Alba Mineral Resources: A stock for all seasons

Master Investor interviews George Frangeskides, Executive Chairman at Alba Mineral Resources

Master Investor: Hi George. Thanks for taking the time to speak with Master Investor today. Please give our readers a brief introduction to Alba Mineral Resources (LON:ALBA) and its recent history.

George Frangeskides: Alba Minerals was listed on the AIM market more than 10 years ago as a mineral exploration company. Our principal mining project is the Amitsoq graphite project in Southern Greenland. About three years ago, Alba ventured into the oil and gas sector with an initial 5 per cent investment in the majority owner of the Horse Hill oil and gas project in the Weald Basin in Surrey, Horse Hill Developments Limited (HHDL). We have since increased our interest in HHDL to 15 per cent through a series of acquisitions, and have also acquired a 5 per cent interest in the producing Brockham oil field, also in the Weald Basin.

MI: Alba’s portfolio spans graphite, uranium, base metals, gold and oil. That’s a rather idiosyncratic portfolio for a small mining company, if you don’t mind my saying so. Is such a diverse spread of assets intentional in order to hedge risk, or was it simply a case of organic growth and spotting opportunities?

GF: A bit of both, to be honest. The uranium and base metals projects have been in Alba’s portfolio for some years. The Amitsoq graphite project was added in the past 12 months or so, as we saw an opportunity for low-cost entry into a project with really great potential. As a result of our thorough review of the Amitsoq licence, aside from the known graphite, nickel and platinum group element anomalies, we also identified two significant gold targets at Amitsoq, which targets incidentally are along strike and relatively close to the previously operating Nanaluq gold mine.

As for our move into the onshore UK oil and gas sector, an opportunity arose to participate in a consortium of investors in the Horse Hill project which was about to be drilled. While the cost of drilling that well – one of the deepest onshore wells drilled in UK history – would have been prohibitive on our own, investing through a consortium meant that we were able to share the costs and reduce the risk involved in our participation. This risk/reward profile fitted our position ideally and the subsequent discovery of significant quantities of oil at Horse Hill justified our taking that exploration risk. We are delighted the Project is progressing so well.

MI: The Horse Hill project is one that readers may already be familiar with. What is the current state of play at Horse Hill, and how are the economics shaping up for UK onshore in the current low oil price environment?

GF: The operator of Horse Hill, HHDL, is in the process of seeking planning permission to carry out four extended production tests on the existing Horse Hill-1 well, which will be designed to confirm the commerciality of the discovery. The application also seeks permission for further drilling. As for the economics, we have seen a significant recovery in the price of oil since its low point at the start of 2016. Also, the oil discovered at Horse Hill is of high quality. Of course, we are still far off the oil price highs we saw in the earlier part of this decade, but we believe that UK onshore production can be achieved at relatively modest costs. The flow test results we achieved last year, when we reported production at a combined average rate of over 1,688 barrels of oil per day, were impressive and give us great hope that the project will be economically viable even at current oil prices. The extended production tests later this year will tell us a lot more about that.

Operations at Horse Hill (March 2016)

MI: As well as Horse Hill, you are also earning a 5% interest in the producing Brockham oil field. How does this interest fit into the wider portfolio?

GF: Brockham is just a few miles away from Horse Hill and in similar oil-bearing geological formations. However, unlike Horse Hill, which is in the exploration phase, Brockham benefits from a full production licence, and was producing oil as recently as last year. In conjunction with the operator of the licence, we have just announced that recent results at Brockham confirm very similar thickness of reservoir and properties to those reported at Horse Hill. The intention is to bring the oil-bearing Kimmeridge limestones into production at the existing Brockham production facility as soon as Oil and Gas Authority approval is in place, with a production start date targeted for this spring or summer. The possibility of Alba benefiting from a share of oil revenues potentially as soon as later this calendar year is a very exciting prospect and a very significant development for the Company.

MI: Graphite is perhaps not the most familiar mineral to mining investors. However, graphite has many industrial applications and has come into the spotlight lately due to its being a key component in lithium-ion batteries. How do you view the prospects for the graphite market, and what are the particular attractions of the Amitsoq graphite project in Greenland?

GF: The Amitsoq graphite project is an example of Alba seeking out new opportunities to invest in commodities where the demand cycle is expected to remain strong in the years to come. Graphite is one such commodity. As you rightly say, graphite is a key component in lithium-ion batteries, which are used to power electric vehicles. The demand for electric vehicles is expected to grow massively in the years ahead. What attracted us to Amitsoq was that it was a former producing graphite mine and that the total carbon graphite grades, averaging well over 25 per cent, are among the very highest of any project in the world. This gives us a really strong platform to build upon. We expect to be drilling at Amitsoq later this year and are developing a fast-track programme to exploitation and ultimate production.

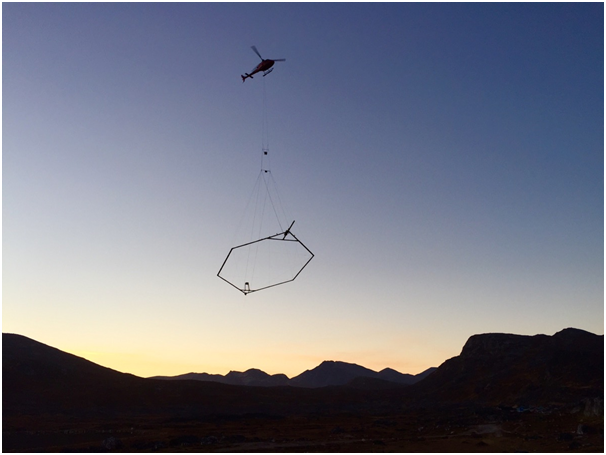

EM-Mag Survey at Amitsoq (September 2016)

MI: The Mauritania uranium project comprises early stage exploration targets. Uranium is in the grip of a pretty horrific bear market but many commentators believe the foundations are being laid for some ‘whiplash’ price action once economic fundamentals reassert themselves. Indeed, some uranium stocks have already started to move in anticipation of better times ahead. What are your long-term plans for Mauritania?

GF: While the uranium sector has had a difficult time of it for a number of years now, we continue to believe in the fundamentals of our uranium project in Mauritania and intend to hold it and wait for an upturn in investor sentiment in that sector. As you say, the project is still in the early stage exploration phase, but we have discovered high-tenor uranium anomalies there, including visible uranium mineralisation. We have applied for a reduced licence area, which still retains those key anomalies, and once the licence is granted we will certainly look to go back in and do some follow-up work on these targets.

MI: Your exploration licence in the Limerick Basin in Ireland is highly prospective for a range of base and precious metals and is only 10 km away from and part of the same target unit as the Pallas Green zinc discovery. What evidence have you encountered so far that your licence could hold similar potential to other major discoveries in the region?

GF: We recently carried out an extended gravity and soil sampling programme at our previously drilled Limerick project. Assay results have confirmed four main areas of anomalism, two of which contain zinc-silver and other elements, a third area is anomalous for barium, but perhaps the most interesting area is an area of copper-silver-arsenic anomalism similar to that found at former Gortdrum copper-silver mine 25 km away. Gortdrum was mined for copper-silver-mercury in the 1960s and 1970s, producing 3.8 million tonnes at 1.19% copper and 25.1 g/t of silver. This target in particular will be the focus of the next stage of work in Ireland.

MI: You have a stand at the Master Investor show on Saturday 25th March. Where can readers find you on the day?

GF: We will be at Stand 55 and will be happy to answer any questions.

Comments (0)