Volatility is at record lows – but for how long?

Since Trump won the U.S. election, markets have been flying higher without pause for breath. The Dow, for example, is up 9.7% and recently broke the 20,000 barrier. Trump is probably one of the most eccentric presidents the U.S. has ever deigned to elect, and poses major risks to trade, multinationals, and the world order. But investors seem to prefer to focus on the mooted tax cuts, infrastructure investment, domestic job creation and a few other bold promises.

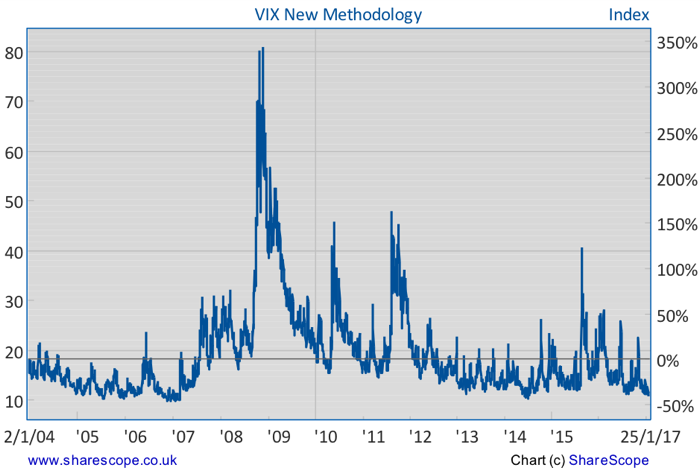

As a consequence, the VIX, which roughly measures investors’ fear levels, is currently at a level not seen since July 2014 and very near record lows. When optimism is running high at a time when global challenges are so huge, I’m not really comfortable being long in the market. When everybody is optimistic and ignoring the risks, a potential mini crash is more likely, because a sudden setback can catch everyone off guard and start a panic.

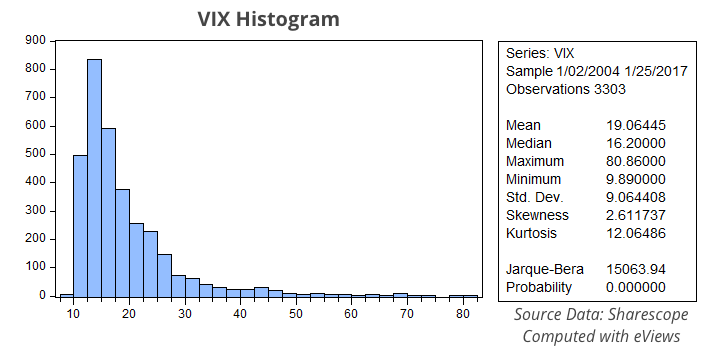

Enter VIX. The VIX is a complex animal which has been built using mathematical formulae aimed at measuring S&P 500 volatility. The index is extremely volatile and tends to rise at a much faster pace than when it declines. At the same time, it exhibits a mean-reverting process, as it tends to revert to a long-term level of around 20, depending on the data range analysed. The mean for the data I collected during the interval between 2 Jan 2004 – 25 Jan 2017 is 19.06.

The mean reversion exists because pessimism doesn’t last forever. But neither does optimism. When taken together, the mean-reverting process is explained. So, while volatility may fluctuate wildly, any large deviations from its mean value are only temporary, as it ends up reverting to that mean. A corollary of this is the stronger the deviation from the mean, the stronger the expected pull back.

The VIX currently trades at 10.81, a value not seen since July 2014. If we dig further to find previous references to that level, we are taken back to 2007, a year when the financial crisis was just around the corner. That could be a warning sign. When the market is too complacent, something bad may be over the horizon.

In terms of distribution, the VIX is hugely skewed because it shows large spikes. While its mean is 19.06 for the period under consideration, the maximum value observed was 80.86 and the lowest was 9.89. A reading of 10.81 is towards the lowest extreme of the distribution, which opens the door for a huge mean-reversion towards the 19.06 level. In technical terms, this is exactly the point at which a long position in VIX seems like a very sound trade.

Now, looking at the fundamental landscape, we have Trump and his bold promises: tax cuts, deregulation, scrapping of trade agreements, infrastructure investment, a renewed nationalism and pride in “made in America”. He is pushing companies to abandon their external projects and return home. Some have already obliged and announced plans to install new factories on U.S. soil.

“We must protect our borders from the ravages of other countries making our products, stealing our companies and destroying our jobs”, Trump exclaimed. “Protection will lead to great prosperity and strength”, he added.

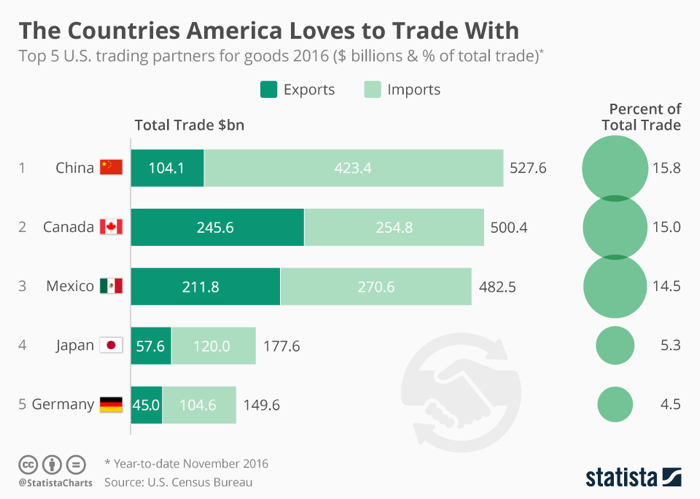

In my humble opinion, Trump’s perception of global trade is distorted. There is a reason why trade is distributed the way it is. Ford produces cars in Mexico and Apple produces phones in China for economic reasons: it’s damn cheap! The U.S. can’t compete with those countries in terms of labour costs, and I’m not sure it would be desirable in any case.

If, for some reason, Trump decides to implement the tariffs system he promised, phones and cars will become more expensive, which means the American consumer will buy less. At the same time, those multinationals will become less competitive in external markets, which in turn means selling much less globally.

So, it is not really foreign companies that are stealing jobs, profits, and growth from America, and there is no sound argument to corroborate the judgement that increasing protectionism would lead to more jobs, more profits and more growth for the US economy. If anything, it seems to work the other way.

If Trump insists on scrapping trade deals, building walls and eliminating the trade deficit with China, the U.S. consumer will end up paying much more for everything and companies like Ford and Apple will lose market share around the world. Because of this, I can’t find a real reason to be optimistic regarding the U.S. stock market.

Pulling all this together, the mean reverting nature of the VIX (INDEXCBOE:VIX) makes it a great long position at these levels. Unfortunately, there’s not really an easy way to trade VIX, because it can’t be traded directly. Moreover, the ETF and ETN alternatives are often poor options because they’re based on future contracts. Unless traded and carried for short periods of time, investors would end up losing money on these instruments due to the rolling of future contracts.

However, some spread betting companies offer a few alternatives that may be worth considering for a long trade lasting for a few weeks. This bet on volatility is also a great form of portfolio insurance for long portfolios, especially at a time when Trump is revealing himself in terms of economic policy.

As a side bet, I would avoid multinationals and tech companies that depend on China. As I’ve explained before, I’m bearish on Apple (NASDAQ:AAPL) due to its lack of innovation. Now I have one extra reason to be bearish: a potential rise in production costs. In the end, Apple needs China to produce smartphones, but China doesn’t need Apple to produce them. Companies like Huawei have been doing great around the world and are becoming ever stronger competition to Apple.

For those brave enough, there is always the possibility of selling the market, either via the S&P 500 (INDEXSP:.INX) or the more large-cap tilted S&P 100 (INDEXSP:SP100).

Comments (0)