Three funds to profit from a sovereign bond market correction

A significant sovereign bond market correction is highly likely in the next three months, according to a poll of fixed income strategists conducted by Reuters. If they are right, it would also mean trouble for the equity market.

There are lots of these polls, but this one is particularly noteworthy as it sounds like turkeys voting for Christmas and comes hot on the heels of a surprisingly hawkish Federal Reserve meeting. The Fed has consistently played down the threat of higher inflation by saying that it would be transitory, yet last week they acknowledged that it could last longer than anticipated.

The announcement saw a sharp jump in the US 10-year Treasury yield back above 1.5%, with bond prices weakening as investors reacted to the threat of inflation. This is the key yield to follow and is likely to lead the action in the bond and equity markets.

If the US inflation data surprises on the upside and investors don’t believe that it is all transitory, it could spark a sell-off in global sovereign bonds and sharply higher yields. An increase from 1.5% to 2%, which is where the Reuters poll thought the rate was heading over the next 12 months, implies a capital loss from the bond market of 25% with any sudden sell-off likely to spill over into equities.

A direct way to profit

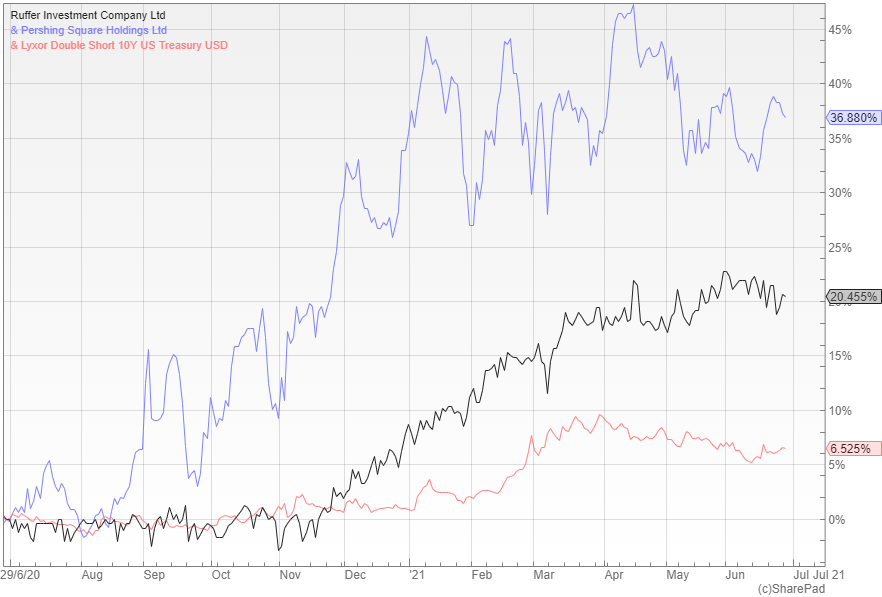

The most direct way to profit would be to invest in a product like the Lyxor UCITS ETF Daily Double Short 10Y US Treasury (LON:DSUS), which is available on the London Stock Exchange and priced in US dollars. It is designed to make money when the US 10-year Treasury yields rise, but the ‘daily double short’ aspect makes the cumulative performance hard to reconcile to the underlying bond market.

A more conventional option would be the £6.9bn listed hedge fund Pershing Square Holdings (LON:PSH), whichhas actively sought to profit from higher yields so as to protect the value of its US equity portfolio. According to the Telegraph, PSH’s billionaire founder, Bill Ackman, has bought ‘instruments that pay off in a large way in the event of a surprising move in rates’.

Ackman expects inflation to spike this year and has said that if rates move enough it would become a market risk event. The instruments that his fund has bought serve as disaster insurance, much like the protection he took out ahead of the pandemic that enabled the shares to bounce back within a matter of days and go on to make an 80% return in 2020.

A bob each way

PSH is a unique vehicle that has been in the news recently for the purchase of a 10% stake in Universal Music Group and has an excellent record in recent years with a three-year annualised return of 34% per annum, yet the shares trade on a persistently wide discount to NAV that currently stands at 27%. It is one of the few ways to benefit from the end of lockdown without running the risk of a catastrophic loss as a result of a spike in yields.

A more conservative each-way bet is offered by the Ruffer Investment Company (LON:RICA), an all-weather fund that has been positioned for the return of inflation for years and is well-placed to profit from it. The multi-asset portfolio consists of inflation-linked bonds and gold, as well as interest rate options and credit protections that should enable it to keep on course despite some potentially sharp market corrections.

There is also a selection of value stocks from different countries that will benefit from the re-opening of economies around the world. It is an imaginative and unique combination that has delivered a three-year annualised return of nine percent per annum with low volatility and minimal drawdowns (peak to trough losses).

Is there a similar GBP etf or fund to short the long gilt ?

Yes, you could look at ETFs such as 3GIS or 1GIS, depending on how much leverage you wanted.