Mellon on the Markets: The best bets right now

Inside the mind of the Master Investor: influential British investor Jim Mellon reveals his latest thoughts on the markets. The month, Jim looks at precious metals, dividend-yielding companies and other investment opportunities that are likely to prosper in a recession.

Is it better to melt in the heatwaves or to mitigate discomfort by using air conditioning? Singapore and many parts of Asia, as well as the Middle East, have prospered, in part as a result of the invention and proliferation of air conditioning. However, it is a huge user of electricity, much of it generated in a climate-unfriendly way, so Greta Thunberg, the teenage climate activist, and her chums will no doubt deploy their agitative tactics in this direction soon.

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

I hope they don’t succeed, as although my house in Ibiza is now entirely and, of course, virtuously solar, restrictions on air conditioning would cause my summer productivity, already severely impaired, to plummet further. And I have two books to write, companies to nurture and investment bets to make.

And what a great time to be placing those bets. Be in no doubt, the absolutely best bets available to Master Investor readers right now, are in the precious-metals complex. Gold and silver, in particular, are the easiest of these to trade and can also be represented in portfolios through selected mining companies.

My total and utter conviction on this is enhanced by the fact that ‘looney tunes’ monetary policy has thrown one third or more of all government debt around the world into negative territory. This means that people foolish enough to buy such bonds have to pay to hold their cash, for any period right up to 10 years, and in some cases, beyond.

The old argument against holding gold and the like was that they carried no yield, and indeed, there was a cost to store them.

That’s another argument gone, and I urge everyone to climb on board the gold train; last month I said it was leaving the station. If you run fast, you might just catch the last carriage. I am pretty sure we will see $1,800-$2,000 before this year ends, and see gold miners move much, much higher. Yesterday’s Fed interest-rate cut by 25 basis points was disappointing to gold bulls, but this will be temporary, as no doubt another cut is coming.

Buy British

The next most obvious trade to me is the UK. It beggars belief that a country, which in part contrast to the eurozone, enjoys its own unique currency, shares very low costs of government borrowing and also has, unlike the eurozone, exactly the right mix of future industries – eg fintech, biotech, materials and battery tech etc – should be trading at ludicrous levels, with regard to both the currency and the stock market.

I also urge readers to consider buying UK stocks aggressively now; which ones? Well I would suggest those that prosper in a low sterling environment, such as Vodafone (LON:VOD), Rio Tinto(LON:RIO) and Prudential (LON:PRU). These are steals, with high and generally well-covered dividends.

From an international point of view, I like Carnival (LON:CCL), listed in the UK but effectively an international business, catering to an ageing demographic; and Raven Properties (LON:RAV),which has a high yield and a strong position in Russian logistics. Russia may well be somewhat rehabilitated in due course and this is a well-managed UK based company, recently released of a large shareholder, in the form of the embattled Neil Woodford.

On the subject of Neil, I thought he might ride it out, but I am afraid his PR has been dreadful, his continued insistence on levying fees on trapped investors is lamentable, and his overreliance on unquoted stocks is unwise. I can’t really see redemption. I prematurely bought his Patient Capital Trust (LON:WPCT), and I note that he has bailed out of a lot of his personal shares.

On the other hand, a year ago, very few would have foreseen redemption for Boris Johnson – but now look where we are! I am pretty sure there will be a deal. Look at the chart to see why.

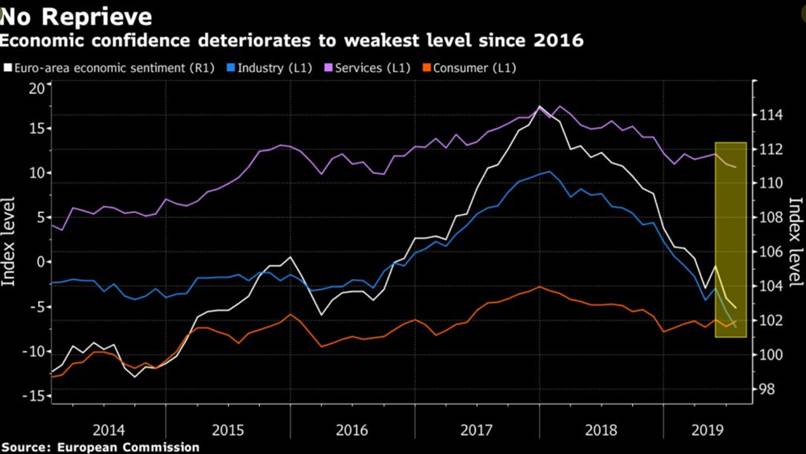

The European situation is dire, and there is a chance, which should not be discounted as negligible, that the Italian and German banking systems go bust all at once. This would be a complete disaster for the euro project and propel gold to unforeseen highs.

The Europeans, I believe, are now rattled by the prospect of a no-deal Brexit, which, whatever the Financial Times says, will be worse for Europe than for the UK. I think some fudging is coming, and the pound is going up big time.

So, get positioned.

The hunt for yield

The hunt for yield, as interest rates stay lower for longer, will mean that investors will start moving away from tech (and I sense this is happening now, as rent-seeking, quasi-monopolist companies like Amazon(NASDAQ:AMZN)and Facebook (NASDAQ:FB)appear to have stalled) and seek out dividend-yielding companies with strong fundamentals. This is the view of my chum John Mauldin, one of the great global economics commentators, who I spoke to yesterday and is super excited about yield opportunities.

The search for yield with strong companies is important, as a recession must be coming, or at least significant slowdowns across the globe. My friend Steen Jacobsen, an excellent forecaster who goes to China regularly, tells me that the Chinese situation is dire and that growth has ground to a halt.

The US is absolutely slowing, and the eurozone is in terrible trouble. Not a good outlook for leveraged companies, of which there are plenty.

Other companies, with what I think are positive characteristics, you might consider are Kraft Heinz (NASDAQ:KHC),− very beaten up, but backed by Warren Buffet; Gilead Sciences (NASDAQ:GILD) −looking healthy and with a reasonable dividend; and Veon (NASDAQ:VEON), a Russian mobile- telecoms operator, with an excellent yield.

I made a pretty bad error in buying Intu Properties (LON:INTU) in the UK, which was a very good case of catching a falling knife and getting a bloodied hand. It has more or less halved since I started buying, and is a salutary lesson to me. My friend Will Nutting believes that the best shorts are when the company is crippled, and I think he is short Intu. I’m going to ride it out, as I suspect the largest shareholder, the Isle of Man based John Whitaker, might seek a buyer for his shares (triggering a full bid), as Intu has excellent malls, and retailing, contrary to the perceived wisdom, is not dead.

So here we are, close your eyes, prepare for a bit of a ride, but buy gold, silver, gold miners, pounds and high-quality dividend shares. Sell bonds, sell tech and prepare for glory!

Happy Hunting!

Jim Mellon

If the pound is due for a strong rally might that mitigate some of the profits to be made from gold?