Brace for impact: How to protect your portfolio using options

The last two months and a half have been extremely positive for equities, for the U.S. dollar, for commodities, and for inflation and growth. In the time of Great Deception, people have become hopeless and willing to blindly follow whoever offers them something different. To that extent, Donald Trump has embodied that role and revived sentiment around the world.

Trump’s promises have led to high hopes in terms of fiscal stimulus, which is expected to come in the form of infrastructure spending and tax cuts for businesses. At the same time, his nationalist inauguration speech renewed the hopes for an increase in investment in the domestic economy, as U.S multinationals are expected to repatriate their fortunes and start developing new plants on U.S. soil while also hiring millions of Americans.

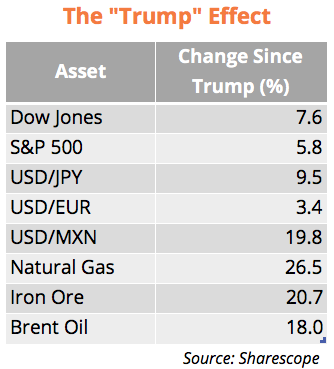

The nascent Trumponomics has already guided the Dow to a near two-digit gain, pressed the dollar up 10% against the yen and a whopping 20% against the Mexican peso, and led to substantial gains in commodities like natural gas, oil, and iron ore. The reflation trade has played well so far, but downside risks are mounting quite rapidly, which could end up derailing part of the recent gains, as this market is ignoring myriad risks that come with Trumponomics.

Investors with larger portfolios certainly want to benefit from the reflation trade, but may also wish to increase downside protection at a time when Trump’s rhetoric will have to be turned into action. We saw Trump retreat a little in some of his views after being elected. We may now witness further back-peddling, as Trump assumes the Presidency.

While I believe the world is in need of a clean break from the lousy economic policies that have driven us nowhere for a decade, I am still not completely comfortable with Trump’s speech. At times, it was idealistic and naive.

A good example is the auto industry. Trump is playing down Mexico as a centre for the industry, threatening to impose a customs tariff on imported vehicles to make it more costly to produce vehicles in Mexico. Some companies already pledged to reverse planned investments in Mexico and instead create or expand production on U.S. soil.

But we must not be so naive. The simple fact of the matter is that it is costly to produce these vehicles in the U.S. because a U.S. worker is paid much higher hourly wages than a Mexican worker. A high customs tariff will lead to much higher prices for the U.S. consumer, no matter what happens to production.

In fact, almost everything in Trump’s economic policy is centred on nationalism and protectionism, which historically has led to inefficiency and reduced trade levels. Thus, to some extent, we should be sceptical about any expected consumer boost and I’d rather stay away from stocks that are heavily dependent on the U.S. consumer, at least until I see some clarification in terms of hard policy decisions.

My intention is not to downplay the bullish effects stemming from Trumponomics, but just to pour some cold water on the fire.

My intention is not to downplay the bullish effects stemming from Trumponomics, but just to pour some cold water on the fire. The crowd tends to overreact to everything, at either extreme. Markets move on expectations. But, at this point, where markets have already exploited the Trump rally, it may be time to retreat a little and protect against mounting downside risks.

Assuming an investor has a portfolio with long equity positions, I’m proposing two simple options strategies that may provide sound near-term protection: a covered call and a protective put. These strategies are not bearish as they still allow for upside potential. But they are defensive in the sense that they offer an improved night sleep when investors are less sure about the immediate future.

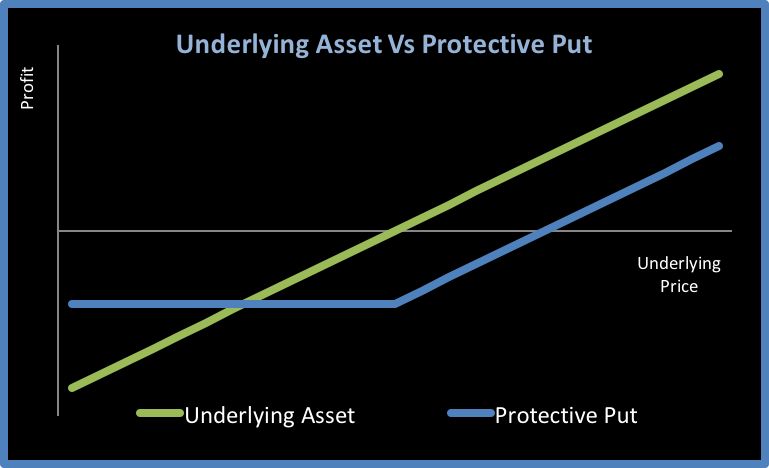

Let’s say you own a market portfolio (for simplicity), composed by the SPY ETF, which mirrors the S&P 500 performance. This ETF is currently trading near $226. The first strategy would involve adding some puts to your portfolio. Let’s say you purchase an at-the-money put option expiring on 3 March. The strike price for this put is $226 and its current price is $3.14. You’re paying 1.34% of your holdings as premium for this protection, but you’re effectively protected for downside risks while still able to enjoy any upside.

So, if the SPY rises 3%, you would earn $6.78 from your SPY holding (3% x $226). With the protective put (as a whole) you have to account for the option premium, which reduces your profit to $3.64. But, let’s say the SPY declines 3%. The situation is reversed and your losses are limited to the option premium paid. If the decline is even greater, the loss will still be constant and equal to the option premium.

But the protective put is an expensive strategy. It is better suited to a situation where downside risks are perceived as substantial. If the SPY moves less aggressively, the protective put is a burden.

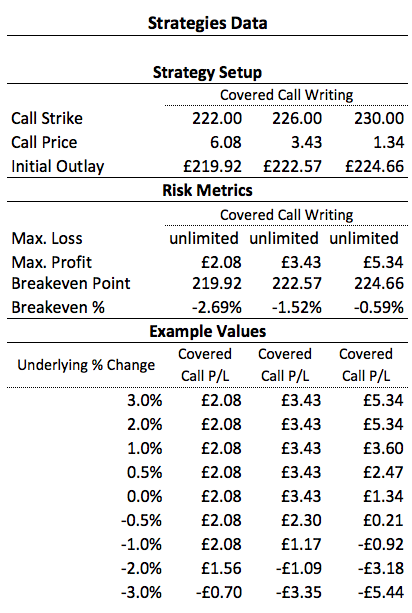

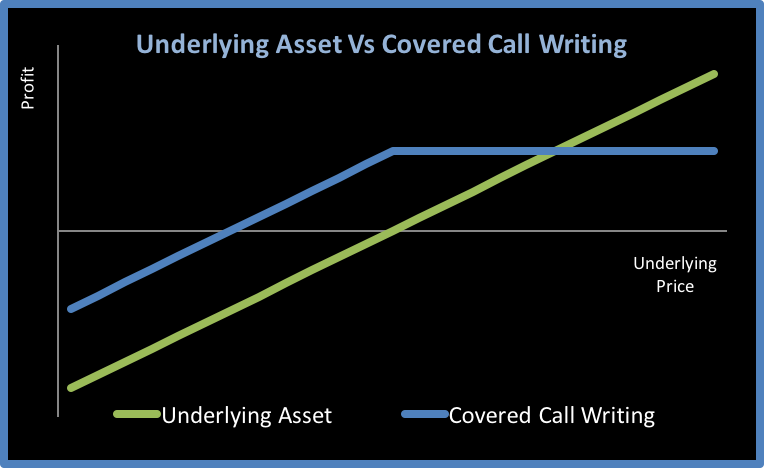

A second strategy is to write a call on your holdings to build a covered call position. Such a strategy is well suited for times where you don’t expect the market to rise significantly. It would be better than the protective put if the market rises or declines moderately. At the same time, it would still be much better than the naked long position in the event of a market crash.

Let’s take on the same example with the SPY holding at $226. A call option can be written with a strike of $226 at $3.43. You receive the premium of $3.43 upfront as if it were some kind of dividend. If the SPY rises above the call strike (which in the example just means rising as the option is at-the-money), your profit from the strategy would be equal to the option premium of $3.43. If the SPY declines, you still keep your premium from the option, which will help offset part of the loss that comes from the decline in the value of your long holding in SPY.

The lower the option’s strike, the lower the maximum profit the covered call strategy can achieve, but the wider the range of underlying price changes for which the strategy remains profitable.

If you believe the SPY will move between 0% and +3%, it may be well worth writing a $226 strike call. This would provide you with a profit of $3.43 if the maturity price for the SPY is within such a range. But if you believe the SPY may instead end up in a range between -2% and +2%, then you may be better off with a $222 strike, which would provide you a smaller maximum profit but still a profit in case the SPY closes 2% down.

The following table summarises example data for three strikes: in-the money ($222), at-the-money ($226), and out-of-the-money ($230).

The above option strategies demonstrate how options may be used along with long-term investment strategies to tweak the shorter-term price action, without interfering with the main long-term investment goals.

Comments (0)