Pension Deficits Will Turn Around

It may be an exaggeration to claim that the current pension deficits of UK companies are entirely the result of the monetary policy action followed by the BoE, but it is not that far from the truth. In March 2011 the total deficit on the books of FTSE 350 companies was £20 billion. One year later the same figure had quadrupled to £81 billion. The massive BoE intervention in financial markets reduced interest rates to their lowest levels in centuries, which contributed to an astounding increase in the value of the liabilities held in pension schemes. These huge deficits work as a poison pill against corporate acquisitions, reduce corporate values, increase the volatility of a company’s stock, and decrease the likelihood of companies offering such schemes to their future employees. The impact on pension schemes is definitely one of the most significant and negative unintended consequences stemming from quantitative easing and zero interest rates. But, at a time when the Federal Reserve is preparing to hike rates in the U.S. – and with the BoE likely to follow the same route early next year – companies carrying sizeable schemes may also benefit the most from an increase in interest rates as pension deficits usually decline in value as interest rates rise.

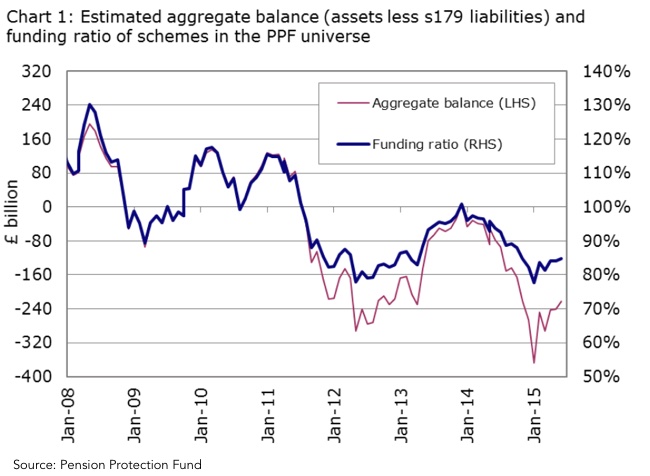

Pension deficits at UK private companies ballooned to a record high of £367.5 billion in January 2015, according to the Pension Protection Fund (PPF). Liabilities were by then rising steeply because the BoE was playing down any expectations of a rate hike and the ECB was promising its own package of massive asset purchases, further contributing to a postponement of rate hikes in the UK.

When bond yields decrease, companies’ defined benefit pension scheme deficits rise. These schemes offer a guaranteed level of retirement income, which is often linked to the employee’s salary. When yields decline, the discount rate used for determining the present value of future liabilities also decreases. As a consequence, the present value of these obligations increases and the company needs additional assets to close the funding gap. The PPF index, which measures the ratio of assets to liabilities in 6,057 UK schemes, decreased from 82.3% in December 2014 to 77.6% in January 2015, hitting a record low.

However, the situation has been improving during the course of 2015. In June the aggregated deficit declined to £223.1 billion while the PPF index improved to 84.8%.

While the situation has improved, it is still far worse than it was just one year ago, when the PPF index was 93.8% and the deficit was £76.8 billion. When put into perspective, both the aggregate balance and the funding ratio are still near historic record levels, which may be tested again if the BoE keeps postponing its first rate hike.

How Are Schemes Affected?

Pension schemes with defined contribution are very sensitive to yields on a range of conventional and index-linked gilts. If the yields on these gilts decrease, the scheme deficit increases. When the yields are very low, schemes are exposed to increased volatility, as any small change in yields would cause large changes in deficits. Companies with large schemes on their balance sheets for which the average duration of liabilities is higher are more exposed to changes in discount rates. While an increase in interest rates usually negatively impacts corporate values (by reducing the present value of the company’s expected future cash flows), for companies with large pension schemes it can play positively, as the increase in rates would help fill the gap in their pension schemes.

A particular scheme’s deficit depends on several factors. First of all, it depends on what the company invests in. The value of assets is affected by the change in the prices of equities and bonds. If the equity market is rising, then companies with schemes more exposed to equities would benefit the most. But that is not generally the case, as UK companies have been increasing their exposure to the bond market at the cost of the equity market, as a result of the financial crisis. The average allocation to bonds increased from 33% to 55% over the last seven years. This means most companies have not benefited from the equity bull market, or they benefited only moderately as the average exposure to it is low.

The deficit also depends on the discount rate, which is not in the hands of a company but dependent on economic developments and central bank action. During the last few years the discount rate has decreased due to unfavourable economic conditions and an accommodative monetary policy. But liabilities also increase with time. When everything is held constant over time, the deficit increases, as the maturity of the scheme approaches. The reasoning is relatively easy to understand: If you have an obligation to be paid in one year, it is worth less today than in one year’s time (provided discount rates are not negative). Take a discount rate of 10% for example. If you have a liability of £110 with maturity in one year, this is worth £100 on your books today. In one month, this liability will be worth £100.80; in six months it will be worth 104.88; and in one year it will be worth £110. This means that companies need to effectively manage their assets to keep pace with the increase in liabilities.

At a time when the British economy is recovering from the financial crisis and adding jobs, bond yields should now be much higher. But the BoE has prevented that from happening and yields are still at levels that are not compatible with expected long-term inflation, creating a major headache to companies managing large pension schemes. They face the challenge of either having to fund the liabilities by injecting cash that could be spent on investment, or engaging in riskier investments by increasing the proportion of equities in the portfolios. But while the first option isn’t efficient, the second is irresponsible. In either case a lack of growth and too much monetary intervention are responsible for the chaotic situation.

The Situation Will Soon Change

As we have seen, a record was hit in January, when the aggregate balance and the funding ratio were at lows. I believe that point marked a bottom, heavily influenced by the announcement of European QE and the introduction of negative interest rates in a few European countries. While the BoE should be the reference point for the UK, we cannot ignore the influence that ECB policy has on the actions of the BoE, particularly when talking about a programme that plans to purchase more than £1 trillion in assets. But most of the damage has already been done and monetary policy is at a point where it will be shifted. The BoE has been postponing rate hikes, mostly because of marginal developments, but when the temporary effects from the drop in commodity prices vanish, a stronger UK consumer will lead to higher wages and prices and urge the BoE to push through rate hikes quicker than many now foresee. Higher interest rates do have a negative impact on equity values but the impact on companies with huge pension liabilities as a percentage of their equity market values will be positive and will allow them to more effectively allocate resources. At the same time, as the gap closes, the poison pill that prevents mergers and acquisitions will also disappear and some of these companies will become takeover targets. One should look at the IAS19 item on the balance sheets to understand which companies are more likely to benefit from a rise in interest rates.

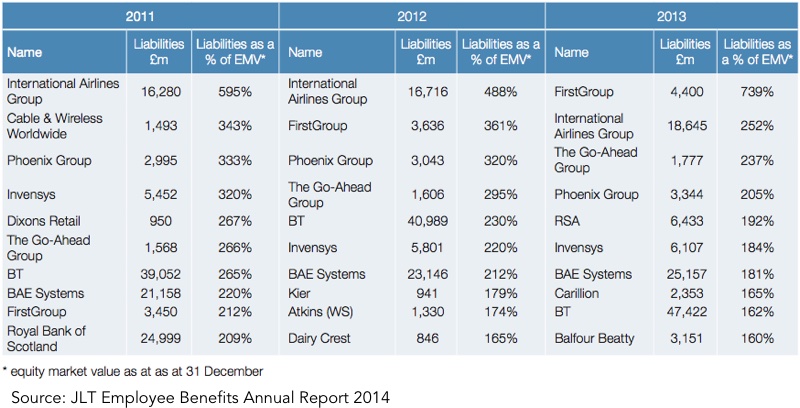

The annual report from JLT Employee Benefits for the 2013 year-end shows the following FTSE 350 companies ranked by the value of their scheme liabilities as a proportion of equity market values.

A total of 17 companies have reported pension liabilities greater than their total equity values and four show liabilities more than double the company market value. The companies with the largest liabilities are more likely to benefit. Unfortunately, the above list is a little outdated now, but it serves as evidence. As soon as the gap is filled, the poison pill disappears and these companies may be the target of acquiring companies. That is the case with RSA, with shares now rising on the back of the Zurich bid for the company. That was also the case with Invensys, with it quickly becoming the target of a takeover by Schneider Electric when it solved its scheme hole. Others will soon follow…

Comments (0)