Greatland Gold Update

What every investor had been waiting for (And Master Investor has been cautioning about) has finally arrived. Greatland Gold, a minnow listed in London – still only 5 years old – has acquired from mining major Newmont Corp total control one of the largest recent and best grade gold and copper finds in Australia, along with an already operating facility to treat its ore. Not only that, but it has become poised to reap £millions in income in only a few months time.

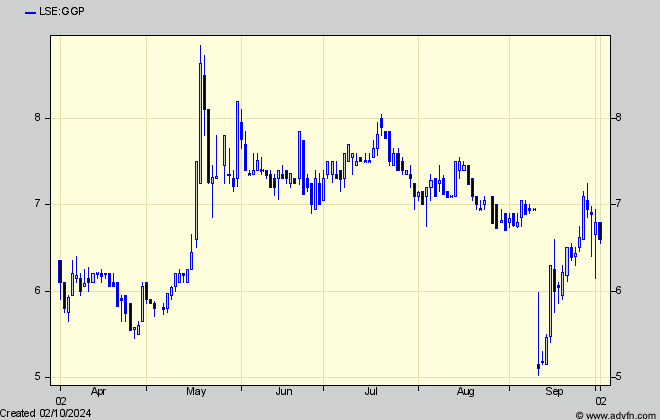

So why (as MI had predicted) has the share price gone all wrong. And why do we think it will stay wrong – for a time, anyway.

There’s no denying that it looks a compelling story. GGP now owns 100% of the 8.4million ounce and counting, Havieron gold and copper resource, comprising a compact narrow and deep high grade porphyry where preliminary plans already exist to mine downwards by standard stoping methods. On top, the deal comes with Newcrest’s old Telfer mine 45 km away which has substantial capacity to treat anything Havieron can throw up and has is own resources ready to be processed and producing revenue.

Owning Havieron 100% has been GGP’s ambition all along. So why, now it owns it all, does the share chart look uncertain, especially with gold so strong.

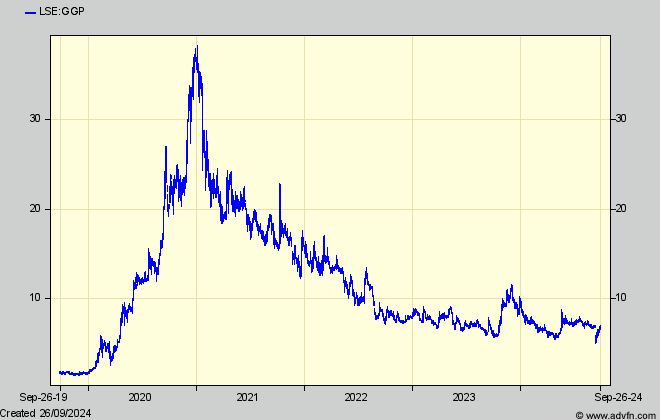

From the very top in January 2021 Master Investor had been warning that the shares had become much too expensive. Ditto at points on the way down when brokers in Australia were touting a ‘target share price’, in one case 27p; although later a UK broker had reduced to 12p, we kept advising investors to keep standing well clear.

That was despite the chat boards – the only source of comment private investors were getting except public relations presentations and shareholder meets – staying bullish regardless.

As ever we had kept explaining that broker price targets (because they survive by selling the shares and need to keep friends with companies they follow and usually advise for a useful fee) should be viewed with caution. And also because their methodology is based on project NPV’s which are not necessarily the same as the NPV’s ‘seen by’ shareholders in the companies owning the projects, and are inflated by lower discount rates than are acceptable to institutional investors. Its why such NPV based ‘targets’ are never anywhere near achieved for long.

Even so the story still looked good. GGP’s ambitions to grow by, hopefully,

buying back the 70% of Havieron it had had to cede to Newcrest Mining (later Newmont) in return for the latter drilling, finding, and planning Havieron, had roped in some big-hitting mining entrepreneurs onto its board who GGP hoped would help it financially to do so.

But, as all long in the tooth mining investors know, it was difficult to see how a small company with no cash could expect giants help it spend nearly $1bn to acquire and develop Havieron and not be squeezed between those giants’ own ambitions or see their equity shareholders diluted. While private investors are willing to pay for ambitions, investment professionals and financiers want to see solid plans before parting with their cash.

And although GGP has now apparently achieved its ambition, a look at the details in the very long AIM admission document for the shares in the newly expanded company (and which few commentators so far have apparently read) shows that there are still major (in our view) uncertainties how it is going to fulfil those ambitions, at least over the next few years.

Greatland has been able to acquire 100% of Havieron, together with Telfer, because owner Newmont Corporation is in the midst of divesting its smaller projects and those in gold, in favour of moving deeper into copper. Having at one stage said Havieron’s value didn’t merit its cost, Newmont put the 70% it inherited from Newcrest up for sale (having said all along that it wants cash for its divestments, and not shares in the buyer).

For it all GGP is paying (in USD) $207.5m in cash, plus up to $100m deferred in consideration for Havieron gold that GGP will be able sell at above $1,850/oz, plus $167.5m in new GGP shares at 4.8p. A total of $475m, or around £360m – the same as GGP’s market cap before the deal.

The cash has been raised through the c$450m (£255m) proceeds of the Sept 10th placing of 5.3bn new GGP shares at 4.8p, while the $167.5m in new shares will be paid when the deal completes (GGP hopes by November, subject to various steps being met including that Telfer is up and running – which it now is.)

But the deal takes GGP less than half-way to achieving its ambition. While the capital raising announced on Sept 10th has enabled it to acquire Havieron and Telfer, the other part – actually bringing Havieron into production (and hopefully extending Telfer) – still looks vague and subject to risks. Newmont is giving Telfer a push start to ensure Greatland takes over a fully working plant. But from then on GGP is on its own.

The original strategy is still being shown on GGP’s presentations but relies on a very out-of-date feasibility study from 2021, and on original majority owner Newcrest’s plan. From recent statements it seems GGP is to change it from when shareholders were expecting priority to be given to opening up Havieron as quickly as possible, with ‘first gold’ (ie well before profitability) by end 2027.

That original plan however, modified for the greater capital cost GGP is now facing as 100% owner and updated by the company, would have required raising a promised construction loan for up to $700m from the banks, who without an up to date feasibility study (not due for up to a year) would not be ready to sign up.

Instead, now owning Telfer which is estimated to have 9.5 tonnes of ready to process ore (still to be confirmed) which could yield 426,000 gold ounces in the first 15 months, the company is saying that it will rely on its revenues to develop Havieron, presumably calling on banks later once they can rely on a more accurate feasibility study.

All this shows how plans are still fluid and delayed, replacing those still shown in the admission document, which although based on GGP’s internal estimates confirmed by a ‘competent’ external adviser, are only to ‘pre-feasibility’ +- 25% accuracy.

That is almost certainly why institutions would only pay a low 4.8p price at the placing. And as we had always feared would be the case, has heavily diluted existing shareholders.

In that regard it is not correct for the company’s CEO to claim that the deal hasn’t done so.

Once signed and shares paid to Newmont, the deal will see the original 5.1bn shares in issue balloon to 13.1bn, an increase of 2.57 times. For dilution not to occur, value in shareholders’ hands needs to have increased by at least that. In terms of mineral ‘resources’ they have done – the CEO claims by 3.6x to give 1. 4x per share more ‘resource’. But share values depend very little on ‘resources’ and much more on profits, and, on known plans the rate at which those resources can be converted into profits has, according to the admission document’s ‘indicative’ forecast, not increased.

Likewise suspect is the CEO’s claim that the 20% of GGP Newmont is retaining is an ‘endorsement’ of its prospects. Reading between the lines and from a many times repeated statement in the admission document, Newmont was aiming to keep only 10% if GGP could raise more than it did on Sept 10th and pay that other 10% to Newmont in cash instead of in shares.

GGP is now working on new plans for Havieron with, hopefully, a higher production rate which might contribute some of that 2.57 times. And for the longer term the company is ‘confident’ it will become a ‘10Moz’ gold company (Not sure what that means). But until it does, each share’s expected profit will have been diluted by 2.57 times, neglecting any benefit from higher gold. For that, shareholders will see any gold profit more than expected subject to 30% tax and a 2. 5% revenue royalty.

So it is uncertain what shareholders can look forward to and when, what with the updated feasibility study likely to look very different than in 2021, having had to factor in major subsequent mining cost increases, offsetting whatever increase in the gold price to expect. Its why professional investors won’t, in my view, be stampeding to buy yet unless for trading.

That’s also because there are risks of more share issues and/or costly loans. Investors are being told that Telfer, once up and running and in first 15 months, ‘could’ deliver 426,000 gold equivalent ounces at a all-in cost of USD 1,454/oz from ore already in place. Thereafter further development could produce more for longer, but maybe not in the interval before Havieron comes on line.

Assuming an achieved $2,500/oz gold price, the Telfer profit after tax in those 15 months would be US$300m compared with the latest company estimate of US$360m to get Havieron to first gold (which even on the original plan isn’t before 2028).

On that original ‘steady state’ plan (as still in the Aim document) for 258,000 gold equivalent annual ounces at a US$899 AISC, gold at $2,500/oz would see net of tax income of US$281m – ie £215m, or 1.65p per share.

That is before company costs, and of the further exploration GGP says it will conduct both around Telfer and wider, as well as any construction loan repayment which, if the full A$700m, would take away £60m pa – or 0.46p pe share.

Institutional investors would not value a limited life income, especially for a still developing miner, on a PER basis, but at some lower multiple, which we don’t think would produce more than 10p a share.

For that, investors will have to wait for at least five years, and with unpredictable Telfer follow on revenue and a possible gap in income before Havieron delivers, GGP could see an outflow from the £100m cash balance it says it will start with, but which includes a large repayable working capital loan. On top there might be further payments to Newmont for each month deal completion is delayed, in addition to US$100m deferred consideration in 2028. There is therefore a risk of further equity issues – possibly when, as it hopes, Greatland lists on the Australian ASX exchange next year.

With all those uncertainties, and 5 years to wait for income which at the moment doesn’t look overwhelming, would a sensible investor buy now? Or will those who haven’t worked out the sums stampede after the gold price.

As we write the shares have recovered from the 4.8p placing on news that Telfer has restarted (under Newmont ownership who is taking its revenue until deal completion) and the 5.4bn placing shares have been listed, giving the placees the chance to take a profit – which they could well do once realising the extent to which the shares really have been diluted, so that any price recovery to previous levels is out of the question.

As the volatility accompanying the deal and the various company presentations dies down, we believe sensible investors will ponder the uncertainties. Others need to note that every extra US$500/oz on the gold price, after tax and royalties on the present 2.8Mt ‘base case’ and on 13.1bn shares, will produce only an extra 0.51p earnings per share.

So we think Mr Sensible will be in no hurry to buy. Even developing miners closer to full production aren’t getting much attention from investors in present markets.

But no doubt news, such as legal completion of the deal hopefully by November, and an increase next year in reported resources and reserves will produce temporary spikes in GGP’s shares, as will further rises in the gold price. Private investors aren’t likely to calculate that something like a further $1,000/oz will be needed before any meaningful benefit to 13.1bn shares in issue however. And increases in resources, likely to be mined many years ahead, aren’t given much credit by institutional investors.

Comments (0)