Are Litigation Finance Investments the Ultimate Diversification Tool?

As featured in this month’s Master Investor Magazine.

“To reduce risk it is necessary to avoid a portfolio whose securities are all highly correlated with each other. One hundred securities whose returns rise and fall in near unison afford little protection than the uncertain return of a single security.”

– Harry Markowitz, 1968

Early Days of Modern Portfolio Theory

The year was 1952. Three years before receiving his PhD in Economics, Harry Markowitz developed an asset allocation model that would revolutionise our perception of the importance of risk. Up to that day, investors only cared about returns. But within the new HM framework (the Mean-Variance model as it became known), assets would be chosen depending on their risk-reward characteristics. The introduction of standard deviation (or variance) into the decision process allowed Markowitz to prove that it is possible to diversify risk by adding assets together in a portfolio, as long as they are not perfectly correlated. The rationale is relatively straightforward: if you have two assets and mix them together, the expected return on your portfolio is a linear combination of the individual returns; but, as long as they aren’t perfectly correlated, portfolio risk is a less than perfect combination of individual assets’ risk. That means you have just reduced risk.

Markowitz gave risk a key role in portfolio management. Even a naive strategy of adding assets for the sake of it would be enough to completely (or, at least, significantly) reduce the specific risk that is related to each individual asset. When the portfolio is well diversified an investor ends with just systematic risk, which, until now, no one could find a solution to eliminate. Then the Capital Asset Pricing Model (CAPM) was developed and for many years it was believed that the return on any security is a linear function of the market return. The only reason why the expected return on a given security (or portfolio) is higher than the market is because its beta is higher than one. A higher return is only achievable though higher beta, which means higher risk.

The results given by the Markowitz Mean-Variance theory and the CAPM are frustrating for portfolio managers. Any fund manager achieving higher than market returns is incurring higher risk; the risk-adjusted returns are not any better. So, instead of spending money in a 2-20 fee structure, an investor would be better off just splitting money between a market portfolio (like the SPY ETF) and Treasury Bonds. He could buy the ETF on borrowed money (shorting the Treasuries) and achieve the same kind of returns hedge funds do, with less risk…

In fact, theory is based on many unrealistic assumptions and markets are not always efficient, such that there is a way to beat the CAPM. But it is also true that most of the time active portfolio managers don’t beat the market. As an example, look at what happened during the financial crisis. Almost all hedge funds, no matter how selective they were, ended losing money along with the wider market. Then they recovered with the market. This in fact gives credit to the CAPM: most hedge funds are leveraged bets on the market. All they get is Beta, not Alpha.

Seeking Truly Uncorrelated Assets

A leveraged bet on the market is not magic but rather financial engineering. What we really need is to find some uncorrelated assets. Sharpe, Mossin, Lintner and Treynor were all credited with the development of CAPM, but none of them said you must stick with the S&P 500 or the FTSE 350. You can also invest in real estate and land, or in government bonds. And for those that want to go the extra mile, why not invest in life settlements or catastrophe bonds. There is also the world of water rights in Australia, and museum art, and pottery elsewhere. Oh, and why not adding the finest French wine (turn to page 58) and Scottish single malt, or even some high-end violins. Unlike the time of Markowitz, when just two asset classes were known (stocks and bonds), we now have so many other asset classes, to the extent that sticking with bonds and stocks is like driving an Aston Martin in first gear. If you have a 6-speed gearbox, why not use it? In finance, as long as there are varying cash flow outcomes and a distribution of probabilities can be assigned to them to quantify the upside potential and the downside risk, there is a trading/investment opportunity.

A key concept in diversification is correlation. In a globalised world it is ever more difficult to find assets with beta around zero. The latest financial crisis showed how risky a diversified portfolio in fact is and how difficult it is to avoid the market downtrend. This suggests a need for assets that are uncorrelated with the market and that are not heavily exposed to the business cycle, to interest rates, and to general turmoil. All assets mentioned above may offer a reduced exposure to such risk.

Litigation Finance as an Asset

What about if a legal claim could be treated as an asset, an investment asset? Wine, scotch, pottery: all seem a little correlated with the business cycle. But a legal claim doesn’t sound likely to bear much market risk.

The world of litigation finance is not new. There are many companies and specialty investors that from long ago finance plaintiffs in exchange for a return. They’re not exactly lending money as their activity involves bankrolling plaintiffs (or plaintiffs’ lawyers) in exchange for a slice of the lawsuit’s potential winnings. They may advance money to pay for legal fees and then collect a return if the court decision is favourable. Litigation finance treats legal claims as financeable assets. These assets aren’t much different from real estate and receivables.

Third party litigation finance, as it is often referred to, originated in Australia. The main idea is very simple: an investor puts money into a third party’s litigation for a return. If the case is won or settled, the investor receives a return on his money. If the case is lost, then an investor loses his money.

However, some argue that this procedure increases conflicts and increases the number of lawsuits. They additionally claim that it expands the average number of years to solve cases, as investors push for big settlements. They finally add that there is no added value to plaintiffs, as they have easy access to justice and can always hire an attorney on a contingency fee basis.

There are many lawsuits that oppose unequal sides. The latest John Grisham novel, Gray Mountain, explains very well why many meritorious claims are left unresolved or prematurely settled when there is an abysmal financial difference between the plaintiff and the defendant. In Grisham’s fictional world, plaintiffs are coal miners who acquired black lungs after a prolonged exposure to coal dust; while the defendants are multi-million dollar coal companies able to hire a dozen of the highest paid specialised litigators and pay them uninterruptedly for years if needed. It is hard to believe that a coal miner could pay the legal fees under these conditions. Many litigators wouldn’t accept working on a contingency fee either, as such prolonged cases are a huge drag on funds for many years. The risk is that they would be bankrupt before the case is settled.

With the above in mind, one could say that litigation finance has a strong favourable impact, as it is a kind of insurance. It solves the problem of unequal financial resources providing funding for the weakest part, whenever the claim is meritorious. In doing so, it removes the unfair advantage money gives to the wealthy defendants. Regarding additional issues, in general, the financiers do not interfere with the case. They usually have a team of law experts and investment bankers to carefully select the cases they believe are worth financing, but they don’t interfere with the counsellor. They of course require this to be someone experienced within that particular field and with an exceptional track record, as this is key for the success of the case (and indirectly for the return investors make), but they don’t interfere with the rest.

While litigation finance offers new opportunities to plaintiffs, it can also provide the diversification an investor is seeking for. The best companies working on litigation finance are able to carefully choose the cases with the highest probability of success, thereby providing high returns for investors at very low betas. In other words, this asset class can provide investors with the much envied alpha.

How to Play the Game

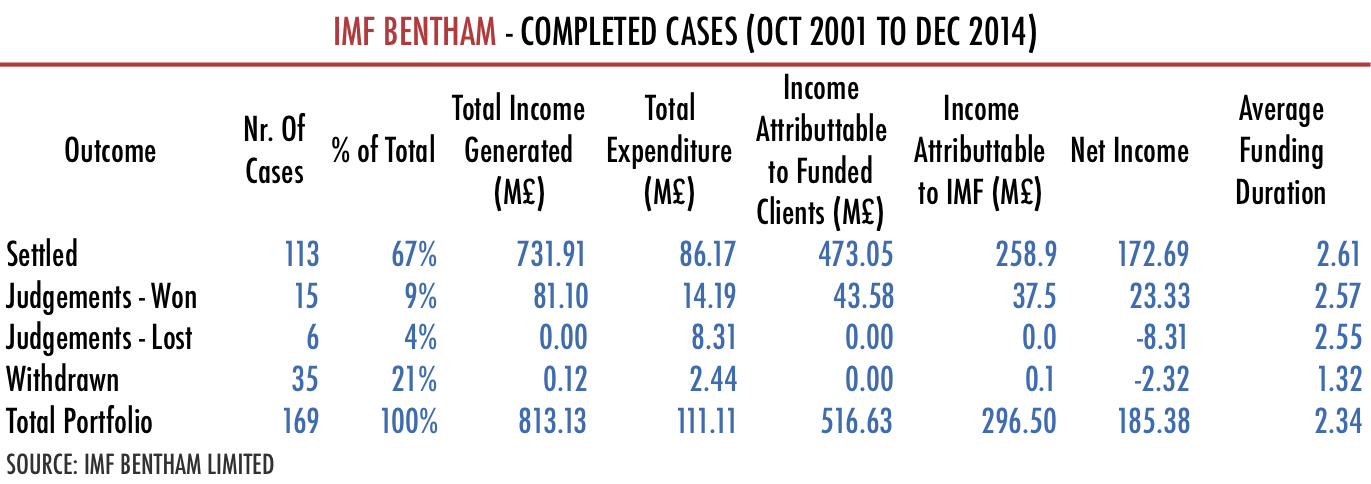

One of the first companies to specialise in litigation finance is the ASX-listed IMF Bentham. The company has generated more than £185 million in net income and £813 million in total income since inception, while spending only a total of £111 million. From the 169 cases in its portfolio, 113 (67%) were settled without the need for a judgement and the company won 15 of the 21 cases that ended with a judgement. These data clearly show that cases are very carefully chosen to maximise the winning probability and add to the idea that the leverage applied via litigation finance in fact speeds up the resolution process (against the claims of the naysayers). The average funding duration for its entire portfolio is 2.3 years, which isn’t much for investors seeking medium to long term returns.

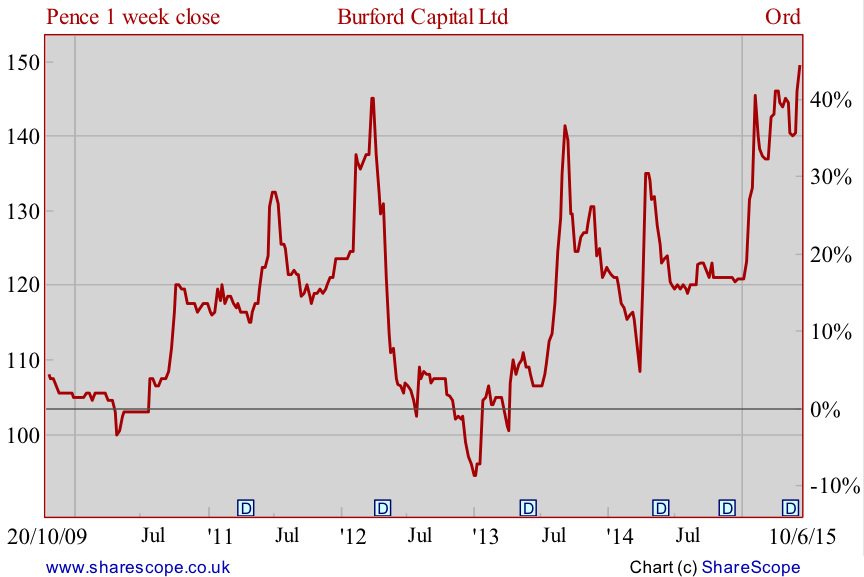

In the UK, investors looking to diversify into litigation finance may wish to take a look at Burford Capital. The company was founded by Chris Bogart and Jon Molot in 2009 and is listed on the London AIM market. Burford pays dividends and currently has a very respectable dividend yield of 3.6% on a P/E of just 10.5x. For those seeking a mix of capital appreciation with income, this equity offers a good opportunity.

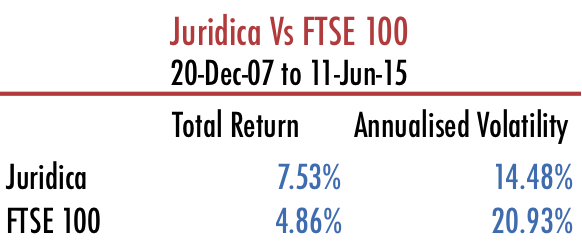

While all of the above represent good ways of diversifying a portfolio, my favourite asset is Juridica Investments. This is an AIM listed close-ended investment company that invests in claims across three different groups: antitrust and competition, patents and intellectual property, and commercial. The fund was admitted to AIM in December 2007 at a price of 100p. Until today the fund has already paid out 58.6p in dividends. For the period between December 2007 and June 2015, the fund shows an annualised total return (price plus dividends) of 7.5% on a 14.4% standard deviation. This compares with 4.9% return and 20.9% standard deviation for the FTSE 100. Unlike the FTSE components, the exposure to the business cycle is very low for Juridica, which allows for the steady payment of dividends while providing capital appreciation over the long-term.

Another option to invest in litigation finance is through committing funds to specific cases through the platform Lexshares. The website presents investors with a set of lawsuits that need to raise funding. The cases are pre-selected by a specialty team but the last word regard ing which cases to invest in comes from the investor, who may choose from the portfolio of possibilities. This may be a good option for investors with better knowledge of legal matters and with a more diversified portfolio. Others would probably be better served through buying a fund like Juridica and allowing it to select a portfolio of cases, instead of looking at cases on a one-by-one basis.

Final Remarks

As Markowitz puts it, “One hundred securities whose returns rise and fall in near unison afford little more protection than the uncertain return of a single security”. Now more than ever, investors need alternative ways to diversify; simply adding equities from the S&P 500 in varying proportions is not enough anymore. In that case, you’re really better off buying the SPY ETF and spending the spare time with family instead of trying to outsmart the market.

Comments (0)