Chart Navigator: Time For Medicine?

There is much to worry about in today’s world. Ongoing uncertainties from global economic conditions, including geopolitical tensions, supply chain disruptions, and the lingering impacts of the COVID-19 pandemic, all contribute to investor worry. Inflation continues to be a concern, driven by higher energy prices and supply chain issues although this appears to have peaked, with the Bank of England’s measures to control inflation being closely watched by investors.

And despite facing a challenging environment, the retail sector is showing signs of resilience. Companies are adapting to changing consumer behaviours by enhancing their online presence and streamlining operations. Some retailers have become attractive investment opportunities, particularly those with strong brand loyalty and effective digital strategies. Shoe Zone (SHOE) has been a splendid performer over the last few years although issued a light profit warning recently. Despite that, the shares have still multibagged from the lows.

However, in an early stage bull market, the new leaders will show themselves early on through trends that are going against the grain.

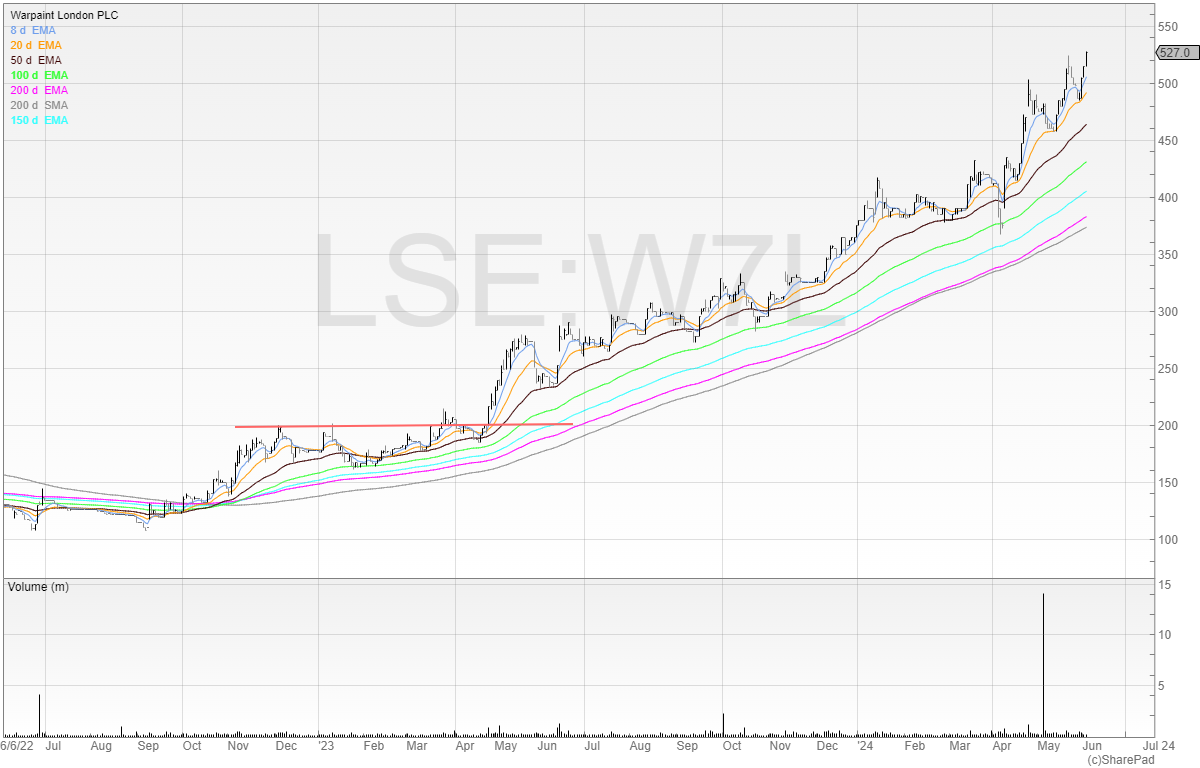

For example, Warpaint (W7L) has been a star performer in the last two years.

Clear uptrends when stocks are falling show relative strength, and these are important to identify.

Another is Intercede Group (IGP) where I hold a position.

Stocks are strong in bear markets will often only get stronger in bull markets.

And as I believe we’re clearly now in a new early stage bull market, identifying these trends is hugely important.

Here are a couple of stocks I’m watching based on technical strength first. I’m not an investor, and I take the view that fundamentals are nice to have but not necessary.

That’s because stocks often start rallying before the fundamentals are showing. And when the stock looks perfect it’s often heavily owned and the risk/reward is terrible.

Far better to be early (but not too early) to the story rather than wait for the stock to be a market darling, in my opinion.

Elixirr International (ELIX)

Elixirr International looks a long drawn out stage 1 to me.

The 50 EMA has then been support, and the price is now consolidating below the recent high of 630p.

I like this because the risk/reward is nice and tight. You can place your stop not far below 600p (Big Round Number plus 610p is recent base) and therefore this means you don’t need to catch much of a move to make it a nice return.

Obviously, if you have a 25% risk then you need 50% to make 2 to 1. But if that stop is 10%, then getting 20% is much easier.. in general.

The business is a provider of management consultancy services and is ran by founder and chief executive Stephen Newton. I like founder ran businesses because they generally tend to be focused on the long-term future rather than short term share price performance. However, as this is a short term trade this isn’t important.

The business trades on a current year PE of 14.9 which isn’t cheap but also isn’t demanding. It’s profitable and cash generative, so I don’t see any immediate red flags here.

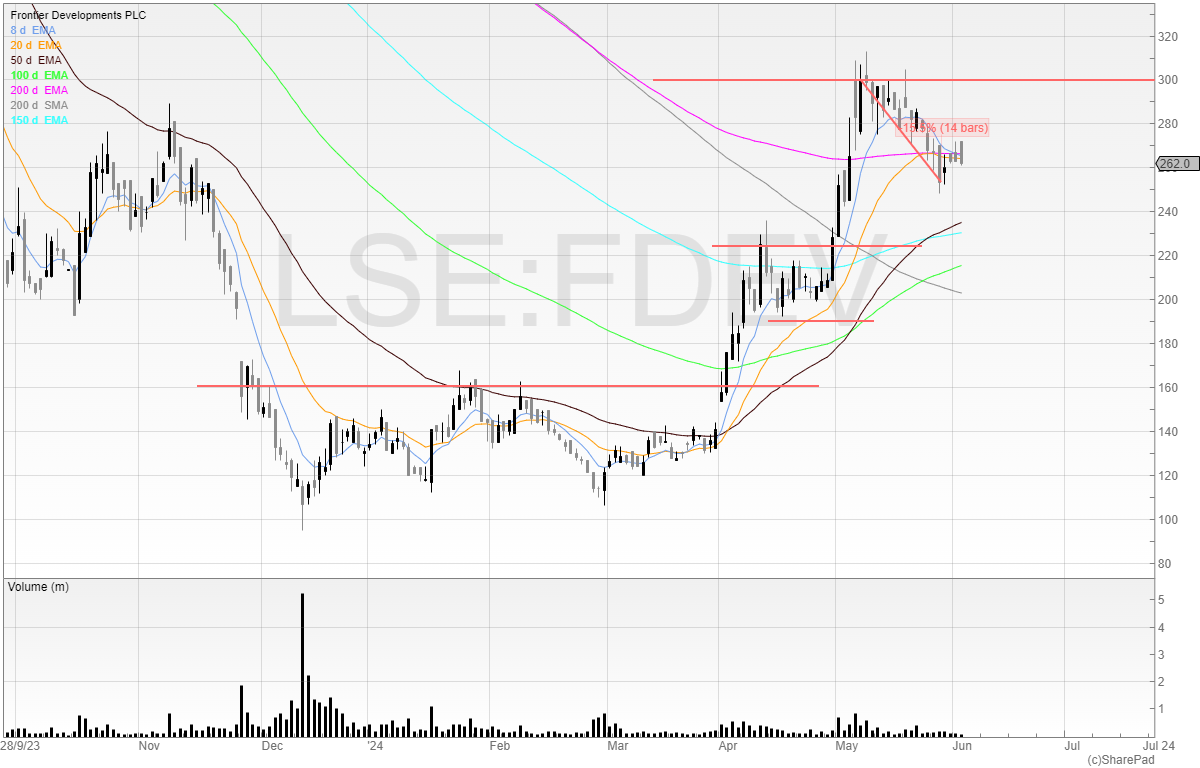

Frontier Developments (FDEV)

Frontier Developments is the creator of the popular Rollercoaster Tycoon series and the stock price for shareholders has been quite similar to that of being on a rollercoaster.

It nearly tenbagged in an 18-month period starting in 2017, more than halved in 2018, then quadrupled from the lows to 2021, and then fell around 95 percent since. Now that’s a real ride!

I can’t stomach such volatility and prefer to have my stop losses in place. This prevents me from losing too much and risk me blowing my trading account.

I’m watching the 300p level which looks to be a resistance point given that it is a Big Round Number.

Frontier Developments is going back to focusing on Creative Management Solutions games having admitted that its diversification attempts hadn’t worked, and it’s important to note four of these games of that type it has produced all reached profitability within one month.

Games development is binary because so much rides on one game being a success. If it’s a flop, it’s disastrous for the share price. Whereas if the game is a success, then once it’s repaid its development and marketing costs it is pure profit.

In any case, I’m here for a trade only and want to see the stock tighten and consolidate more before breaking out of the base forming around 300p.

Oxford Biomedica (OXB)

Oxford Biomedica has been going a long time. It’s a biopharmaceutical company focusing on the field of immunotherapy by managing a platform of technologies for designing gene-based medicines. It’s clear that I’ll never have an edge on this business because I don’t fully understand what it does but luckily I don’t need to. I’m only interested in the chart.

This is looking like a stage 2 stock.

Big base breakout, strong rally, and little given back with the stock being bought on dips. All the moving averages are now pointing upwards (save for the 200 MA).

With a burn of £36 million and a £7.5 million tax credit received, this business looks adequately capitalised for the near term. Would I invest in it? Absolutely not. But for a short term swing trade with a tight stop loss I think this is attractive should the stock break out.

Market thoughts

It’s clear the market is picking up and stocks are even moving up on no news, which shows the strength of the market. Raspberry Pi has chosen to list on the London Stock Exchange and high-profile business Shein is considering doing so, though the LSE will have plenty of competition. Whether a fast-fashion brand should be allowed to do so is another question, but those who say it shouldn’t should be aware that Boohoo also had issues with its supply chain. In any case, a Shein IPO would be great for the UK stock market.

Michael holds a long position in IGP.

Get more of Michael’s trading ideas at https://newsletter.buythebullmarket.com/

Comments (0)