Where next for multi-bagger Solomon Gold?

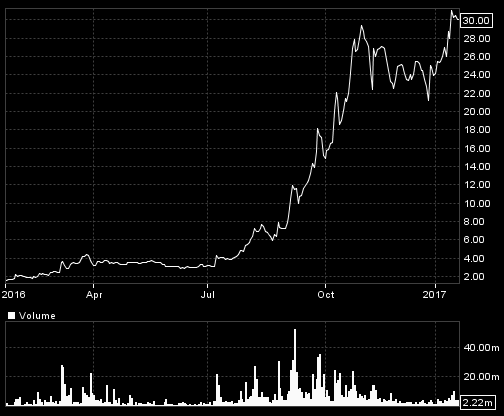

My initial recommendation for Solomon Gold (LON:SOLG) last March was based on a value of gold and copper ‘in the ground’ that its drilling was then targeting on just one part of its Ecuadorian Cascabel project, which looked – even at a conservative 1% – to be at least six times Solomon’s then market cap. Since then, early followers have seen a nine-fold rise and there are 70% more shares in issue. A market cap now 15 times higher has well exceeded that original ‘target’. So what next?

The answer is a lot! Newcrest Mining, Guyana Goldfields, and Maxit Capital, all of whom have bought major stakes, have moved the game a long way on. The $44m they brought to the table allows Solomon to step up a drilling programme that might otherwise have taken 10 years to unearth Cascabel’s full potential, with seven drills operating by October compared with only two last month.

There are few potential world copper resources comparable with what the wider Cascabel (at this early stage) might turn out to be – just in time for a forecast world copper deficit by the decade’s end. No surprise then, that observers think the few global copper mining giants – BHP, whose initial offer to get Cascabel on the cheap was turned down, and Tio Tinto, who it is surmised must be interested – will be keeping a close eye on the emerging drilling results.

So what about the shares? Despite large profits to be taken, and during what has been a slight hiatus in the drilling programme while gearing up for expansion, there seems to be little danger of any serious relapse (saving acts of God and Ecuadorian politics – elections are due Feb 19th ).

While Solomon has been drilling Alpala – only the first of 14 ‘targets’ at Cascabel that magnetic surveys show might host similar mineralisation – the discovered zone has been getting deeper and wider. And while waiting to incorporate the latest results and to provide the NI43-101 standard required for its listing planned ‘soon’ on TSX (not to mention a move up from AIM to the UK main market) has delayed the maiden resource originally expected in 2016, those are not the only news events that should keep the momentum going.

The key to Cascabel turning out to be a world-class mine, which observers increasingly expect will be built or taken over by a major, will be the first drill turns on the next Cascabel prospect – at Aguinaga 2 km away, which IP and magnetic surveys indicate might be similar to the Alpala system, but not as deep. It should therefore prove cheaper to develop as a starter mine than will be the expensive underground block-cave method necessary at Alpala (for which the coming on board of block-caving expert Newcrest was a key move).

The key to Cascabel turning out to be a world-class mine… will be the first drill turns on the next Cascabel prospect…

But Aguinaga won’t start before next year, and meanwhile drilling will concentrate on defining the full extent of Alpala where the latest holes still haven’t penetrated beyond the extensive mineralisation found so far. Some mining observers even speculate that its major ‘core’ is still to be found at the greater depths (over 2,000 metres) now being drilled.

So that original ‘estimate’ for Alpala alone, is increasing all the time. Last March I was evaluating Alpala at the 500 Million tonne resource that Solomon was then hoping for and which, assuming a $60/tonne value (on the then discovered grades), worked out at $30bn of gold and copper ‘in the ground’ of which 1% equated to 31p per share (based on the number of shares in issue at the time).

Now, however, Solomon’s CEO, Nick Mather, is talking of ‘at least’ a 1 billion tonne resource at Alpala, and 10 billion for the whole of Cascabel. But meanwhile, switching our crude first estimate to the methods mining professionals use based on the currently known dimensions, and on a 0.3% (copper equivalent) ‘cut-off’ grade (the limit below which that grade would not be economic to mine) shows an in-ground value at current prices amounting to £16 billion – i.e. £11 per share, or 11p at a 1% valuation.

So the share rise since March has eaten up half my then ‘value’ proposition. But its quality has improved. 1% was conservative even then, but now there is a much better chance Cascabel will be developed we can apply a valuation more like the 3-5% that applied in good mining times.

While the shares have partly caught up on those original estimates (perhaps explaining their recent hesitation), the estimates are steadily increasing. There is nothing in them for Aguinaga, nor for the ten prospects beyond it for which – although to non-professional eyes their published magnetic signature diagrams don’t look as compelling as those for Alpala and Aguinaga – they could still add to a resource for Cascabel as a whole which would increase the attraction to the mining majors who want size more than anything else.

Solgold still looks very, very cheap for its longer term potential…

My conclusion? Solgold still looks very, very cheap for its longer term potential, but that potential will probably take another five years to evolve. Solomon’s stated plans are to achieve 400,000 metres of drilling by next year against the 28,000 completed so far, in which time anything could happen, including offers that Solgold’s shareholders (luckily the controlling management has a significant stake so won’t sell cheaply) can’t refuse. Alternatively further offers from Newcrest or BHP or someone else to farm in to pay for further drilling would obviate that usual danger for shareholders in an explorer – more share dilution.

The usual explorer risks are still there. But, so far, Solomon’s reliance on advanced IP and magnetic methods to target drill holes hasn’t disappointed investors with many ‘dry’ ones. And while jitters will come if copper or gold tanks, that would give an opportunity to jump on board Solomon’s long-term evolving story, which I think looks to keep investors interested for quite a few years yet.

Currently investors await assays for the latest encouraging looking drill results, not to mention the prospectus for a listing on TSX with the first resource estimate. The February 19th elections in Ecuador, whose mining-friendly President Corea is standing down, might cause a few flutters, although there is no suggestion that any newcomer would damage the policy.

* Disclosure: The writer owns shares in Solomon Gold.

Hi John! Following the MRE and other development, what are your current opinions on Solgold? Progress seems to be more lacklustre than expected, so was wondering what your take on it is now! Cheers.