Mining Financiers Look To Feast at PDAC, But Junior Explorers Face Famine

By Our Canadian Correspondent

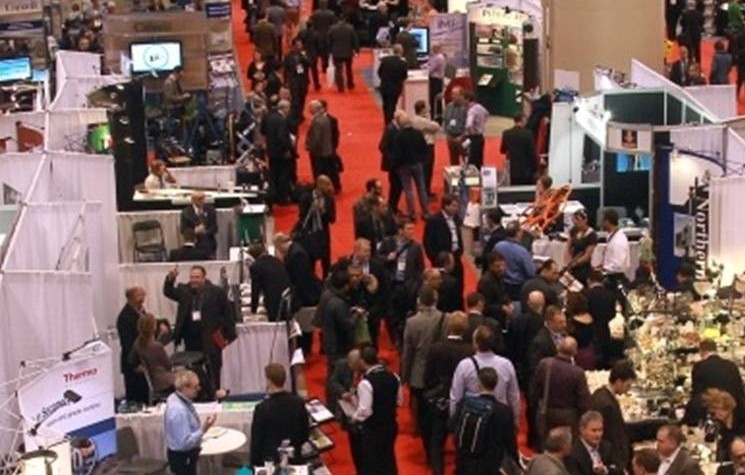

The 83rd annual Prospectors & Developers Association of Canada (“PDAC”) Conference got underway in Toronto, Canada on March 1st, with mining financiers looking to feast on a smorgasbord of opportunities.

Unfortunately, as the world’s largest mining conference draws to a close on Wednesday, the money men appeared to have had a very selective appetite and the bulk of the already starving junior exploration companies look set to go home hungry.

As expected, financing options were a central theme of PDAC 2015 with a program lineup that included “crowd funding financing for junior mining companies” and “opportunities for accessing risk capital.”

The technical program of PDAC 2015 kicked off by giving these cash-starved juniors only a modest ray of hope that metal prices will help revive their financial funk.

In the Commodities and Market Outlook session Ivanhoe Mines executive chairman Robert Friedland and Mark Selby, president and CEO of Royal Nickel attempted to rally the metal-oriented troops.

Mr. Friedland focused on global urbanization and the need for metals, most notably copper and platinum. By 2050, he predicted that 66 per cent of the global population will be living in cities, a move that will up consumption of both those metals.

William Tankard, research director for mining at Thomson Reuters, also gave a plug for the platinum group metals by stating that 60 per cent of the production of that metal group is now being mined at a loss. Meanwhile, Mr. Selby pounded the table on nickel stating that it is about to outperform other metals and that the investment scenario he sees is even better than the big run up from 2002 to 2007.

Throwing some cold water on the parade was Paul Robinson, CRU Group director. He painted a gloomy prospect for the iron ore market with average prices of around US$65 per tonne in 2015. Making matters even worse for iron developers was reports that Rio Tinto is now producing iron ore at a cost of US$17 per tonne from its Australia operations.

On the copper front, Michael Schwartz, manager of market research at Teck Resources, sees little growth in copper mine production from now till 2020 meaning a price of around US$2.90 a pound is expected for 2015, while Jonathan Sultoon, senior analyst at Wood Mackenzie, brought up the wave of oversupply in the metallurgical and thermal coal markets but indicated that it should balance out beginning in 2016.

So with the lack of metal pricing to drive demand, the resiliency of the cash strapped junior explorers continued to be a surprise to most investors wandering the aisles of the show. A quote widely attributed to Mark Twain seems to fit the bill, namely: “reports of my death have been greatly exaggerated”.

Speaking at a keynote program at PDAC, newsletter writer John Kaiser stated that there are 717 companies with negative working capital, 291 with between C$0.00 and C$500,000 in working capital and only 554 with a more comfortable C$500,000-to-C$20 million in working capital.

Since there is no sign that conditions are getting better for the vast majority of firms, Mr. Kaiser continues to state that most of these so called zombie juniors will eventually delist. So with a turnaround in metals prices not expected until at least 2017, perhaps 2015 will be the year that at least the negative working capital companies disappear and the supply/demand situation will start to equalize. In the meantime, for those companies with the right assets there appears to be plenty of money waiting in the wings.

The ever finicky investment bankers sparked some excitement in January ahead of PDAC by funding just under C$800 million in bought deals in six gold companies over a two day period. The big boys however are looking at only advanced assets and were notably flying under the radar screen at PDAC.

Several parties mentioned that perhaps these firms have had trouble selling the bought deals to clients.

In the absence of another flood of equity offerings, alternative financing options will continue to keep the sector alive. Leading the alternative financing charge are partnerships, royalty and streaming arrangements, and mergers between cash-rich and mineral-rich companies.

Pierre Lassonde-led royalty giant Franco-Nevada supplied some US$900 million in 14 transactions in 2014 and is hoping for another banner year in 2015. Royalty and streaming companies like giant Silver Wheaton, Sandstorm Gold and Callinan Royalties also made it known that they were open for business.

During the show Banro announced two gold forward sale transactions relating to the Twangiza mine and a gold streaming transaction relating to the Namoya mine, both in the Democratic Republic of the Congo. Total price tag is US$100 million and the buyer is Gramercy Funds of Connecticut.

Also wandering the show looking for bargains were well respected and serially successful mining financiers, Ross Beaty, Chairman of Pan American Silver and Lukas Lundin, Chairman of the Lundin Group. According to Mr. Beaty, he is looking for additional gold and silver investments. He and Mr. Lundin have already both put funds into advanced Yukon gold explorer Kaminak Gold and Mr. Beaty took a 9.9 per cent interest in Northern Ireland gold explorer Dalradian Resources.

Despite the financing drought, Mr. Beaty remains steadfast that a company with a great deposit and sound management will get the money it needs. Both mining men are also attracted to the mineral potential of politically risky Ecuador, which had a big booth presence at the show.

Late last year Fortress Minerals, a member of the Lundin Group of Companies, bought the multi-million ounce Fruta del Norte gold project in Ecuador from Kinross Gold in a cash-and-share deal worth US$240 million. Kinross originally acquired the asset in 2008 with the US$1.2-billion acquisition of Aurelian Resources.

For his part, Mr. Beaty bought into junior Odin Mining & Exploration, which is currently drilling the Cangrejos gold and copper project in southern Ecuador. Both projects will require co-operation from the Ecuadorean government so rest assured both Mr. Beaty and Mr. Lundin have be hobnobbing with the powers that be in that South American country.

Well-heeled contrarian investor Rick Rule was at the show and hunting for mineral companies worthy of his dollars. Mr. Rule has about C$100-million to spend as chairman of Sprott U.S. Holdings, a unit of Sprott Asset Management and is banking that the junior cash boxes like Kobex Capital with around C$30 million and Phoscan Chemical with some C$60 million will find some good mining projects in this cash-strapped market.

Despite being a little light compared to the previous few years, the floor had a bevy of exploration companies peddling their wares including a handful of London-based companies like Minco, Condor Gold and Roche Bay.

Taking home some of the PDAC award hardware this year was David Palmer, President of Probe Mines, which was recently bought by Goldcorp in a C$526 million deal; Ivanhoe Mines, which took home this year’s Thayer Lindsley Award in recognition for its Kamoa copper discovery team in the Democratic Republic of the Congo; and Matt Manson, President of Stornoway Diamond who took home the Viola R. MacMillan Award for leading Stornoway’s development of the Renard diamond project in Quebec.

So, while there appears to be more empty booths than usual in the investor exchange area of PDAC in 2015 the deal makers were there in full force and it will be interesting to see if any deals are announced over the next few weeks. Looking ahead 12 months we can expect a leaner and meaner batch of juniors at the next PDAC as the fight for survival looks set to continue.

Comments (0)