Master Investor September Mining Update

After the summer doldrums, at last a few dribbles of news I need to comment on. And while shares of most of the long term projects I follow have drifted, some are showing more signs of life. Armadale (LON:ACP), Emmerson (LON:EML), Solgold (LON:SOLG), and especially Horizonte Minerals (LON:HZM), are responding to positive progress, and I believe the rest will follow in their own time.

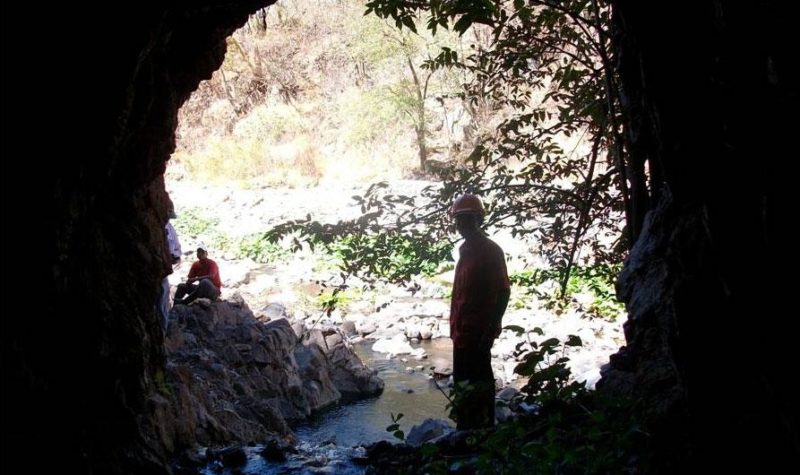

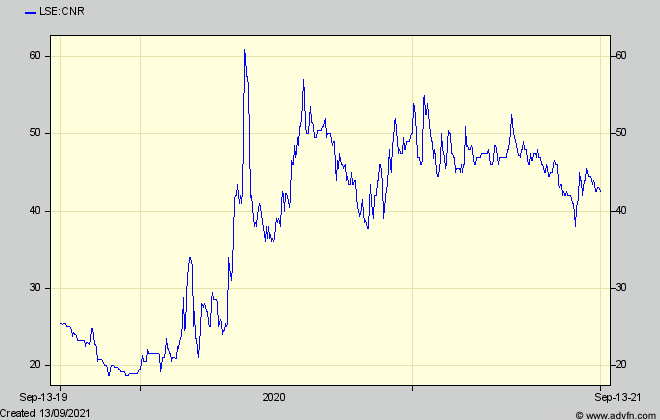

I haven’t mentioned Condor Gold (LON:CNR with a Market cap of £58m @ 43p) for some time (See here for my latest full description) but although its shares have marked time, it is slowly getting closer to starting up – hopefully next year – its La India gold mine in Nicaragua.

Having done much work to further drill and plan and to evaluate the options it has to start partially and more cheaply, than with a full mining operation, the company recently published an updated technical and economic study covering its two main options.

For the first time, it has updated each for a $1,700/oz gold price, and each shows an exceptionally short one-year payback for an initial capex which is, however, rather higher than anyone had expected. But with the economic case so much stronger, better terms for raising the capital will compensate for that higher cost.

The quickest option is to develop only part of the already planned open pit, by way of smaller feeder pits which have now been more precisely delineated. For a start-up cost of $153m, this is expected to produce six years of an average and – high by most standards for a junior miner – 120,000 oz pa of gold, reducing to 47,000 pa for the final three years. This option generates a $302m post-tax NPV at a 5% discount rate and an exceptionally good 58% return on capital.

The alternative is a longer life, more profitable, and higher production scheme, which adds underground mining of the richer ores beneath the open pit. This will cost initially $160m (with more later) and will produce 70% more gold over 12 years, with a 54% return on capital and a $418m 5% NPV. That NPV is earned over a 12 year mine life instead of 9, which is why the internal rate of return (IRR) is slightly less than for the first option.

If gold is assumed at the current $1,800/oz against the $1,700/oz in the studies, the NPVs would be respectively 15% and 20% higher.

In each case a pay-back in one year and a high IRR means CNR should have no difficulty raising a substantial proportion of the capex by way of a mix of project loans, or ‘gold’ loans, and equity. That will be after a full feasibility study is produced early next year and, unlike less profitable projects, should not have to include the expensive ‘streaming’ loans from the likes of Franco Nevada who makes a higher return from them than do the miners who have to go cap-in-hand to it!

I see a newcomer to CNR Research, Hannam Partners, is suggesting a £97m gross cash inflow for 2024, whereas my estimate (based on the PEA numbers for a $1,550/oz gold price) is that average annual cash flow for the smaller operation after tax but before any loan repayments would be $74m. For the larger, underground, operation it would be closer to $100m pa.

Loan repayments will take away from that depending on their terms. Assuming, pessimistically that current shares in issue are doubled to meet a 30% (£38m) equity component of the capex, and again pessimistically that all loans are repaid over the first two years, CNR shareholders thereafter would see 35p cash per share flowing in annually for the next 7 years while the company proves up the rest of its large land-holdings towards its target of over 5Moz of gold reserves. By then Condor will have been well in the radar of the N American investors who rate gold producers much more highly than they do CNR now.

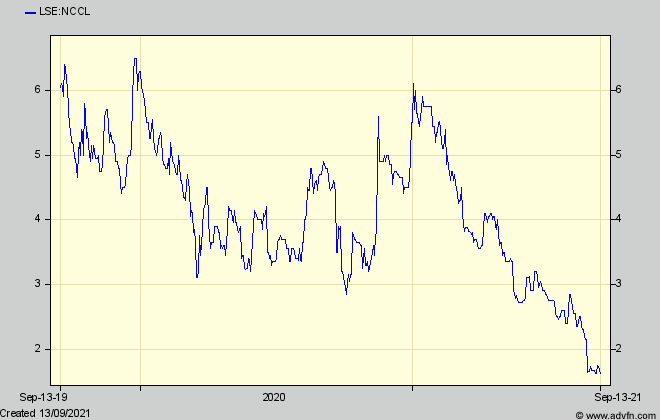

Another for a potentially significant share profit is Ncondezi Energy (LON:NCCL) which still appears to be on track to build its 300MW Tete Mozambique power project. Although the vital tariff agreement is very late, an equally vital agreement with its Chinese partner (CMEC) for the EPC (engineering procurement and construction) contract has been signed, which will have finalised the price (subject to inflation and other cost movements) for those elements of the $1.1bn total project cost. (Legal and financing costs are other significant parts). Along with the indicative terms for project financing already provided by Chinese banks, this will have cemented the inputs to the tariff calculations.

At the same time, the world bank has announced the signing of a contract to build the Mozambique end of the Mozambique-Malawi Regional interconnector, confirming the Government’s intention to build up its infrastructure in that area, where Tete is the project most advanced to generate the power for it.

As in many such projects in the developing world, NCCL as the ‘sponsor’ company, and due to delays outside its own control, has had to spend far more and for much longer that originally hoped, to push through the needed planning. So it is its own health that has preoccupied investors as much as that of the project itself – the latest manifestation of which was the need for a $600,000 funding last month at a low 1.5p involving a 11% increase in issued shares. While much criticised, and provided it really is the last such funding before financial close and the release to NCCL by CMEC of substantial sums to recompense its past spending, NCCL has nevertheless kept the increase in its issued shares (and therefore potential dilution of the project’s value to shareholders) within much more reasonable bounds than eg has Kibo Energy. The latter’s issued shares have ballooned almost tenfold since it first entered the energy market, whereas NCCL’s are still less than double those when I first covered the company six years ago.

Which means that, unlike for Kibo (even before it was forced through financial incompetence to exit the African power market) potential value for NCCL shareholders is still substantial.

Before financial close (which is expected in the first half of next year) exact figures can’t be calculated. But the company’s latest projected economics show that the $1.1bn capital cost would, approximately, generate an average annual $175m EBITDA over 25 years – leaving a total of $1.9bn net cash to equity shareholders, of which NCCL’s agreed 42% share would be $799m.

Missing from the equation is how the contributions to that $1.1bn will be met. NCCL has indicated that it expects 70% will be met by a project loan from the Chinese banks already signed up, and it is repayment of that loan that accounts for most of the difference between the annual $175m EBITDA and the annual $76m flowing to equity shareholders.

That means that, in order to earn its $799m total, NCCL has to contribute 12.6% or $140m up front, and it has various ways of doing so. What follows is therefore my own – very rough – speculation, because NCCL hasn’t yet announced its intentions, and a variety of permutations are possible for the style of funding including (unlikely in my view) that Chinese investors will buy out NCCL’s share.

About $30m could be met from what it is owed by CMEC for NCCL’s share of past work, and perhaps another $10-20m from the development fee it will be paid (although that is speculation, as no details have been announced).

NCCL might divert some of that to fund its new solar power venture, but if it raises (say) $100m through new equity, the question is what investors will pay for shares whose returns NCCL will by then be in a position to forecast. Such a calculation is fraught with difficulty, but my own conservative estimate is that they might pay 5c per new share, so that on the 2,440m total then in issue, cash earnings per share would be (on average) 1.3c and their own yield 26%. If they pay 10c per share, the total would fall to 1,440m and cash earnings per share would be 2.2c, meaning their yield would be 22%.

Some might think my calculation is over-cautious and that investors would accept a lower return and therefore pay a higher price. But it shows how sensitive such a calculation is. In any case, I started my articles on mining shares by stating that, in addition to pure recommendations, they would concentrate on how investors should approach valuing them and the pitfalls to look out for. In this case caution is warranted because finding investors to invest in African coal projects won’t be easy, and it may be that the only interest will be from pension etc funds looking for an annuity style return. They demand what looks to equity investors a very high return.

In any event, NCCL might have other options – except that I don’t think CMEC will buy the whole company as some hope. Power plant builders never do, because owning coal mines and limited life generating plants is not where they make their money. Building them is.

Even so, my crude calculations (subject to many further unknowns) show there is a lot of scope for the shares to recover from their exceptionally low lows, which could have been partly engendered by recent placees ‘flipping’ their cheap shares. So, recovery might take time.

Comments (0)