Inflation-linked bond funds to balance your portfolio

Investors have traditionally held a mixture of equities and bonds to reduce portfolio volatility, but this sort of asset allocation is unlikely to protect them against a meaningful increase in inflation. The easiest solution would be to swap the fixed income component for an inflation-linked bond fund.

Most bonds pay a fixed level of income and the majority have seen their prices bid up to an extraordinary degree as a result of the historically low rates of interest. They now offer very little in the way of yield with next to no prospect of a capital gain, which makes it virtually impossible for them to cushion any losses from an equity sell-off.

One way round this is for investors to switch their fixed income allocation into index-linked bonds, where the coupons and the capital repayment on maturity both rise in line with inflation. If inflation takes off these ‘linkers’ could be due for another period of strong performance.

Inflation expectations have been rising ever since the approval of the first coronavirus vaccine last November. They have been spurred on by statements by the central banks in the US and UK that they will let their economies run hotter than before to make up for the years when they failed to hit their target.

It is entirely conceivable that the combination of monetary and fiscal stimulus coupled with the pent-up demand after lockdown will see the return of meaningful levels of inflation for the first time in decades. There is speculation that this could trigger an increase in interest rates, which would be bad for all bonds, although it is by no means certain.

The global economy is saddled with enormous levels of debt relative to GDP, which for many countries hasn’t been this high since the Second World War. Any sizeable increase in interest rates would be unaffordable and as it is not feasible to repay the debt via tax rises and spending cuts, the only viable option would be a period of financial repression.

Financial repression is where interest rates are artificially held below the rate of inflation, with central banks using their bond buying programmes to keep market yields low. If this is what happens we will see strongly negative real interest rates that could generate healthy capital gains for index-linked bonds.

How they work

Inflation-linked bonds are primarily issued by sovereign governments, although there are a few corporate issuers as well. In the US the principal and interest payments rise in line with the consumer prices index (CPI), whereas in the UK they currently use the retail prices index (RPI).

With a traditional bond the principal remains fixed, but with an index-linked security it increases in line with inflation so that the maturity value could end up substantially higher. There is also sometimes a deflation floor to protect against any downside risk when the bond is redeemed. The coupon rate is applied to the inflation-adjusted principal, so the income payments are likely to rise over time.

Traditional fixed interest securities respond to changes in nominal interest rates, whereas linkers react to real interest rates that take into account the level of inflation. If there is a prolonged period of financial repression when real rates are strongly negative then inflation-linked bonds would be capable of generating substantial capital gains.

“Index-linked bonds are like normal bonds apart from the fact that the interest and coupon rates are linked to inflation, so they would go up as inflation goes up. That does not mean they give total protection as when inflation is high you normally get interest rate rises and that affects the price of all bonds negatively,” warns Darius McDermott, MD of Chelsea Financial Services.

To determine their relative value investors can look at the difference between nominal yields and real yields, which is called the breakeven inflation rate. This indicates the inflation expectations that are priced into the market with the US 10-year breakeven rate currently being 2.41%.

If the actual inflation rate over the life of the bond is higher than the breakeven inflation rate when you buy it then investors would earn a higher return holding linkers rather than their fixed income equivalents, while also having lower inflation risk.

Record demand in the UK

In March an auction of UK 10-year index-linked government bonds attracted record demand with the volume of bids being three-and-a-half times greater than the £800m of securities on offer. This was the highest such ratio since the auctions began in 1998.

The high demand meant that the bonds, which are due to mature in 2031, were pricing in an average RPI rate of just under 3.4%. They have not been this expensive since late 2019 and stand well above the latest annual RPI reading for March of 1.5%.

From 2030 the inflation measure used for UK government linkers will switch to the consumer prices index including housing costs (CPIH), which typically runs around one percent lower than the RPI. This is a significant change yet there will be no compensation paid to investors.

Ryan Hughes, head of active portfolios at AJ Bell, says that an index-linked bond is in theory the only guaranteed way that an investor can maintain the purchasing power of their money, provided they hold the bond until maturity.

“For any investor worried about inflation, index-linked bonds can have a role to play in a portfolio, but they are not without risk, not least because they are typically a long duration asset, which makes them much more susceptible to changes in interest rate expectations,” argues Hughes.

Global expectations of an increase in interest rates have grown rapidly this year. Over the space of just two months, UK index-linked gilts have fallen 10%, showing that they can experience significant short-term volatility.

“The biggest issue for inflation-linked bonds is that they tend to be the first to move when investors think inflation might be a risk and as such they quickly factor in rising inflation expectations, so investors may struggle to get exposure to inflation protection at the right price,” warns Adrian Lowcock, head of personal investing at Willis Owen.

UK index-linked bond funds

FE Trustnet lists 14 funds in the UK index-linked government bonds sector with the five-year returns ranging from 41.3% down to 32.6%. Over the last 12 months they have all lost money, although the biggest decline was only 2.5%.

The managers that operate in the sector have a relatively small universe of linkers issued by the UK government to work with. This limits their scope to outperform, but because of the bonds’ sensitivity to interest rates, even a small difference in duration positioning can have a large impact on the performance.

Hughes says that some active managers have taken a fairly aggressive stance in this respect, which has helped to deliver some outperformance in recent years. A prime example is the Allianz Index-Linked Gilt fund that is led by Mike Riddell, which has outperformed by three percent since its launch three years ago.

“It has a shorter duration of around 17 years, compared to 21 years for the index, which will lead to a different outcome to the benchmark. However, given the relatively limited tools available for active fund managers, it is not really a market where anyone has displayed consistently good outperformance of the index or a passive solution.”

In view of the relative efficiency of the market, he recommends a passive option like the Lyxor Core UK Government Inflation-Linked Bond ETF that holds 30 gilts and has a duration of around 21 years. It has an ongoing charges figure of just 0.07% per annum and aims to track the main FTSE Actuaries Government Securities UK Index Linked Index.

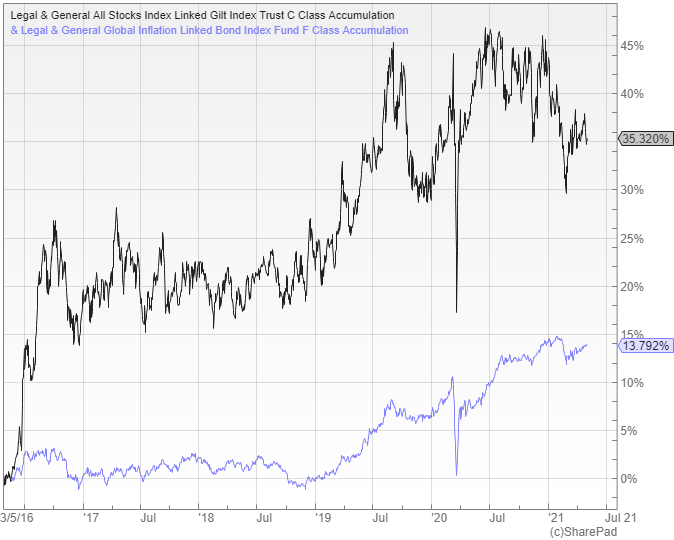

Alternatively there is the L&G All Stocks Index Linked Gilt Index fund that is favoured by Lowcock.

“With interest rates so low and inflation historically low, charges can have a big impact on returns,” notes Lowcock.“This fund costs around 0.15% so keeps the costs down. It is passive and would be an option for investors looking for long-term inflation protection in their portfolio.”

Overseas funds

Another option is to look at the overseas index-linked bond funds that can be found in the Investment Association’s global bonds sector. These offer a different return profile and have mostly made single-digit positive returns in the last 12 months, but have tended to lag slightly behind their UK peers over five years.

The L&G Global Inflation Linked Bond Index fund tracks the Bloomberg Barclays World Government Ex UK Inflation Linked Bonds Total Return Hedged GBP Index. Two thirds of its £1.2bn assets are invested in the US with most of the rest in Continental Europe. It has returned 15.4% over five years and has a distribution yield of one percent.

Lowcock likes the Royal London Index Linked fund that is managed by Paul Rayner and Craig Inches, both of whom have extensive fixed-income experience.

“They combine economic research with detailed analysis of the main drivers of government bonds,” says Lowcock.“The fund focuses on developed markets with the managers looking for opportunities through technical analysis.”

If you are worried about the risk of higher interest rates there is the ASI Short Duration Global Inflation-Linked Bond fund that invests in securities with a maturity of up to 10 years. A maximum of 30% can be invested in corporate bonds and the managers can also hedge some of the currency risk. It has £290m of assets under management and has generated a net annualised return of 2.05% per annum over the last five years.

“Given that the index-linked markets are fairly small, the more flexible the fund the greater the opportunity to add value. The manager’s job is really to beat inflation over the longer term after any costs and while they can achieve this the margins are narrow,” concludes Lowcock.

Multi-asset investment trusts

Another way to gain access to inflation-linked bonds is by using one of the defensive multi-asset investment trusts that have a big allocation to this area. There are three excellent low volatility vehicles available and each of them is positioned to profit from a sustained period of financial repression.

The largest of them with assets of £1.4bn is the Personal Assets Trust (LON:PNL), which aims to protect and increase (in that order) the value per share for the funds of shareholders over the long term. It has a good track record and at the end of December had a 35% allocation to index-linked bonds, with 12% in gold, 11% in cash/equivalents and the balance in equities.

A smaller alternative is the Capital Gearing Trust (LON:CGT), which has £648m of assets under management. The fund aims to preserve the real wealth of shareholders and to achieve an absolute total return over the medium to longer term. It has a decent performance record and at the end of March had 30% invested in index-linked government bonds, with other debt making up 15%, cash five percent, gold two percent and funds/equities 48%.

The Ruffer Investment Company (LON:RICA) aims not to lose money in any 12 month period and to grow the value of investors’ wealth over the long haul. It has done exceptionally well and at the end of March had a 30.4% investment in index-linked gilts. This was complemented by holdings in cash, gold and equities, as well as illiquid strategies and options to protect against a market crash.

There are growing signs that inflation could become a serious threat to investors’ wealth and if that is the case then conventional fixed interest securities would be extremely vulnerable. The better option may well be a decent allocation to index-linked bonds.

Comments (0)