Mellon on the Markets

The mini collapse in shares earlier in February must surely presage something more serious. In my excessively long experience of markets, the first shudder is rarely the last. Emollient words from inexperienced market commentators should be roundly ignored. This bull market is approaching the shadows of its duration and investors should make use of the current phony war to reallocate and reshuffle their portfolios. From now on, it’s pass the parcel.

When I was a very young fund manager with an optimism bordering on the fanatical, I came back to the house I had just bought in London (at the time, I lived in Hong Kong), switched on the TV and saw on Teletext (ancient history) that the US market had fallen by a quarter or so. Luckily, I had been fortified by Chianti in a nearby hostelry, or the shock to the system might have been too much!

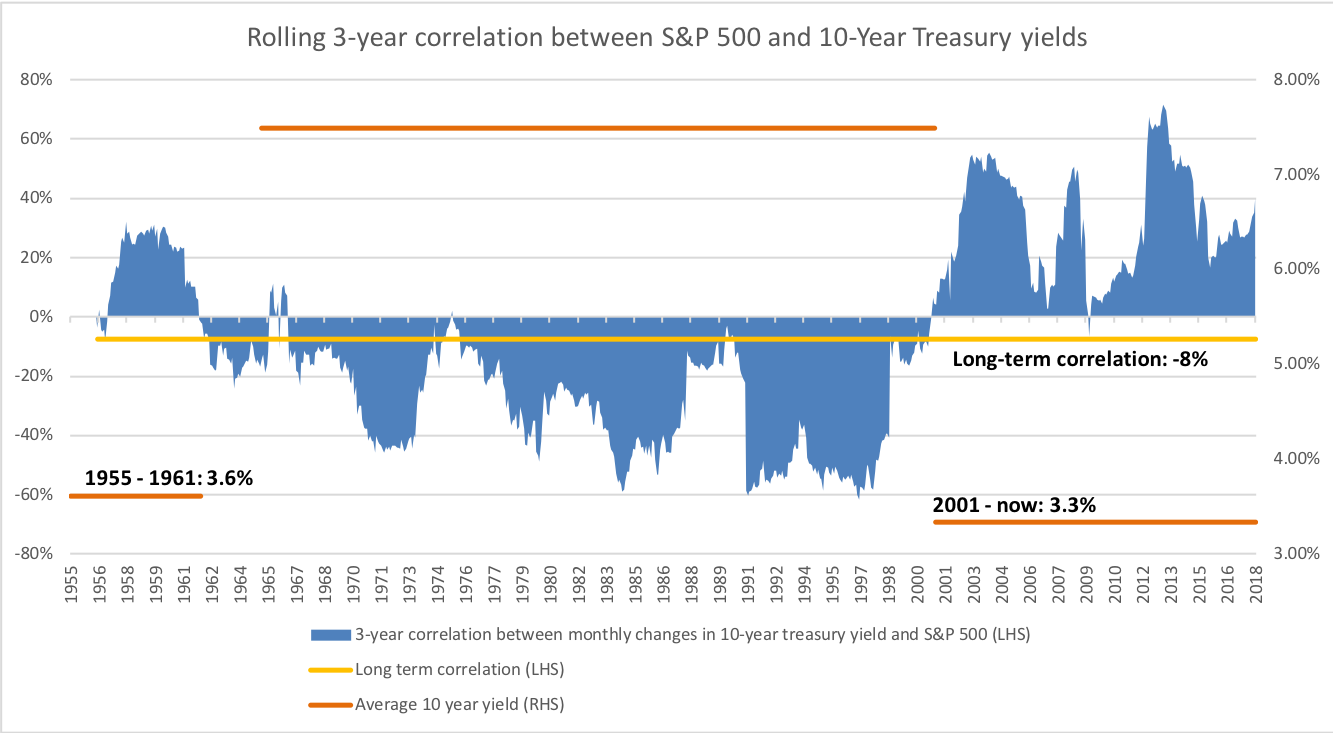

Since then, there have been many ups and downs, but mostly ups, and I have become used to them. But I have to say, the situation today strikes me as precarious. Bond yields are, to use the favourite parlance, “normalising”, inflation – which has been my bugbear since last year’s Master Investor show – is returning, and there has been too much damn complacence.

The next lurch down is on its way

To my mind, the upsurge in the VIX fear index (nicely played as a trade by my colleague Anthony Chow) was an omen; the collapse of the whole ludicrous crypto-complex was another; and the tweeting of stock market bullishness as a personal validation by President Trump, a further negative augury. Since then, normal service has been resumed. But, mark my words, the real blitz has not yet started in earnest – but it will.

Unlike in 1987, when the first frisson of bear market blues hit me, valuations have expanded to ludicrous levels, the likes of which were last seen in 1929. Stock prices have been manipulated by ultra-low interest rates (which are going to soon be a thing of the past), by share buy-backs and by an accumulation of “stories”, which when retold in the cold light of day, two or three years out, will look considerably less alluring. This makes me feel that the next lurch down is coming – and coming soon.

This doesn’t mean that I am not a raging bull on all the good things happening in the world (longevity, medicine, tech, etc) but it does make me wary of the immediate outlook for the major stock markets of the world. I think that the broad indices could fall by 25% or so peak to trough, and while some will do better than others (e.g. Japan vs the US), normally even the good girls go down with the bad.

From now on, it’s pass the parcel.

In my talk at Master Investor this year on March 17th (and by the way, it’s a ticketed session so best to apply soon, if of interest), I will be outlining a portfolio which I think can weather the storm that is coming. It will include some banks that will benefit from higher interest rates and the reduction in so-called “misconduct” charges, some dividend-yielding companies that look secure in their earnings, and some blue-sky tech and biotech companies that have the potential to change the world.

My call – until very recently an appalling one – that the big internet platforms of Google (Alphabet) (NASDAQ:GOOGL) and Facebook (NASDAQ:FB) would soon be getting some comeuppance seems to be coming modestly right. These companies are way over-owned in institutional portfolios, and although their PEs have come down, they are still stratospheric compared to the inherent risks the companies face – rising costs of compliance, less advertiser engagement, mounting competition and, most importantly, regulatory risk – as well as, in the case of Facebook, boredom. A short Facebook position will be my number one short idea for the year ahead, along with a massive short in German Bunds, which having fallen a bit, are destined for a much bigger fall.

My thesis

My overall negative sentiment is based on the following. The economic situation appears to be benign, but in fact is based on ever-increasing amounts of debt in most major economies. This debt accumulation is also facing diminishing returns in terms of its ability to drive further growth. Countries with rising and particularly worrying levels of debt include the US, China, Italy, France and Japan.

Take the US as an example. Just before the mini-crash at the end of January, the Trump tax cuts were being hailed as miraculous. On further examination, they are anything but, and will add hugely to the budget deficit of the US, which is already substantial. To put this into perspective, under the Trump plan, receipts will be only 75% of expenditures at a Federal level, and this matters.

It matters because the US economy is already running hot – wages are rising, commodity prices are generally rising, and interest rates are on the way up. With the government “priming the pump” at exactly the wrong point in the cycle, inflation will become a problem, necessitating more rate hikes this year (five in 2018?) – and hey presto, we already have the first sprouts of recession emerging.

Never miss an issue of Mellon on the Markets – Sign-up to Master Investor Magazine for FREE

Yes, I am aware of the disinflationary power of digitisation and automation, but I am sure that wage inflation and commodity inflation will outweigh all of those big time in the next two to three years. With corporates pretty indebted (remember those buybacks?) as well as the consumer (although less so than in 2008), things could get ugly.

And it’s the same in many other major countries. The UK isn’t as bad, and actually is performing better than most might have thought. Germany’s balance sheet is pristine. But if the US and (God help us) China slow down – and I think they will – prospects for global growth and trade diminish.

Our world is awash in a sea of debt – and that is not a good place to be. Yes, there is synchronised economic growth going on; and yes there is a productivity gain that is coming due to automation; and yes there are wonderful things happening in longevity. But central banks (so far, with the exception of China) are putting on the brakes (rather belatedly so), inflation is rising fast, yields are going up, and that is never a good place for equity investors.

Master Investor 2018

So please come on down to Master Investor on March 17th. As always, I will have some recommendations for you on the day (those attending my ticketed event will get them 10 days ahead of everyone else), and there is a sold-out list of companty stands to visit. In particular, I want to direct you to aircraft leasing specialist Avation (LON:AVAP), Fast Forward (LON:FFWD), Manx Financial Group (LON:MFX), Condor Gold (LON:CNR), Insilico Medicine, and Bradda Head.

Evil is speaking, Dominic Holland is doing his hilarious thing, Merryn Somerset Webb of Money Week is speaking with me, and Tom Stevenson of Fidelity, along with many others, will be giving his views on markets. Registrations are already up 20% on last year, and it’s going to be a cracking show. See you there!

Happy Hunting!

Jim Mellon

Click HERE to follow Jim’s trades on twitter

Jim has been a bear for the last ten years and missed a lot of returns. Is he finally right?

Crypto looks to be recovering and I see no signs of wage growth (if there is any it is needed to pay off debt). Tech is becoming even more deflationary over time. Tech is powerful and the gig economy is not getting regulated any time soon.

Jim’s longevity thesis is also question mark given life expectancy is coming down in parts of the usa.

The main thing to understand is that the world is now in revolution mode and with that a lot of accumulated experience in non revolutionary times becomes worthless.

Central banks are out of control and the endgame for that is probably some kind of civil war.