Berkeley Energia – Another ‘Sirius’ mistake?

Following my recommendation 15 months ago, followers saw Berkeley Energia (LON:BKY) nearly treble by January as more and more commentators jumped aboard and as the company issued a stream of bullish news on progress and prospects for uranium.

But the shares are now 20% off their top and perhaps the market is satiated with a barrage of puff. Recent broker reports have been trumpeted incessantly by the company as showing ‘targets’ for the shares well above 100p – near double the current price. And the interim results and accompanying re-recommendations haven’t budged the shares. So what should holders – and any newcomers – do now?

There seems little doubt that BKY’s Salamanca mine will be very profitable and that the uranium price is probably at the beginning of a long recovery – even if ‘spot’ prices (which do not reflect the long term take-off prices that BKY is looking for and of which it already has a good slice) do not reflect it.

For the shares, however, there is a fair price – and there is one that looks too far ahead. Their recent modest weakness has another possible explanation – that while Salamanca has got started with some $30m raised, it needs another $65m soon (about half BKY’s market cap) to complete funding for just the initial mining stage. And within two years another $150m is needed.

Another is that Spanish press reports assert that Salamanca does not yet have all the necessary permits to mine, while there is also local opposition. In light of the employment benefits Salamanca will bring (and in the similar case – now resolved – of the old Rio Tinto mine which is now in production but went through a similar phase), such a risk seems minimal.

Readers, though, will know my opinion of brokers’ ‘targets’, which mostly are bogus, inflated by quoting ‘NPVs’ as if they will ever be reached by the shares. In truth, they are merely ‘values’ of a long (the longer the better for a bigger ‘target’) future string of income. An investor wanting a profit would be a fool to pay such a full ‘value’ for a share so long in advance of the income the NPVs measure, and they are only there (even if an appropriate discount rate to calculate can be agreed) to satisfy a bank that in the long run whatever project it is financing will earn enough to repay its loan with the profit margin it wants.

So we return to those trumpeted ‘targets’. Some of their sponsoring brokers have refused to supply me with their ‘research’, on the specious excuse that although I am fully qualified with much longer experience than any of their analysts, I am now a ‘private investor’, deemed incapable of understanding research aimed at ‘professional’ investors! That of course is down to the FSA (now FCA) who thereby prevents private investors deciding for themselves how valid might be share puffs by brokers wanting to please their client companies needing funds, their trading books, but certainly not their punters!

But perhaps those brokers spotted my outing of similar puffs for Sierra Minerals, whose analysts’ absurd long-run NPV based ‘target prices’ have turned out to be treble those that wiser institutions have considered appropriate during the six months subsequent to the funding they were produced for.

As for BKY, while I can’t now check the vital assumptions behind those puffs varying between 93p – “with 150p upside” – and 128p and 135p, information on its web site and from last July’s Feasibility study enables me to make my own calculations. These show the ‘targets’ to be using different assumptions about the NPV discount rate, and the amounts, price, and timing of the funding still needed (and the resulting shareholder dilution) that can’t be known until it actually happens, so they must be thumb-in-the-air guesses. To repeat, it is no good calculating an ‘NPV’ per share for a company’s ‘project’ if its shareholders’ interests are diluted down and down subsequently by the necessary funding (whether via equity, borrowings, or partnerships).

…it is no good calculating an ‘NPV’ per share for a company’s ‘project’ if its shareholders’ interests are diluted down and down subsequently by the necessary funding…

To reassure investors, Berkeley has said that instead of coming to shareholders it might find a partner to ‘farm in’ to Salamanca and so ‘avoid shareholder dilution’. That is misleading, because any partner in return for its share of funding will take his share of the project, thus ‘diluting’ shareholders (their interests in this particular project – if not in any other) in that way. Dilution also comes in another form from the streaming deals Berkeley has been entering into. The cost to shareholders of such deals – as I showed in earlier articles – lies in the lower product prices achieved, so that the real ‘cost’ (in the cases I examined) can be much higher than would have come even from share dilution. But it is never spelled out.

Assuming just equity funding and taking Dundee Capital’s 135p ‘target’ (the only recent research I can access) it appears (no detail is disclosed) to assume funding via share prices (in addition to borrowings) that rise in accordance with its NPV forecasts. (It projects the shares ‘reaching’ its target in only one year – phew!). Against 255m shares in issue now, its target has been calculated on 341m shares against the approx 390m that its own projected 2018 balance sheet shows. If the extra funds can only be raised at the current 55p price, shares in issue would instead be 685m – so reducing that NPV/share ‘target’ to 67p.

It may not turn out like that, but a chicken and egg situation where the target depends on the share price achieving the target, shows just how unreliable are such calculations – quite apart from whether an NPV is appropriate.

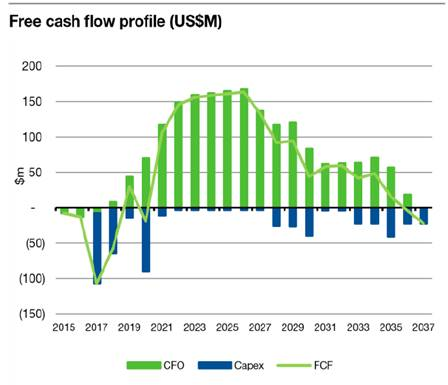

Back to what investors should do. Plenty of commentators are saying uranium related stocks are on a long term roll. Maybe, but look at BKY’s cash flow profile (taken from its latest presentation).

Apart from whether assumptions (as in the DFS which are based on the trade body’s forecasts) for a realised uranium oxide price rising from $39/lb in 2018 to $68/lb in 2030 will turn out correct, the chart shows cash profits not rolling in until 2021. The run-up to that will be the first time when investors who don’t believe in the intellectually bankrupt idea of NPV based share value will be taking an interest, because they can then see real earnings year by year.

As in the case of Sirius Minerals (which admittedly is much worse than BKY) where shareholders won’t see any earnings before nearly ten years from now, such that few investors seem impressed by the long-term ‘NPV’ argument, I don’t think many will be buying into BKY quite yet. Canny ones will wait until the funding picture clears – probably not until 2019. Those who believe, might, in the absence of better informed advice, follow the charts and momentum. But I wouldn’t.

Comments (0)