Mellon on the Markets: FAANGs for the memories

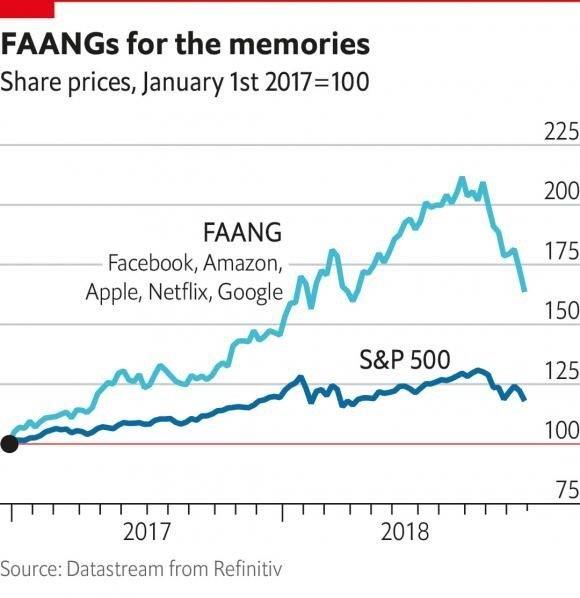

At long last! Hallelujah!! The FAANGS, and particularly my pet hate, the socially destructive Facebook (NASDAQ:FB), have taken a meaningful tumble. Actually, a one trillion-dollar tumble, which is about the size of the Swiss economy.

Now the sheep get sorted, the chaff is winnowed and one has to admit Alphabet (nee Google)(NASDAQ:GOOGL) doesn’t look half bad, but the pure social media companies are so much toast. Farewell hoodies, sayonara timewasters.

But this fall signals something else as well – the withdrawal of the party punch bowl (when was the last time you saw one of those by the way?).

FAANGs for the memories

The Fed’s gradual – actually, not so gradual – shrinking of its balance sheet is causing mucho problemas. Emerging markets are down by a quarter this year, the dollar is in the ascendant, yields on crap bonds are rising and not everything is as rosy in the garden of growth and stock love as it was.

Never miss an issue of Master Investor Magazine – sign-up now for free! |

And surely, it’s going to get worse. Yes, I am familiar with the refrain of optimists that the US market has got cheaper as a result of its non-performance this year and the increase in earnings. But those earnings have come about as a result of tax cuts (one off), buybacks (falling) and increased leverage. A toxic cocktail of retreating positive factors.

Could it be – as the US economy slows – and it is – that earnings FALL?

Yes, it is possible.

So be wary on US stocks for the moment.

In my long – and variegated! – career, I have noticed that those who pounce too early on exposed “value” typically end up with shredded hands as they catch a falling knife.

My fingers bear the scars.

Brexit bargains

Meantime, what a bore Brexit has become. Hopefully we just go for the EEA/EFTA suggestion proposed by Nick Boles and backed by Dan Hannan. Interminable posturing and complaint over something about 1% as important as a war is frustrating.

I do think that Mrs May, obdurate and resilient as she is, isn’t that stupid to go down in flames and I would be loading up on UK domestic stocks right now – and on the pound versus the euro and the dollar. The UK is cheap (except in real estate, which has further to fall) and this is my watching brief to my crack team of traders. Get ready for really bullish moves into the UK.

One reason for optimism is that the volume of contra-pessimistic comment has been so high, the Cassandras so numerous, that one would think the UK would already be submerged in recession. It isn’t – and on this I disagree with my friend Steen Jacobsen of Saxo – this is shaping up to be a really big buying opportunity.

I also think China – battered beyond belief – is worth looking at. ETFs will do in this case.

I have warned the idiocracy (new word) about cryptocurrencies for some time. They have collectively crashed by 80% in the past eleven months. Now as a dead cat bounce, one or two of them, Ether and Bitcoin, just might be interesting, but the idea that these bits of overhyped nonsense have any more worth than the promises of their snake oil sales folk is just plain wrong.

It might be worth looking at some tether coins – i.e. those that are backed by fiat money but offer the anonymity of bitcoin (which is its only redeeming feature, and not one of which I have availed myself, I hasten to say) and are also stable in price.

Tips for 2019

I am due to give some year-end recommendations soon. I would suggest shorting gilts, which are ridiculously overpriced, notwithstanding the astonishing improvement in the UK’s public finances. A surplus is within clear and imminent sight.

Never miss an issue of Master Investor Magazine – sign-up now for free! |

I remain committed to precious metals as I know that inflation continues to mount, and is unstoppable in an era of full employment.

My friends Dec Doogan, Greg Bailey and I financed a drug company in its infancy four years ago – Biohaven (NYSE:BHVN). It is listed on the NYSE and has done well. But it has come off the boil recently in the face of publically available information that suggests a positive outlook. This is a buy.

For the pre-Xmas stocking I would also suggest Zenith Minerals (ASX:ZNC) in Australia (very strong in lithium), for cash flow Lloyds Bank (LON:LLOY) in the UK (a dividend monolith), and not withstanding recent falls in oil, BP (LON:BP.) as a well-managed and predictable company.

If we are battening down the hatches, we might as well make sure they are watertight.

Happy Hunting!

Jim Mellon

Comments (0)