakes are recognised the world over as the finest of sea salts, especially on the Watson-Mitchell dining table.

With works on the site expected to commence this Autumn, the CML group has stated that the transformation of the brownfield Oval Park site is expected to bring over 200 jobs to the district by 2024 and potentially many more in the following years.

Is CML a Property Company Now?

Absolutely not – would be my immediate answer.

However, you really have to applaud any company that looks to make efficient use of part or all of its assets in the pursuit of its corporate strategy.

Nigel Clark, Chairman of CML Microsystems commented:

“This transaction yields funds from an underutilised asset which will benefit the business moving forward. It underpins the Group’s well publicised strategy as a pure play semiconductor business with a sole focus on global communications markets.”

The Business

CML develops mixed-signal, RF and microwave semiconductors for the global communications markets. The group utilises a combination of outsourced manufacturing and in-house testing with trading operations in the UK, Asia and USA.

It targets sub-segments within the communication markets with strong growth profiles and high barriers to entry. It has secured a diverse, blue chip customer base, including some of the world’s leading commercial and industrial product manufacturers.

The spread of its customers and diversity of the product range largely protects the business from the cyclicality usually associated with the semiconductor industry.

Growth in its end markets is being driven by factors such as the appetite for data to be transmitted faster and more securely, the upgrading of telecoms infrastructure around the world and the growing prevalence of private commercial wireless networks for voice and/or data communications linked to the ‘Industrial Internet of Things’.

As a result of focused market and customer intelligence activities, CML’s new product development teams are supporting the expansion of the group’s total addressable market to include applications within 5G, Satellite and the Industrial Internet of Things markets.

This complements the existing markets of public safety, maritime and mission critical wireless voice and data communications, leveraging the company’s systems knowledge, semiconductor engineering capabilities and routes to market.

The Group’s Markets

The global communications markets addressed by the group are exhibiting a number of growth areas.

Within the Land Mobile Radio/Private Mobile Radio arena, systems are constantly evolving from analogue to digital with some customers focusing on new products to integrate with long-term evolution technology.

Public safety agencies prefer the spectrum efficiency associated with digital networks and the ease with which communications can be encrypted for security purposes.

Interoperability has become a key success factor, with the P25 suite being the dominant standard in North America and Terrestrial Trunked Radio, which is the leading standard in Europe and some other regions.

Digital Mobile Radio is a global private industry version of a digital standard where the radios of multiple suppliers designed using the DMR standard can be used in conjunction with each other.

The group is an established supplier to a number of the major equipment manufacturers throughout the world and continues to take market share through product evolution and function integration.

On a sales per region basis the group does most of its business in the Far East, with 57.9% of its 2022 £16.96m turnover, some 26.9% in the UK and the balance 15.2% into the Americas.

The Equity

There are some 15.91m shares in issue.

Larger holders include Premier Miton Group (12.20%), Otus Capital Management (9.93%), MI Gurry (8.47%), CA Gurry (8.1%), TMR Dean (8.03%), Herald Investment Management (6.79%), Liontrust Asset Management (5.45%), Schroder Investment Management (5.30%), Ruffer Investment Management (4.80%) and Charles Stanley Investment Management (3.07%).

Broker’s Views – Well Supported Earnings Growth

Analyst Martin O’Sullivan at Shore Capital, the group’s NOMAD and Broker, considers that its value continues to be supported by the earnings growth potential stemming from organic growth in the global communications markets.

His estimates for the current year to end March are for revenues to rise to £20.5m (£17.0m), with adjusted pre-tax profits increasing to £3.5m (£2.1m), taking earnings up to 21.6p (12.8p) and its dividend to 11.0p (9.0p) per share.

For the coming year he suggests £23.1m sales, £4.4m profits, earnings of 26.7p and 13.2p of dividends per share.

Over at Progressive Equity Research, their analyst Ian Robertson is impressed by the group’s planning approvals and reckons that it is a clear demonstration of its Management delivering value.

He is looking for £20.5m sales, £3.5m profits, 17.5p earnings and a 10.8p per share dividend for the 2023 year to the end of next month.

The prospective is for £23.3m revenues, £4.2m profits, earnings of 19.7p and a 13.5p dividend.

My View – 650p Target Price

I am not at all worried by the very high price-to-earnings ratio for this group’s shares.

The company has a very strong balance sheet with some £23m cash, no debt and is highly cash generative.

Furthermore, the recent planning approvals must have given the group’s net asset backing a significant potential uplift.

We do not yet know the value of the two contracts, but the additional financial strength will help to push forward the group’s corporate strategy over the next few years.

It may take some time for the group’s shares to return to the 792p peak achieved way back in January 2001, however, at the current 560p, valuing it at £89m, they do offer very appealing medium-term appeal and represent an excellent springboard to participate in a rapidly growing marketplace.

I now put a Target Price of 650p on the shares over the next eighteen months.

Mark will be appearing the Master Investor Show on the 15th of April. Get your free tickets here.

Comments (0)