A cash ban is on its way in Europe

The European Union is considering the possibility of banning €500 banknotes in a move to fight corruption, fraud, and even terrorism. The high value of these banknotes makes them “too useful a vehicle of corruption and other illegal activity”, anti-fraud authorities claim. We should force people to execute transactions using electronic money and through plastic cards because “traceability is paramount in fighting corruption and fraud “, they add.

And now for the real reason to ban the 500-euro note: central banks are desperately trying to find a way to overcome the lower bound on interest rates. Banning the highest banknote denomination increases the costs of holding hard cash, which is the same as reducing the lower bound.

From night to day physical currency was turned into our worst enemy to the point that we should ban it completely. It is often argued that cash finances terrorism, allows people to conduct illegal activities, and makes it difficult to collect taxes. It is also suggested that cash is a burden on banks because they need to keep branches open in remote locations and maintain ATM machines. Sometimes it is even insinuated that cash allows people to be forgotten; to make purchases while still preserving the right to privacy. Heaven forfend! Hardly ever is it pointed out that cash is one of the last remaining tools in the hands of people that impose a limit on central bank action. This last feature could be seen as the yellow and red cards a referee keeps in his pocket during a football game. The simple fact they exist (even if seldom used) effectively caps players’ behaviour, as they fear the referee may pull the cards out of his pocket. By the same token, central banks don’t want to mess with negative rates, as they fear depositors would convert electronic money into hard cash. Now imagine a football game where the players know the referee is unable to show them a card. Do you think players’ behaviour would change?

Comparisons aside, let me go through the negative rates issue and the zero lower bound that caps interest rates. Well, zero is just the name that was given to the cap because we now know that it is not exactly zero but rather something near. When rates hit that lower bound, monetary policy faces an asymmetric outcome: the effect of pushing the rate higher is not the same as the effect of pushing it lower. The reason is because banks fear passing the negative rates to their clients, as people can always convert deposits into cash. When that happens monetary policy becomes ineffective, as rates remain higher than central bankers believe they should be to break a deflationary spiral. Low prices justify even lower prices, as people postpone consumption decisions and save too much. The central bank then believes it should break this cycle by ‘encouraging’ people to save less and consume more.

A well known economist, Willem Buiter, has many times argued in favour of banning cash as being the best tool we have to restore monetary policy effectiveness. This way, it is argued, we could eliminate boom and bust forever, as the central bank would cut or hike its key rate in perfect symmetry, banks would pass the changes onto clients and clients would alternate between savings and consumption accordingly. Under the current scenario of global deflation (is it really deflation?), the ECB or the FED could cut rates to -5%, without triggering a bank run. “That makes cash a sort of stimulative hot potato: everyone should want to use it, not hold it” (Tommy Stubbington, WSJ).

A negative interest rate represents a burden on depositors. But the alternative, of holding its balances as physical currency, may also be. Holding cash implies facing storage, security and transaction costs. These may be quite high for a company like Apple that collects money from customers in the US and pays it to suppliers in China. After all, money kept under the mattress or in the corporate headquarters is not readily available to pay suppliers. For these reasons a bank can always impose negative rates, in particular on corporations and high net-worth individuals. But there are limits that, when surpassed, may lead to bank runs.

If cash is banned from the system, people would not be allowed to convert bank balances into banknotes. Monetary policy would then regain its symmetry.

While the above is true, I am still not sure that banning cash could solve anything. Central banks believe that if interest rates are negative and cash is banned, they could boost nominal GDP. But this notion departs from the quantity theory of money, which states:

MV = PT

Where M is the money supply, V is the velocity of money, P is the price level and T is the number of transactions in a period of time. This is no theory but rather a tautology. At any given time, what is spent on purchasing goods and services must be equal to the number of transactions times their average price level. But because of many difficulties, this has been reformulated to:

MV = PY

Where we now have Y that is easily replaced with GDP. So, roughy, we can say that, when cash is banned people will try to get rid of cash balances faster than before, which will lead to an increase in the velocity of money, and finally translate into higher nominal GDP. The idea behind this is very simple: negative interest rates represent a cost to depositors and a benefit to borrowers, leading to a decrease in savings and an increase in consumption. But such reasoning may be rotten. The empirical observation tells us that savings rates have been going in lockstep with the decrease in interest rates, which is exactly the opposite predicted by central banks. The reason for this may lie in the fact that lower interest rates reduce the income generated by low risk assets. Instead of selling these assets and purchasing riskier assets, households may try to save more in order to achieve the same savings goals. This seems to have been happening in Japan for decades. If this explanation depicts the true reality, then the central bank would be better off hiking rates.

But the central problem does not concern the exact relationship between interest rates and the savings rate. The quantity theory tautology says that the money balances you spend must go somewhere; it doesn’t say it must go to GDP items. At the same time it mentions the average price level of transactions and not the price level of an arbitrarily set basket of goods and services. Faced with negative rates, people may just purchase gold or shares. If we generalise such behaviour, all the central bank would achieve is an asset bubble, not GDP growth or inflation.

Another argument goes in the direction of the money supply, M. Who said M would remain unchanged if interest rates decline? Faced with stagnant economic activity banks may not be willing to lend more and households and corporations may not be willing to borrow. Households and corporations would then just convert liquid assets into less liquid assets, like deposits into shares, which would lead to a reduction of M. That would happen because households would expect lower losses on those items than from cash on deposit. Prices would rise but not by enough to cover the inflation rate. A major disconnect between the financial economy and the real economy would then occur.

So, if we could overcome technical difficulties and moral and social issues associated with banning cash, the key question to ask would then be: will negative rates prompt people to spend more on goods and services?

In my understanding the answer is No. Negative rates will just create even more difficulties in an already rotten system and lead to more boom and bust than before. At the same time, I don’t believe technical difficulties can be surpassed. If cash is banned in the Eurozone, money would flow away. The only option would be to impose capital controls, but that would destroy the spirit of the European construction.

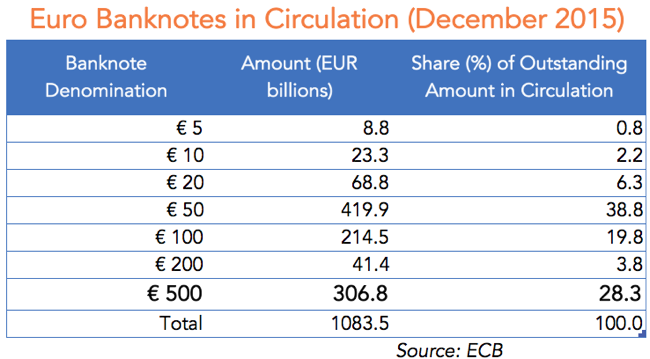

For now a complete cash ban is just a theoretical debate. We’re still far away from it. But the €500 banknote ban will soon turn into a reality, as policy makers know that such a step will increase cash holding costs. Keeping €1 million in €500 denominations is equivalent to two bags of sugar in terms of weight. If someone is forced to keep the same in €20 denominations, the weight would be increased to 50 bags of sugar. In a linear word, holding costs would increase 25 times. In a less linear world the increase in costs would still be enough to give some extra margin for the ECB to further cut its key rates. So expect the €200 and the €100 denominations to follow.

We know that a high percentage of the €500 notes in circulation are currently in the hands of criminals. But banning them would not eliminate criminal activity; it would just make it more difficult. They could still hold a 1,000 swiss franc bill or a €200 banknote (at least for now). There would always be an alternative.

In terms of negative rates, the €500 ban is a big step for central banks, who are attempting to increase the costs associated with holding cash, in a project that may culminate in a complete ban of cash holdings. In the future, if cash is banned, central banks would gain complete control over your transactions. By then every financial transaction could be traced, taxed and charged a fee. Central banks could even charge different fees depending on where you spend your money to be sure you save less and consume more GDP items. By then, the free economy would have been replaced by a fully centrally planned economy: one based on repression; one where you are no longer free to do what you want.

Comments (0)