Apple Vs Spotify

“Innovation distinguishes between a leader and a follower.”

― Steve Jobs

“Welcome to the most exciting and important frontier since the digital music revolution began 16 years ago”, said Rdio’s CEO in mockery of Apple after the company unveiled a series of new products that were mere copies and redesigns of existing products and services marketed by other companies. One of those was a subscription-based music streaming service, something which Rdio and Spotify had already been offering long before Apple.

While Apple was concentrating on ending the age of the physical CD, seducing its users to download their music instead of buying old-fashioned CDs, Spotify was concentrating on destroying that very same Apple business by offering its users the opportunity to listen to the entire CD catalogue at a monthly fee that was comparable to the price Apple was charging for a single CD download. Apple was ahead of the curve when it launched its iTunes service in the early 2000s, but it is now well behind it more than a decade after. Its iTunes service looks like the old-fashioned CD product they destroyed and is packed with uninteresting functionalities that make the whole product one of the most complex and unfriendly ever created by Apple.

Apple thought that the destruction of the physical CD would bring the iTunes music store into the spotlight, where it would be the centre of the digital music scene. But by the time Apple got the job done regarding the physical CD, users already wanted something different from what the company had to offer. Why own a CD and build a music library piece by piece when you can have access to all music whenever you want? Users are now looking for streaming services like Spotify, Rdio and Deezer. They don’t care about ownership but about having the music readily available whenever they want to listen to it.

The music industry was severely hit during the 1990s and the early 2000s due to the improvement of Internet connections and technology. The number of illegal downloads using programs like Napster (the early Napster) grew immensely. Businesses selling music, being it physical or digital, were somewhat reliant on the capacity of regulators and prosecutors to limit this shadow market. But the streaming services are different. Many of the users that were illegally downloading music to skip a fee payment are willing to pay for a streaming service. Streaming offers the possibility of listening to everything one could imagine for a small flat price. These services substantially limit the shadow market by removing the economic advantages of it. Just because of this, the music industry owes much to these streaming services.

The digital consumer wants everything readily available. This explains why Spotify was able to grow its user base to the current 60 million, with 25% of them being paid subscribers. Spotify turned music streaming into a real need and its users are willing to pay for the service like they pay for utilities or any other monthly bills. For £10 you can subscribe to an unlimited streaming service that allows you to listen to more than 20 million tracks ranging from the top charts featuring Wiz Khalifa and David Guetta to the most exquisite classical works like the Cantus Arcticus of Einojuhani Rautavaara. Almost nothing is left behind and there is something for every user no matter what his tastes are. While Apple was building a repository of digital CD’s, Spotify was shaping the needs of music lovers.

Across the years Spotify was able to get rid of its most direct competitors offering a better service for the same price (and sometimes less). In a certain way, one could say that Spotify developed a kind of eco-system, where many developers offer apps that work inside the main Spotify software contributing to an improved user experience. The investment was huge, as the company always believed that profits would be a natural consequence of a growing user base.

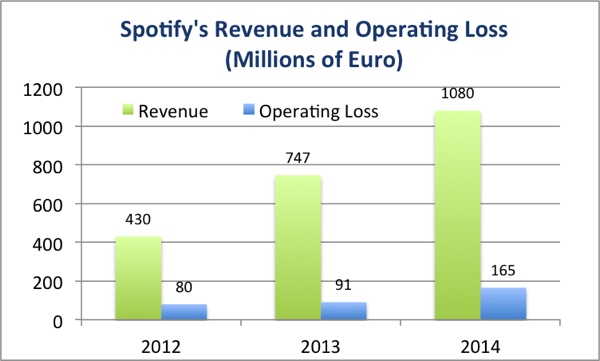

But there are some thorns in the music streaming business. Spotify is not making any money as it is paying out more than 80% in royalties to the music industry. In fact, no one is making any money from music streaming with the exception of the biggest record labels. According to its latest filings in Luxembourg (which I accessed only indirectly through “The Guardian”), revenues grew from €747 million to €1,080 million between 2013 and 2014, but the company ended with a widening operating loss, rising from €91 million to €165 million.

The company is growing very well in terms of the number of paid users and revenues, but royalties are still 80% of revenues. The company paid €882 million in royalties on a €1,080 million revenue last year, which leaves a gross margin of just 20% – not enough to pay for its expenses.

Spotify believes it is worth investing more and more to increase its user base, in particular the number of paid subscribers, but if it is not able to renegotiate these royalties, it might never see a profit in its lifetime. It even seems that royalties are growing in proportion to revenues. Compounding this issue, Spotify now faces a huge additional problem – Apple’s new music streaming service. Apple finally decided to redesign its old-fashioned iTunes and enter the streaming market. Apple is not doing anything innovative here, and it is likely that Spotify and others will continue providing the better service, but with 800 million credit cards already on its database, Apple has an unfair advantage that may annihilate the streaming business forever. Spotify cannot compete against the major eco-system developers, in particular against one that is sitting on a billion dollar cash pile and that is not concerned with making profits out of the streaming business.

If 2% of Apple’s users were converted into subscribers for the new music service, Apple would instantly surpass Spotify. Provided that it is very unlikely that users subscribe two paid services at the same time, the more Apple gets, the worse off Spotify becomes. It reminds me of the early ages of Internet Explorer when it started being distributed with Windows. In just a matter of years, the browser captured more than 90% of market share and killed off the once leader and now defunct Netscape Navigator. It’s tough when you have to compete against someone that is bigger than you and doesn’t even care about making a profit. Spotify needs some leverage before it is too late.

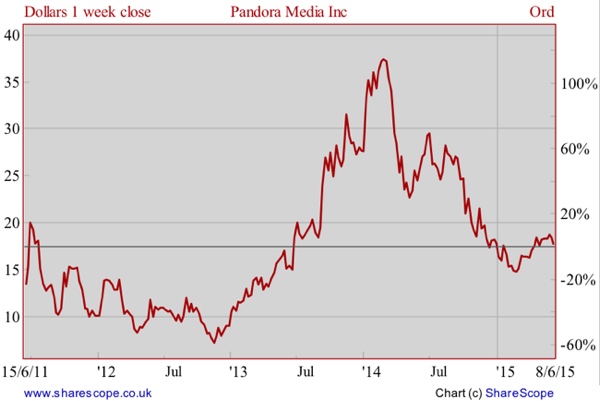

Apple’s music service is aimed at contributing to Apple’s corporate image and retaining users within the eco-system. It may be seen as a marketing cost for the company. On the contrary, Spotify must make money from streaming at some point. But with Apple looking likely to grab a chunk of the market, Spotify may never get the number of paid users it needs to overcome the royalties hurdle. If nothing is done, Spotify will end as another Netscape Navigator or maybe another Blackberry – currently a very tiny shadow of what it once was. Spotify delayed a rumoured IPO for too long and now it may already be too late. The equity market is approaching a top and if Pandora’s equity is a good proxy for Spotify, I would say this is not the best time for an IPO.

The only salvation here is through acquisition. Spotify must make a huge partnership or be acquired by a major player. There were some rumours months ago of Spotify being acquired by Google. The business was by then valued north of €10 billion. But then the deal broke as Google was scared away due to the 80% payout in royalties. And, of course, Google is not in a hurry, as the company believes Youtube is a good music streaming service. The other big player is Microsoft. The company has been acquiring a few existing key businesses like Skype and Nokia. Spotify offers Microsoft the opportunity to beat the market in an important industry and will help rebuild its corporate image at a time Apple is approaching a turning point. This would keep Spotify alive and in the fight on equal terms against Apple.

Regarding Apple, I believe the mocking of Tim Cook’s presentation makes more sense than ever. There’s nothing new coming from Apple these days. The Steve Jobs era is gone and Apple is nearing a turning point. Jobs’ vision on simplicity has been reversed, as Apple’s OSs are ever more complex and slow. It’s true there’s a new watch, but there is also an iPad Mini that is equal to its previous version. There’s still a lot of juice to come from the iPads and iPhones, I believe, but when the music is over I’m not sure about the Tim Cook Apple’s capacity to innovate and lead the market. If you want proof, just take a look at the huge cash pile on which the company is sitting – they just can’t find a way to invest it.

Comments (0)