Jim Mellon: Reality sinks in for the FANGs

Never miss an issue of Master Investor Magazine – sign-up now for free! |

The summer fry continues, with wildfires all across the US and Europe – and even in the Arctic. Apparently, the reduction in wind speeds below the jet stream (in part caused by the large number of wind farms which have been built in the past decade) is causing its trajectory to change. Climate change is here, and mankind’s efforts to counteract it are just not sufficient. This is a theme I am going to look at more closely in the coming months.

Reality sinks in for the FANGs

On the subject of climate, it seems that the benign conditions under which some markets, at least, have prospered might be changing, and not in a good way. One such crack is the recent precipitous decline in Facebook (NASDAQ:FB), which in one tumultuous session fell by as much as a quarter, representing the single biggest destruction of stock value in history. I have long railed about Facebook being a timewaster’s charter for its two billion adherents, and it seems that even some of those are cutting the cord.

Facebook is important, because, it – along with the other FANG stocks and one or two others, such as Boeing (NYSE:BA) – has represented almost all of the outperformance of US markets in the last couple of years. It is interesting, in this context, to note that in Europe, where there are no comparable tech champions, there has been woeful underperformance in key indices.

I also note that Amazon (NASDAQ:AMZN) came out with excellent results, largely on the back of their web services division, and that analysts have revised their targets upwards. It is undoubtedly the case that Amazon is the best of the FANGs, but at the current rate of earnings it is about 90x forward earnings. Yes, when they stop investment in so many new areas, presumably margins will improve further, but for such a large company, with the world’s richest person at the helm, 90x earnings is a heck of a stretch.

Even more ridiculous are the valuations attached to such luminaries of the tech scene like Tesla (NASDAQ:TSLA), whose CEO does seem to have, ahem, anger management issues.

I remain pessimistic about the US market for this year and the next.

The fact remains that the US market is expensive, and the one-off stimulus from tax cuts and energy prices to S&P companies is just that – one time. The Fed is tightening, both by shrinking its bloated balance sheet, albeit in a gradualist way, but also by hiking interest rates. The US economy is running hot, with seven million more job vacancies than people to fill them, and with that going on, there is a substantial headwind for any stock market gains.

As such, I remain pessimistic about the US market for this year and the next, and further point to the fact that US companies are quite leveraged, having engaged in M&A and share buybacks (financial engineering) for years now.

And as for the famous FANGS, the Euro Commission fine on Alphabet (NASDAQ:GOOGL) of about $5 billion last week isn’t by any means the last bad behaviour sanction which will be meted out. All of these tech companies are stuffed full of cash, and presumably that cash is a source of temptation (rather like the banks used to be) for governments everywhere.

For these companies, there also remains regulatory risk. Will Amazon be allowed to keep killing traditional retailers ad infinitum? Will Google be regulated like a utility? Will Facebook be reined in, and be categorised as a news source in itself rather than as a platform? These are questions all of us should be asking – at some point, the pass-the-parcel game will come to an end and tears will flow.

Brexit and the Italian question

In the meantime, what a hash Brexit appears to be. I would like to think that we are at the moment of maximum hysteria before a (soft) deal is concluded, but Monsieur Barnier doesn’t seem to think that Mrs May’s carefully crafted proposals cut la moutarde. I have a feeling that because of the absolutely appalling handling of the negotiations in the last two years, there will now be a second referendum, and that with a few concessions from Europe, Remain will win.

I have always advocated for a much softer Brexit than the ideologues, and my general view is that it isn’t life and death either way. Note how the UK economy is still chugging along in the face of the gloomiest of predictions at the time of the plebiscite, and how sterling is holding quite steady.

My concern about the UK with regard to the eurozone was mainly pegged to the worry that Italy might blow up, and that the whole ship would sink quickly. The Italian problem has not gone away and indeed could flare up rather like a summer wildfire any time.

Don’t discount this in investment calculations.

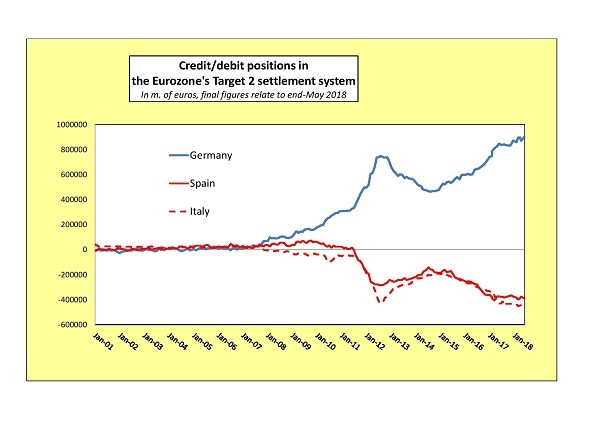

I attach a graph showing the imbalances – rather like an overdraft at the ECB – in the so-called Target 2 calculation, which Italy and Spain now have relative to the Germans. In the event that Italy walked away from the euro, it would represent a massive write down which would imperil most of the European banking system.

The Italians would default on an unsustainable debt, reclaim the lira and merrily devalue to try to restore their long-lost competitiveness. Don’t discount this in investment calculations. A super smart hedge fund guy I know has his principal bet against Italy – so just be careful and watch and wait. And of course, Europe’s early growth spurt at the beginning of this year appears to have petered out.

The risks are to the downside

Further East, emerging markets have done very badly this year, partly as a result of the Federal Reserve sucking dollars out of the world money supply, and partly for specific reasons (e.g. concern about debt levels in China).

The Bank of Japan has signalled a willingness to tweak its ludicrous zero yield policy on Japanese Government bonds, because, as it stands, the banking system is severely compromised if it doesn’t make such a change. I still think that if you have to hold a specific market, it’s best to hold Japan. It’s cheap, companies are reforming fast, and pension funds and individuals are underinvested in the stock market.

I still think that if you have to hold a specific market, it’s best to hold Japan.

I’ve been wrong on gold so far this year, but because I am a believer that inflation is insidiously worming its way back, I am holding my ground. In terms of stuff we are looking at, we like the look of some bombed out auto companies such as VW (GR:VOW) and Peugeot (UG:EPA). But tread with caution, as I think generally there is more downside risk than upside at the moment.

Getting back to the FANGs, I noted that in the quarter that Facebook just announced, one million people exited its all-embracing arms. I was one of them. I have been talking about the malign effects of social media for some time, so in order to avoid being branded a hypocrite, I have exited social media completely.

And I can tell you it feels great!

Happy Hunting!

Jim Mellon

I was wondering why you disappeared from twitter…. it makes sense now.

Shame about you stopping Twitter Jim.

I never quite saw it in the same light as other social media since it’s a good way of communicating to the masses and getting your message out.

I do miss those Tweets…

So – US unattractive; Europe unattractive; Emerging Markets unattractive; possibly Japan.

It does not leave much. The outcome seems to be retain good quality assets for the long term, and hold a good part in close to cash; and do not sell in panic when the big fall comes.