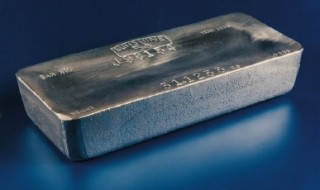

Why I’m ‘keeping the faith’ with Fresnillo

One of the most difficult parts of being an investor is living with paper losses. Inevitably, there is a degree of frustration when an investment doesn’t go quite as planned. I’ve experienced this lately with a shareholding in precious metals miner, Fresnillo (LON:FRES). It’s down around 7% since I bought it. Although a disappointing performance…