Cryptocurrency: The Next Phase

In December 2017 I wrote a piece for this magazine entitled The Future of Money. I explained that is just a conceptual construction of the human mind. It does not exist in nature; animals have no notion of it; even humans managed to live for countless millennia without it. If people agree to use cowrie shells as money, then cowrie shells aremoney.

So the world of monetary economics is like Alice Through the Looking-Glass. When I use a word, Humpty Dumpty said, in rather a scornful tone, it means just what I choose it to mean — neither more nor less[i]. Money is whatever people regard as money – even if it only exists on computer hard drives.

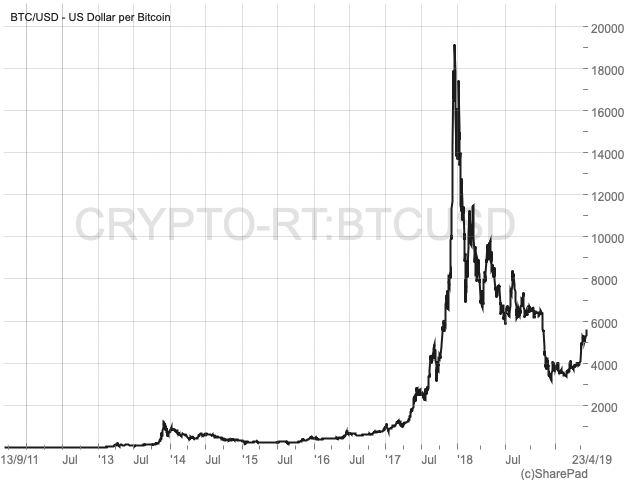

That piece came out at the apogee of the bitcoin boom. I was partly trying to explain how the new asset class of digital money – cryptocurrency – had come about. When bitcoin plunged in value in early 2018 many of us thought that was that. Cryptocurrency – always a dubious asset class – had hyped itself out. But it turns out that the bitcoin bubble was just the beginning of the story…

Cryptocurrency did not go away, even though it became less attractive for speculators. And now social media networks – in particular Facebook (NASDAQ:FB) which also owns WhatsApp and Instagram – and payment platforms like PayPal (NASDAQ:PYPL) are working out how to use digital currency to effect secure transactions between their users and subscribers.

The technology which makes cryptocurrency possible – blockchain – is still generating huge interest in the world of tech. It is quite possible that second-generation cryptocurrencies will soon be everywhere we look.

Bitcoin: triumph and tragedy

On 18 August 2008 somebody registered the domain name bitcoin.org. On 31 October 2008 a link to a paper authored by a certain Satoshi Nakamoto entitled Bitcoin: A Peer-to-Peer Electronic Cash System was posted to a cryptography website. Supposedly, Nakamoto then released the software behind bitcoin as open-source code (meaning that anybody could develop it) in January 2009. But was it the mysterious Nakamoto, whose identity remains one of the great mysteries of our time?

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

After bitcoin was launched it took seven years or so for it to attract attention outside the community of cyber-geeks who understood the sheer originality of the blockchain software technology on which the digital currency relied. Blockchain is a decentralised digital public ledger by means of which the entire history of each “coin” is recorded – not in one place but spread across hundreds of thousands of computers. Consequently, the supply of bitcoin (or other cryptocurrency) is limited; and every user can be confident that the provenance of any digital coin they buy has been verified.

In time, of course, the speculators piled in, viewing bitcoin as a type of digital gold. In January 2010 one bitcoin traded for $0.06 and it didn’t go much above that for years. But around mid-2015 the world’s leading digital currency began to gain value, gathering momentum throughout 2016. By 01 January 2018 each bitcoin was worth $19,498.63. Early enthusiasts – many of whom were by no means professional investors – had become, nominally at least, multi-millionaires.

I was one of those who urged caution. I argued in these pages in November 2017 that, while bitcoin (like other digital currencies) was a medium of exchange it was not a store of value and therefore had no intrinsic worth. In the event, a collapse followed the spike and many bitcoin fortunes (in dollar terms) were lost. In the first two months of 2019 the value of bitcoin has been hovering around the $4,000 mark. In terms of the total value of all bitcoin in circulation, that fell from an estimated $230.9 billion in January 2018 to $66.6 billion by the end of December last year.

Some said bitcoin was the future; others that it was a fraud. Either way, bitcoin and its imitators were branded as volatile and ultimately unregulated. For all that, a number of prominent hedge funds have continued to show interest.

IBM (NYSE:IBM), Microsoft (NASDAQ:MSFT) and JP Morgan Chase (NYSE:JPM) have all announced that they are developing blockchain technology for their own ends.Jamie Dimon, CEO of JP Morgan, in October 2017, called bitcoin “a fraud”. Yet in February this year – guess what – JP Morgan announced the first bank-backed digital token, the JPM Coin[ii]. The JPM Coin, the value of which is linked to the US dollar, will be used to settle transactions instantaneously between its largest clients within its settlements system.

Regulation

Arguably, the real key to the future success of cryptocurrency is regulation. Most major financial centres have yet to approve cryptocurrency as they regard the technology for “mining” and storing it as still unproven.

In July 2017 the Securities and Exchange Commission (SEC) in the United States announced that laws governing the trading of securities may also apply to some cryptocurrency transactions – but it failed to provide concrete guidelines. At about the same time, China banned outright Initial Coin Offerings (ICOs) by means of which software start-ups were raising finance in promised digital currency to fund their expansion. Several Asian countries, including China and South Korea, also outlawed cryptocurrency exchanges (where investors can convert cryptocurrency into “real” fiat currency).

When digital entrepreneurs launch so-called Initial Coin Offering (ICOs) they sell their own virtual currencies in order to raise money for software they plan to develop. In return for real money, investors receive digital tokens. Regulators worry that this novel fund-raising method allows start-ups to flout investor protection rules. Financial authorities around the world have been promising to crack down on ICOs, which came out of nowhere in 2017 to become a popular way for start-ups to raise tens of millions of dollars. Interestingly the Swiss authorities, thus far, have proved accommodating – Ethereum was launched there via an ICO in 2014.

One reason advanced for tighter regulation is the fear of money-laundering. But proponents of cryptocurrency argue that the role of crypto in the criminal underworld has been exaggerated. In 2014 the Common Reporting Standard (CRS) was adopted by most of the world’s central banks (though not the Federal Reserve which had first instigated it). Under the CRS the Chinese authorities, for example, could demand that the Hong Kong authorities hand over information on any Chinese citizen residing in Hong Kong – except for property information. For this reason, property, rather than cryptocurrency is still the preferred way for people with guilty consciences to launder money.

The Swiss canton of Zug and the US state of Wyoming have both passed laws to accelerate the trade in cryptocurrency. In Zug you can pay parking fines in bitcoin. The Wyoming law gives cryptocurrency a distinct legal status alongside cash, bonds and property.

Those who advocate the wider adoption of cryptocurrency argue that it makes perfect sense for a digital, global economy to have a digital, global means of exchange. Once a major regulator defines a workable regulatory regime for trading cryptocurrency, others will probably follow for fear of losing out.

How cryptocurrency could change the world

During the bitcoin bubble the global economic establishment – from George Soros to Mark Carney – told us, perhaps with some justification, that bitcoin was a serious threat to financial stability and that sensible investors should stay away. But, for all the frenzied speculation throughout the second half of 2017, we need to stand back and ask what the world would be like if – just as when cowrie shells gave way to metal coins – the nature of money were fundamentally to change.

The fact is that most major banks have started to trade cryptocurrencies to some degree and bitcoin is accepted quite widely by retailers around the world.It is difficult to get information about the number and value of total transactions conducted in digital currency, but, anecdotally, they are still growing.

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

If the use of cryptocurrency were to become truly widespread, then there would be massive implications for the economy.Firstly, central banks would no longer be able to control the money supply as they do for conventional “fiat” currencies by setting interest rates and carrying out interventions in the money markets (such as through quantitative easing (QE)). You can’t just print more bitcoin when the whim takes you, because the supply is fixed. Second, bitcoin – or another cryptocurrency – could become a truly global form of payment which would render central banks irrelevant as people dump traditional fiat money in favour of the most popular cryptocurrency.

The loss of power by central banks over monetary policy might be mirrored by a loss of control over fiscal policy by governments. Up until now, governments collect taxes in their own fiat currency and borrow in the bond markets (the gilts market in the UK) to make up any shortfall. If most people were paid in digital currency, then the state would have to levy taxes in that currency. But would governments be able to borrow in cryptocurrency to cover the fiscal deficit? The answer to that question is unclear.

Governments would no longer be able to inflate their way out of debt – the classic pattern over the last century. Instead, they would have to rely on direct taxation alone – and that will put pressure on states to shrink their spending programmes.

Then there is the impact on the banking sector. If people start to store much of their purchasing power in their digital wallets, then that implies that they will reduce conventional deposits of fiat money within the banking system. Once traditional banks start to lose deposits on a large scale, many will become illiquid and some, ultimately, will fail. As the threat of systemic failure within the banking system increases – especially in highly vulnerable currency systems such as the eurozone – so individuals will convert more of their traditional cash assets into cryptocurrency. This would further exacerbate the banking crisis.

There might even come a point where, collectively, we decide that we don’t need banks any more.Much as I have been rude about bankers in these pages, that would imply a massive change to the structure of our economy.

Political repercussions

The rise of cryptocurrency will probably also impact our political institutions. Some crypto enthusiasts like Vijay Boyapati have proposed[iii]a new form of delegative democracy (instead of representative democracy) whereby a voter could choose different representatives for different issues (e.g. transport of education) and change them at any time. Proponents of delegative democracy believe that private, decentralised solutions will replace traditional public institutions.

Then there are the crypto-anarchists who live in hacker communes (a certain Amir Taaki has set one up Barcelona); and the people who want to start their own micro-states, possibly floating at sea in seasteads, each of which will have its own cryptocurrency. One fervent champion of bitcoin, Brock Pierce (who is Director of the Bitcoin Foundation) tried to set up a crypto-financed state in hurricane-ravaged Puerto Rico (to be called Puertopia). Get ready for weird.

Facebook “likes” crypto

In May 2018 Facebook (NASDAQ:FB) announced that it was setting up a team to explore blockchain technology and to determine how to commercialise it. The team was to be headed by David Marcus, a former President of PayPal. There are now at least 45 engineers working on this top-secret project and Facebook is still recruiting new blockchain experts.

In a report by the New York Times on 28 February, the veil was lifted for the first time on what that team has achieved. The NYT claimed that five Facebook employees had briefed the newspaper on condition of strict anonymity. The company is working on a digital coin (FaceCoin?) that users of WhatsApp will be able to exchange with their contacts instantly. Since reporting this on the MI website on 08 March, I have learned that Facebook quietly secured a digital currency license from the Central Bank of Ireland two years ago, permitting the issuance of digital money and the provision of payment services throughout the EU[iv].

Sources suggest that the new cryptocurrency will first be made available in India where WhatsApp has 200 million regular users. Moreover, India receives more remittances from Indian citizens working overseas than any other country. In 2017 these amounted to $69 billion according to World Bank figures.

Facebook has about 2.5 billion users across its three messaging platforms – FacebookMessenger, WhatsApp and Instagram. Many of those accounts are corporate and there is much double counting as many individuals have multiple accounts. But that is still about one third of humanity. So it is probably fair to say that Facebook (whatever you may think of it on an ethical or societal level) is the most comprehensive network in the history of mankind. If Facebook is really serious about cryptocurrency then investors should be too.

Four leading cryptocurrencies

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Bitcoin (BTC) was the first cryptocurrency, originating in January 2009. Currently, there are almost 32 million bitcoin wallets according to data compiled by Statista. However, most bitcoin users have several bitcoin wallets and use multiple wallet addresses to increase their financial privacy when transacting in bitcoin, so the number of individual users is somewhat less than that. As I write bitcoin is trading at just under £3,000.

Etherium (ETH) was first released in July 2015. Ether is a token whose blockchain is generated by the Ethereum platform. Ether can be transferred between accounts as a form of payment. In 2016, as a result of the exploitation of a flaw in software, and the subsequent theft of $50 million worth of Ether, Ethereum was split into two separate blockchains. The new separate version became Ethereum (ETH) while the original continued as Ethereum Classic (ETC). In mid-March 2019 one Etherium was changing hands at about $138.

Litecoin (LTC) was an early bitcoin spin-off first appearing in October 2011. The Litecoin Network aims to process a block every 2.5 minutes, rather than Bitcoin’s 10 minutes. While writing, one Litecoin was worth £46.50.

EOS. The EOS-IO platform was developed by block.one and released as open-source software on 01 June 2018. One billion tokens were distributed by block.one. whose CEO, Brendan Blumer, announced that the company would back the EOS-IO blockchain with over one billion US dollars in funding from the token sale. The platform raised over $4 billion to support the blockchain during the Initial Coin Offering (ICO). EOS is trading at $3.79 as at the time of writing.

There are 15 cryptocurrencies quoted on the Bitcoin Exchange Guide website.

Messenger services in the crypto vanguard

Telegram (private) is a cloud-based instant messaging and voice-over service registered in London and founded by Russian mathematician Pavel Durov and his brother Nikolai Durov. Users can send messages and exchange photos, videos or any kind of file attachments. Telegram has an estimated 300 million users worldwide. According to the NYT, Telegram is also working on a digital coin which will work with Signal Messenger, an encrypted messaging service developed by super-geek Moxie Marlinspike. In March 2018 Telegram reportedly raised over a billion dollars via an ICO.

Two Asian messaging giants – South Korea’s Kakao (KRX:035720) and Japan’s Line – are also said to be working on their own digital coinage. The backers of early cryptocurrencies lacked reach but this new generation of messaging giants have the power to propel cryptocurrency into a new phase of its evolution.

Do cryptocurrencies have intrinsic value?

“Unlike bitcoin, fiat currencies have underlying value because men with guns say they do”. This was Nobel Prize-winning economist Paul Krugman writing in the New York Times last year. In other words, fiat currencies work because they are backed by the state. (The German sociologist Max Weber (1864-1920) defined the state as the monopoly of legitimate violence over a given territory.)

But, hang on Professor Krugman, all bitcoin transactions are automatically verified by the blockchain – and millions of people are confident enough to use bitcoin to buy and sell products and services every day. Moreover, it is government that debauches fiat currency by triggering hyperinflation – as in Zimbabwe and Venezuela – despite the men with guns.

Professor Krugman also claimed that transaction costs are higher with bitcoin than with fiat money. Yet bitcoin offers international clearance within an hour – whereas payments through the international banking system usually take days to clear.

Bitcoin and the rest are definitely a medium of exchange – one that is immune from inflationary pressure precisely because states cannot print (or “mine”) them. The question is whether they are a store of value. Initially, I thought not because it had no intrinsic value – but now I’m not so sure.

Payment platforms

PayPal (owned by PayPal Holdings (NADAQ:PYPL) having been spun out of eBay (NASDAQ:EBAY) in 2015) is used by over 250 million account holders. One of its subsidiaries, Venmo (acquired in 2013), has taken off in the United States by making it easier to send payments by mobile phone. In China, over one billion people every month use the payment system that operates inside the hugely popular WeChat messaging system which is owned by Tencent (SEHK:700). All of these companies are thought to be working on digital currencies of their own.

Remember that there is a welter of specialist payment platforms out there. For example, Ujo provides automated payment services dedicated to musicians who want to sell rights to their music. Even a traditional credit card company like Visa is reported to be recruiting blockchain talent. That suggests they are thinking of setting up cryptocurrency credit card platforms.

How not to lose a cryptocurrency fortune

One problem with cryptocurrency investment has been that you are only a hard drive away from losing everything.

It was recently reported that cryptocurrency guru Gerald Cotten took a reported $200 million of bitcoin with him to the grave when he died in India last December. Mr Cotten was CEO of QuafrigaCX, Canada’s biggest cryptocurrency exchange. (It is an outfit that is currently subject to litigation and contention and which I am absolutely NOT recommending. If you Google this company you will find that the website contains a message reporting that the company is under investigation for financial issues).

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

The problem is that Mr Cotten had erected layered security around his bitcoin stash with complex passwords for each layer. When he unexpectedly died his family realised that they could not get into his hard drive. As a result, a huge fortune remains locked on a piece of hardware – potentially forever.

That is not the first time that a cryptocurrency fortune has been literally wiped out by death. In 2013 Matthew Moody, an early bitcoin advocate, died in a light aircraft crash in California. His father has spent these last years trying to reclaim his digital fortune – so far without success.

And, supposedly, the mysterious progenitor of bitcoin, one Satoshi Nakamoto – who, if he ever existed, has now vanished – holds a stash of an estimated $3 billion worth of bitcoin. One can only wish him the best.

And what if a bitcoin holder were to be kidnapped – a gruesome thought? Well, it has already happened. In December 2017, an executive at UK-based bitcoin exchange Exmo was kidnapped in Kiev, Ukraine – and only released after a $1 million ransom was paid.

One possible safeguard is to set up a so-called multi-signature key. Let’s say, so long as three out of four account holders log in, then the digital wallet can be unlocked. To be quite clear: If you do not have the private keys, then the bitcoin is lost.

Characteristics of next generation cryptocurrencies

While using the same basic technology (blockchain), the next generation of cryptocurrencies will seek to avoid the shortcomings of first-generation cryptocurrencies.

Firstly, the NYT thinks that any digital currency that Facebook were to develop would reside on a decentralized network of computers independently from its creators. The same goes for ones developed by messaging networks and payments platforms – in other words such currencies could be used universally. New cryptocurrencies would make it easier to move money between countries, particularly in the developing world where it is harder for ordinary people to open bank accounts and to obtain credit cards.

Second, new cryptocurrencies will do away with the energy-intensive “mining” process that bitcoin relies on. Facebook’s digital currency will be a stablecoin – that is to say, a digital currency pegged to the US dollar[v](though its value could vary marginally from the dollar).

According to the website Stable Report there are three types of stablecoin: asset-backed on-chain; asset-backed off-chain; and algorithmic. The first kind would be cryptocurrencies which are backed by other cryptocurrencies. The second type of stablecoin is collateralised by real-world fiat currency such as the US dollar or the euro or by a commodity such as gold. The third type, algorithmic, relies on a combination of algorithms and contracts to maintain price equilibrium. (But would the algorithms work?)

As far as we can tell, Facebook is working on the second type of stablecoin which would be collateralised by greenbacks or by other currencies. This implies that there would be a trusted third party which actually holds a dollar of “real” cash (residing somewhere in the banking system) for every dollar of digital currency in circulation. The question is: would Facebook act as the trusted third party?

And how much control would Facebook retain over the digital currency? If Facebook is to be responsible for approving every transaction and keeping track of every user, it is not clear why it would need a blockchain system at all, rather than a traditional centralised ledger like the one that PayPal uses. The whole point of blockchain was that it obviated the need for a trusted third party to sit between the two sides of a transaction.

A digital token with a stable value would not be of interest to speculators, the main champions of cryptocurrencies thus far. But consumers could hold it in order to pay for things online without worrying about its value fluctuating too much. The NYT reported that some Facebook insiders had suggested that its digital currency will be linked to the value of a basket of foreign currencies rather than just to the US dollar.

On the other hand, second-generation cryptocurrencies are likely to face many of the same regulatory and technological hurdles that constrained bitcoin. The absence of a cryptocurrency central bank has supposedly made them useful to criminals. (Though Arthur Hayes, co-founder of BitMEX, argues that buying bitcoin is a terrible way to launder dirty money because all transactions are recorded on the public ledger.) Further, computer networks that manage cryptocurrencies hitherto made it hard to process huge volumes of transactions simultaneously.

A stablecoin known as Basis recently closed last December after just eight months. The New Jersey-based company announced that there was no apparent way around being classified as a security – as opposed to a currency – which would significantly reduce the number of potential buyers. Basis had attracted well-known backers like Andreessen Horowitz of Foundation Capital and Kevin Warsh, a former governor of the US Federal Reserve[vi].

The most high-profile stablecoin to date, Tether, (USDT) has been surrounded by controversy. While Tether’s creators claim that each of its tokens is backed by one US dollar, the company’s refusal to be audited has raised doubts as to whether that is true. On 14 March 2019 Tether changed the collateral to include loans to affiliate companies.

The largest cryptocurrency exchange

BitMEX (the bitcoin mercantile exchange) is the world’s largest bitcoin exchange. It was founded by Sam Reid, Arthur Hayes and Ben Delo in 2014. BitMEX is not a spot market but a derivatives exchange. Users deposit bitcoin and then use those deposits to speculate on the future price of bitcoin using various futures and options contracts. It is the only bitcoin exchange which offers users the chance to leverage up their positions by up to 100 times. Apparently, Chinese users call BitMEX “100x”. Unlike conventional futures markets there are no margining arrangements – but no one can lose more collateral than they have put up. By last November the daily value of trades on BitMEX was between $2.5 billion and $8 billion – equivalent to the daily turnover of the Australian stock exchange (ASX). BitMEX also provides in-depth reports on the crypto-currency ecosystem.

Meanwhile in Russia and China…

In January it was reported in The Daily Telegraph that Russia’s Central Bank was preparing to replace the US dollar as a reserve currency with bitcoin[vii]. Supposedly, this will be a bid to circumvent the effect of western sanctions which were imposed on Russia further to its annexation of Crimea in February 2014 – and were then intensified further to the Salisbury poisonings of March 2018. It would also form part of Russia’s plan to reform its state pension system.

| First seen in Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Vladislav Ginko, purportedly an economist at the Russian Presidential Academy of National Economy and Public Administration (RANEPA), claimed that the Russian central bank could buy as much as $10 billion of bitcoin, financed by dumping US Treasuries. However, the Cryptoslate website has cast doubt on Mr Ginko’s credibility. Apparently, Mr Ginko has tweeted on Russia’s move into bitcoin several times before without showing great insight. In July 2018 he tweeted that Russia would soon move to a cryptorouble. In 2017 he predicted that bitcoin would rise to $2 million. No one has been able to verify his bona fides at RANEPA.

There have been more reliable reports in the second half of last year to the effect that the People’s Bank of China (PBOC) was preparing to launch its own digital currency. During a March political gathering in Beijing, former central bank CEO Zhou Xiaochuan said that any state digital currency must be compatible with financial stability while at the same time protecting consumers. The Digital Currency Research Institute of the PBOC has been hiring people with knowledge and experience of blockchain technology[viii].

According to Fintech News, Yao Qian, head of research at the PBOC said last year that a digital currency could drive down transaction costs, increase the efficiency of monetary policy and extend financial services to rural areas. It would also be easy to trace. (An autocratic government’s dream.) He asserted that the development of the digital economy required an electronic currency issued by the central bank – that is to say it would be a state-sponsored digital currency: non-state digital currencies would presumably be outlawed.

It is likely that such a state-sponsored digital currency would be pegged to the existing fiat currency in the first instance so as to make it less volatile – a stablecoin. There is conjecture that such a stablecoin could be adjusted in value periodically in accordance with the consumer price index. In that way, while fiat money might lose its value over time thanks to inflation, the stablecoin would have constant purchasing power.

Will Mr Trump go for gold?

In mid-March 2019 rumours started to circulate to the effect that President Trump has been considering the return of the US dollar to the gold standard. It is suggested that he fears that the IMF is going to issue a global currency in the form of Special Drawing Rights (SDRs) so as to usurp the greenback as the currency of choice for most international transactions. But the MAGA president will not take the demotion of the dollar lying down. Moreover, Mr Trump is known to be a lover of gold – Trump Towers everywhere are marked out with gold lettering…And he is thought to have made a killing in gold investments in the past.

While on the campaign trail in 2016, Mr Trump said: “Bringing back the gold standard would be very hard to do, but boy, would it be wonderful. We’d have a standard on which to base our money”.[ix]

Mr Trump and many of his supporters regard the IMF-World Bank as the ultimate globalist conspiracy – a supra-national central bank. But he knows that reviving the pre-1971 gold standard would be problematic. As I wrote here in the December 2017 issue it is very unlikely that gold could ever be restored as the key reference commodity in the global monetary system.

Now – here is my point – some economists regard the adoption of a state-sponsored digital currency as the equivalent of a return to the Victorian gold standard. Therefore – this is purely conjecture on my part – I would not be surprised if Team Trump is looking seriously at digitising the dollar.

Prepare for the next phase

In an interesting interview on 18 March the Winklevoss brothers (who were around at the birth of Facebook) declared themselves “extremely confident” about the crypto industry. The internet took 30 years to become universal. Blockchain technology is barely ten years old and has only received the serious attention of investors over the last three years or so.Even if bitcoin bombed in 2018, the number of people with digital wallets, which are capable of storing digital money, has continued to rise.

If a new generation of stablecoins does emerge in the near future, immune from the speculative volatility which characterised the first wave of digital currencies – manic buying and hoarding – that development could be a game-changer, especially for investors. For example, commodity-backed cryptocurrencies could become a way for investors to get exposure to gold, copper, Brent crude – whatever – at the click of a mouse.

Action

I am not qualified to judge the investment potential of buying into cryptocurrencies for speculative purposes. However, I would urge investors to consider who would gain most in a world where cryptocurrencies were to become the principal medium of exchange, and where, conversely, conventional fiat currencies took a back seat. This could happen sooner than we think.

If you think this is likely to happen soon, that would be an argument in favour of investing in social media platforms – especially Facebook and Twitter (NYSE:TWTR) – and of leading payment platforms such as PayPal and even credit card providers like Visa (NYSE:V). Facebook and messaging networks like Telegram can put digital wallets full of cryptocurrency at the disposal of hundreds of millions – if not billions – of users. With more than $40 billion in annual revenue, and greater experience in navigating regulatory issues, Facebook has a good chance of creating a stablecoin that will be accepted by regulators. This will be bad news for banks if they do not keep up – JP Morgan has shown itself once again to be ahead of the curve. Also, opportunities may arise to invest in the various cryptocurrency exchanges.

This is a fast-developing space. Investors will need to stay awake.

[i]Through the Looking-Glass, by Lewis Carroll (1871)

[ii]See: https://www.cnbc.com/2019/02/13/jp-morgan-is-rolling-out-the-first-us-bank-backed-cryptocurrency-to-transform-payments–.html

[iii]In “The Bullish Case for Bitcoin” (no longer in print).

[iv]See: https://techcrunch.com/2016/12/07/facebook-just-secured-an-e-money-license-in-ireland-paving-way-for-messenger-payments-in-europe/?guccounter=1&guce_referrer_us=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_cs=vRm7tcsxDqZuQ_ruNct27Q

[v]See Bloomberg, 18 December 2018 at: https://www.bloomberg.com/news/articles/2018-12-21/facebook-is-said-to-develop-stablecoin-for-whatsapp-transfers

[vi]See: https://www.bloomberg.com/news/articles/2018-04-18/a-133-million-bet-on-a-cryptocurrency-designed-to-be-boring

[vii]Daily Telegraph, 14 January 2019, story by Hasan Chowdhury. Available at: https://www.telegraph.co.uk/technology/2019/01/14/russia-plans-tackle-us-sanctions-bitcoin-investment-says-kremlin/

[viii]See: https://www.fintechnews.org/chinas-3/

[ix]Video available at: https://thescene.com/watch/gq/donald-trump-weighs-in-on-marijuana-hillary-clinton-and-man-buns?mbid=marketing_paid_cne_social_facebook_scene_gq_dp_28

Comments (0)