Jim Mellon: A crash is coming in the US

Inside the mind of the Master Investor: Jim Mellon reveals his latest thoughts on the markets. This month, Jim warns against getting carried away with US tech.

I haven’t written one of these letters for a little while, as I have been engaged – and not as successfully as I would like – in writing my new book, Moo’s Law, which is about the new agrarian revolution. It will be out in August though, and soon be available for pre-order. Everything to charity.

Anyway, in respect of my missive procrastination, there are only so many times that I can advise everyone to buy gold and to lace their portfolios with metathematic investments. (Those aren’t drugs, by the way!) And, to be wary of the US Robin Hood bro’ market, which has become increasingly frantic and narrow.

So, I will say it again – watch out in the US, particularly in the Nasdaq stocks, and keep holding the precious metals and their surrogates.

The US will have an inflationary boom starting next year; the kindling for that is in the hearth, and the Fed and Treasury are busy pouring the gasoline onto the fire now. The same applies to the UK, parts of Europe and to everywhere else where caution has been thrown to the winds and the monetary presses have been running hot.

I have no idea who will win the US presidential election, but neither of the candidates strikes me as being particularly good for the markets post-November. The Trump administration has not covered itself in glory vis a vis the pandemic, and is seeking to inflame matters by talking up law and order as a counter-theme to the BLM movement, which is in itself somewhat of a reflection of the deep seated inequalities in US society. Trump is also reigniting the war of words and tariffs with the EU and with China, all designed to play to his core base.

Meantime, be in no doubt that if Biden – currently the front runner – wins the Presidential election, this will not be a good thing for enterprise and stocks, especially as Democrats would most likely take the House and Senate at the same time.

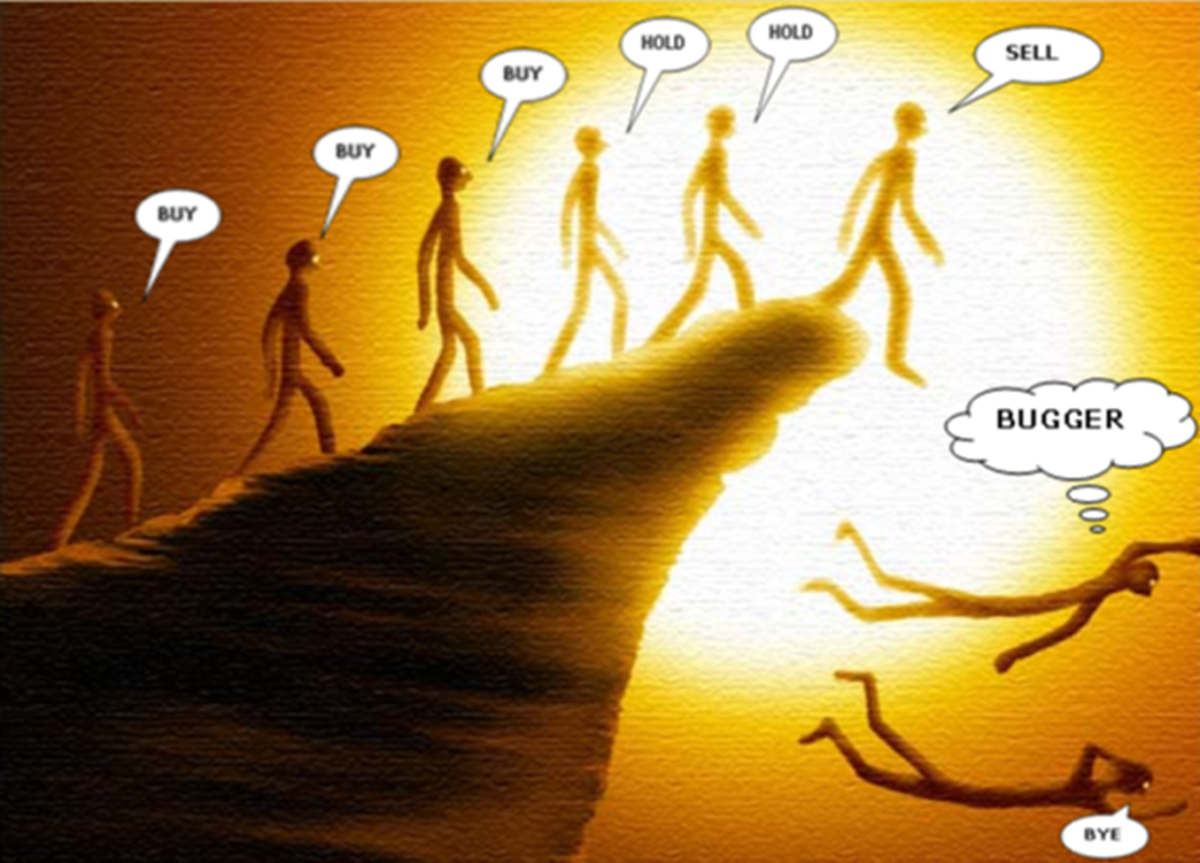

I read an “if you can’t beat em, might as well join em” article today – always a bearish signal – and I note that the Nasdaq, now up quite a bit for the year, is 16% above its long term 200-day moving average, and that has not ended well in the past.

But there are of course, less risky ways of making money than jumping on the bandwagon of the Teslas, Amazons, Zooms etc. – and that is to stick to the obvious beneficiaries of the great macro trends. Yes, of course that includes clean meat, climate change solutions and health/longevity companies, but let us leave those aside for this letter.

In an inflationary environment – and I have been heralding this for some time – precious metals, inflation linked bonds (TIPS), and probably real estate (particularly residential, but only after a shake-out), will be the places to be.

There are some people who have lived their lives as gold and silver bulls, and like stopped clocks they are about to be really proved right.

Gold is termed an anti-fragile asset by Charles Gave, a really sage man, and so it is. It does particularly well in times of stress – and who could not say that we are not in one of those now.

Some market practitioners only see the green on the screen and act as though nothing is happening, only upward movement.

They might be right about a V-shape recovery, of a sort at least, they might be right about disruptive technologies, and they might be right that the US and UK and Chinese and German and 189 other nationalities of consumer are ready to spend, spend, spend, but they are not right about the valuation of markets.

I still think UK shares are generally cheap, weighed down by Covid chaos, and by lingering Brexit doubts, and I think Japan is a great market to be invested in. But just you wait and see, there’s a crash coming in the US, and it won’t be long in arriving.

There might, might be a melt up before, but participating in it will be like risking all on a game of pass the parcel, when safer, more-likely-to-succeed investments are all around for us to see, if only we have eyes.

Meantime, please keep holding the stodgy and boring stocks that will survive – in the UK, Lloyds, Phoenix Group, RSA, Legal & General, Prudential, Whitbread, all dull as ditchwater, will be the ones to spring out of the traps when things get going.

But don’t have more than 50% in stocks overall; 20% in precious metals, 10% in cash (GBP or JPY by choice), 10% in inflation linked bonds, and 10% in metathematic investments.

I’m going to give you a quick flavour of the latter: US alternative milk sales (soya, almond etc.) were about 1% of the milk market a decade or so ago; they are 16% now. Plant based meat sales are about 1% now. You know where I am going…

Jefferies, a big US investment bank, estimated about a year ago that it would take 10 years for Beyond Meat to be tracking at $1 billion of sales; it is now estimated to be doing that this year.

This pandemic has been a curse; I am just leaving the Isle of Man where we have been for 100 days. They have handled it brilliantly, but no one likes lockdown and I must say I am excited to be travelling.

If we don’t do something about the food supply chain, we will be confined to barracks several more times before we slip our earthly moorings.

It is quite clear to me that everyone needs to think about food. For their health, for the environment, and for the planet generally. I am, as are my colleagues, and I urge you to contact laura@agronomics.im if you think the same way.

We are off to Spain for a while, and the good news is that in our absence, Juniper the mother of our Ibizan Podenco hound, having been feral and roaming around the island for three years, has rejoined her daughter and our pack, and we cannot wait to see her. Money is not everything.

Happy Hunting!

Jim Mellon

Jim Mellon is right about gold, and the fact markets are seriously over-valued, but there is not going to be any inflation.

There is one thing Jim hasn’t mentioned – mass unemployment. That is the game changer which central banks cannot do anything about. Covid cannot be monetised away, and until a vaccine is found (and that may never happen), mass unemployment will ravage the economies of the world.

Buy Gold, USD, treasuries for their yields, but keep out of the stock markets – including Japan – unless a vaccine is found.

It would be useful if Jim would suggest some funds or trusts that ould achieve the portfolio balance he’s suggesting without lots of mini-purchases. Most Investors aren’t comfortable holding individual equities, and don’t know how to buy precious metals or TIPS or metathematics other than through a fund.

Hi Tony, we’re planning our next webinar to be a Q&A with Jim so we’ll try to see if we can ask him about some fund options as I’m sure many readers would be interested in this. Also taking on board your other points, we are hoping to offer some form of education in these areas. Amanda

My money is on a meltup then huge collapse. I am a buyer of the Dragon Portfolio. Would be nice for a master investor article on that piece by Chris Cole.

What is a US Robin Hood bro’ market please?

Hi Jim, are you a big fan of precious metals stocks at this point? Any stocks you like In the producer, explorers? Would love some individual stock ideas you like .

Also, with regard to the big picture macro, could you lay out what your long term views are with regard to the inflationary environment you see coming? Will we see 18% interest rates again (ie will interest rates rise)? Most analysts have said that the market can’t tolerate higher rates therefore rates cannot and will not go up.

Is your view we are going into a hyper inflation or high inflation environment or will it be a more stealth and slower inflation?

3. I am an investor in portage bio and would love your opinion on the company and what will spark higher share prices and more interest and excitement in the stock. Volumes have been very low following the share consolidation .

Thanks again for what you do for small investors like me.

Sincerely,

Jeremy in Ontario Canada

Condor Gold.