June Mining Update

So there you have it. A 49p recommended cash offer – vs 35p when I flagged Trident Royalties (LSE:TRR) last December.

Some think it’s too cheap, even though near the peaks reached two years ago after floating at 20p and despite the chairman having accepted and sold. But as I pointed out, TRR is only just approaching break even, and its significant Packer Pass lithium stream won’t contribute for some years. So I suggested further share price recovery would be slow.

Those thinking too cheap point to the higher consensus (suspiciously all grouped around 80p) previously touted by brokers, but as I say, their NPV based methodologies are completely inappropriate for setting a fair price for a share. In addition, the company has admitted for the first time, that funding, and competition and risks in acquiring new streams, is proving more difficult than expected for small fry like Trident. Together with failure over recent months to find other stronger partners, it has decided to throw in the towel – to an unproven Australian company Deterra Royalties (ASX:DRR), who might be worth following for when Packer Pass kicks in. With some key shareholders saying they will accept, there seems no room for much more argument.

Where to stash – quickly – the modest loot? How about Condor Gold?

This, like Solgold, has been drifting along with a strategy that so far has delivered no outcome for shareholders, yet with an apparently valuable asset in its La India gold project in Nicaragua, which we have described over the years here at Master Investor. Condor has finally got it fully permitted and almost ‘construction ready’ – but since deciding in Nov 2022 that it wasn’t feasible to develop itself, has been looking for a buyer.

The trouble is it is situated in Nicaragua (alleged to be mining friendly, though politically – ruled by dictator Orega – maybe not so much so) although with other operating Canadian owned mines – one of which not far away is touted as a possible buyer.

Until recently however La India didn’t own quite all of the land needed for mining where some artisanal miners don’t want to lose their original way of life, athough that may, now, have been rectified. On top, it has taken a very long time for a sale to emerge, even though multiple parties are said to have been talking.

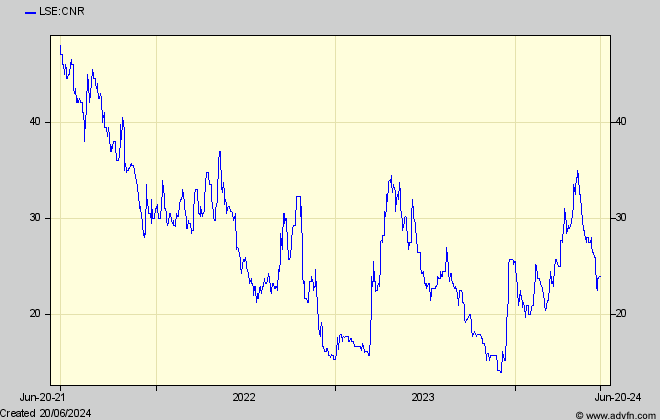

But events at last seem to be approaching a sale either of the project or of the whole company, which with the shares seemingly near the despair end of a “will it – won’t it” see-saw, and at a possible chart support, not to mention with a strong gold price in the background, warrants a look at a possible sale price.

I last updated Condor in 2020 (with the shares at 55p) following a Master Investor (owned but not edited by Jim Mellon – a 23% Condor shareholder and, more recently, chairman) presentation.

Since then a Bankable Feasibility study has firmed up on the economics (originally estimated in 2014) for the deposits at La India, showing a total of 862,000 oz of recoverable gold, from one large and two smaller open pits, and another 607,000 oz from underground – mineable in 6 years from the pits and in another three years from underground.

That is without considering further resources the company expects to find in its licenses in a wider surrounding area, which it thinks could approximately double that mineable reserve.

So far, and at a very conservative $1,600/oz gold price, the latest feasibility studies are showing a total 5% NPV for all three mining stages amounting to $348m, in return for up-front capex of $160m – delivering a reasonable 47% internal rate of return (over 9 years).

But at around the current $2,200/oz gold price, the total 5% NPV becomes $767m (with a 87% irr) of which $520m could be earned from the first 6 year phase mining the easier open pits. They will cost $153m initially, with only a modest further expense to access the underground gold which would take the total NPV to $767m.

These figures obviously look good against Condor’s current $67m market cap, but they need to be modified quite severely to assess what a buyer might pay.

For a start, costs have risen markedly since the studies were completed two years ago, while the use of a 5% discount rate to calculate the NPV’s might be questioned. A 8% or 10% rate as is used for many other mining projects would take away 17% and 28% respectively of the stated NPV, while, in any case, a NPV is not a sensible measure of what a buyer would pay. (It is what a buyer will get back over the project life, plus the (small in this case) annual discount rate, and therefore not a price to pay if wanting to make a profit. In effect it is merely paying up-front, to get it back over its life)

In reality a buyer has to consider what he can afford given he will have to meet the capex in addition to the purchase price. He won’t go by any NPV and its elastic way of stating only a crude and usually exaggerated approximation to value, but will go by the nearer term cash flows, perhaps modified by whatever loans or up-front off-take deals he might get.

Doing this this for La India, we find (from the published figures, which unfortunately are not detailed enough for much accuracy) that at around the current $2,200/oz gold price average net cash inflow from the first three open pits over 8.4 years will be c $84m pa, after $153m spent up-front.

Payback of the original $153m is said to be in only 7 months (only because the first two small starter pits will deliver much higher returns initially) which means that over the following 7-8 years some $550m cash would be generated, which has to repay the buyer’s initial purchase cost and his profit – not until the last 4-5 years. (without detail these calculationss are crude, but all we’ve got)

After recent cost increases, the capex and mining costs will almost certainly be higher, so I doubt a buyer would pay more than $100-$150m (the amount tentatively suggested by Condor in 2022 when deciding to sell) – or 50-75p per current share.

But the market is obviously highly sceptical, despite the company reporting last month ” eight companies are under Non-Disclosure Agreements, with five non-binding offers received and three site visits completed. Although none of the non-binding offers have yet progressed to firm proposals, the Company is in advanced discussions with one gold producer, while 2 other parties are actively reviewing the Company’s assets. The Board is optimistic that a sale will be concluded in the near future.”

And the company earlier having said “We are very aware of the value of our assets and will not allow them to go at anything other than a fair price.“

Condor’s latest balance sheet shows only 26p per share, of current and ‘receivable’ assets (with few other liabilities) – representing its auditor’s estimate for La India’s sale value. But that is likely to be very conservative

Such crude calculations as I have made might not carry the day however. A buyer might have ulterior motives, such as shareholders wanting expansion at any cost, or have unused capacity he wants to fill – as did nearby Calibre Mining at one stage when, also, it was mooted that processing costs at La India could be saved by trucking its ore there. A buyer might also be willing to assume a higher gold price (although I think unlikely). On top, is the presence of more than one interested party, which means an element of competition might boost an otherwise disappointing offer.

Given all this, it is odd that the shares are bumping along at what looks like a low chart support level. Some observers are sceptical that La India really is ‘construction ready’. But if there is no sale, the gold (a lot of it) will still be there, so it seems to me the shares are a pretty strong buy at its present c 25p price – with the strong possibilty a sale could deliver at least a 100% profit and possibly more. Some think news might come at the AGM on June 28. But there is no reason to suppose any agreement would coincide with it.

Comments (0)