John’s Mining Journal: featuring Horizonte Minerals, Emmerson and Ncondezi

Veteran mining analyst John Cornford reviews some of the more interesting plays in the junior mining sector…

Horizonte Minerals

I must apologise for suggesting (as is my often too cautious habit) in my coverage of Horizonte Minerals (LON:HZM) two weeks ago, that investors should hold off buying for the moment except on dips. The shares are now 60% ahead. I did however say “unless the nickel price continues upwards” – which it has done – resuming its upward trend almost immediately after I wrote, to where it is now 6% ahead in two weeks and 11% in one month.

I am too used to early-stage miners seeing short-lived spikes in their shares, when a small number of relatively inexperienced investors chase after good (but very early) news about their progress, and then take a quick profit. HZM, however, ought to be a different kettle of fish – increasingly on track to be a major miner and not just a mid-cap one – albeit that it won’t be for some years.

So, it will obviously attract more heavyweight investors who won’t otherwise go near mid-cap miners. And maybe they are behind the buying. But don’t ask me whether they will keep the momentum going.

Emmerson

After such a disastrous investment, no former Sirius Minerals shareholder is likely to look at another potash miner – even though potash is a vital ingredient for farmers supplying the world’s growing need for ‘green’ food. Anyone who can recall my recommendations back in 2016 to avoid Sirius will know that my reasoning centred on its looming inability to raise funds from equity investors – the professional element of whom wouldn’t ‘buy’ what the brokers were touting as a fair price to pay for new shares. My opinion was based on the brokers’ (and the company’s) absurd ‘NPV’ valuation – bolstered as it was by taking in over 55 years of predicted future income. As long-term readers will know, I believe NPVs are a misleading guide to share value, even when taking in income a relatively short time ahead. Realistic investors won’t pay up-front for such long-term projected income, but rather want to know instead what annual earnings (and likely share price) there will be in their foreseeable future. NPVs almost always obscure what that will be.

Emmerson (LON:EML) re-listed itself on the LSE main market in mid-2018 at 3.7p, having acquired the Khemisset potash resource in Morrocco. It differs from Sirius in that its potash it is a more regular type – MOP (Muriate of Potash) – as opposed to the relatively untried even though supposedly more efficient Polyhalite (or SOP) that Sirius (under its new owner BHP) will produce.

Sirius’s untried product might have been another reason why investors wouldn’t pay up, but there is no such excuse for Khemisset, whose $400m initial capital cost is more manageable than the eye-watering $3.6bn that Sirius needed. For that investment, EML is predicting an 8% NPV of $1.14bn; an IRR of 29.8%; and start of production in 2023/24. That NPV is based on a 19-year life, so by my lights is still an exaggeration, but less so than Sirius’s 55 years. At an 8% discount rate an NPV over the first 10 years is two-thirds that for 19 years, so still a reasonable margin over the capital cost.

But does it represent what counts – the margin over EML’s current market cap, and over its likely market cap when Khemisset is fully funded?

That depends whether EML has better luck in raising that $400m. In June last year the company theorised that it could raise $230m in project financing, and more recently stated that it is in discussions with various funders or potential partners. So, making a stab at the position after funding, and assuming a 10-year $230m loan (whose repayment would equate to a 10% NPV around the same level) we might say that EML will have to expand its current 726 million shares to over 4.1 billion if issued at 5p to plug the gap.

On that, my conservative 8% PV per share (ie the NPV, plus the – now financed – capex, less the project loan repayment) would be ($1.4bn + $0.4bn -$230m)/4.1bn, which equals 38c/share – or 29p.

On another measure the average EBITDA, at a MOP price 30% below the present spot price, is predicted to be $300m per annum. Deducting the loan interest, tax, and depreciation, takes that to, perhaps, $170m per annum earnings that will be reported, equal to 4c/share or 3.2 pence. In annual cash flow terms (ie before depreciation) the company expects an average $325m per annum – which would be 6 pence/share.

Such back-of-an-envelope calculations, although taking account of all the right elements, have to be extremely crude at this stage. All sorts of cost escalations and further capital raises to keep the company lights on until production usually throw them out, on top of which the accuracy of the feasibility study from which these estimates are taken is only 20-25%.

But there still looks to be a pretty good margin for the likely share price these figures would justify over the current share price to explain why they look as though breaking out from their historic trading range.

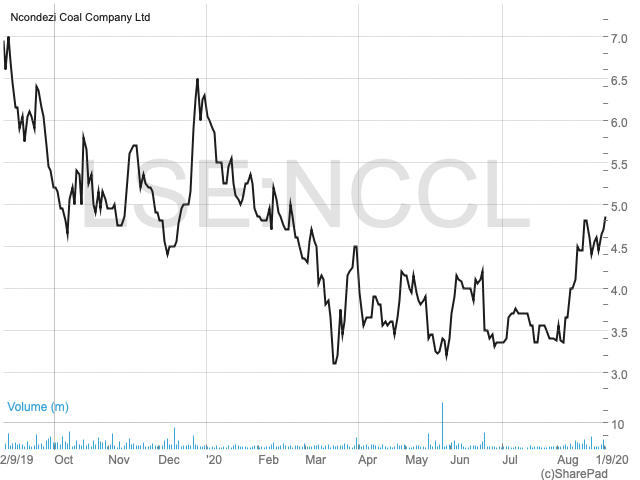

Ncondezi Energy

Ncondezi Energy (LON:NCCL), as the only one of the four aspiring coal-to-power generators on the UK markets that I have always thought worth buying, is getting much closer to financial close of its Mozambique 300MW power project. That’s when all the financing and other details should be available to put a more accurate value on the shares. But it is still a painful slog even though an announcement last week confirmed that the shareholders in the ‘project’ (not in the shares) will be NCCL itself with the right to subscribe for up to 40% of the equity, and Chinese builder CMEC (60%) – with CMEC also sourcing the 70% project loan from Chinese banks. News soon on the tariff agreed with the government will be almost final confirmation that the project will happen, with power delivered to the Mozambique and Southern African grids desperate for it by about 2024.

But it won’t necessarily provide the final piece of the jigsaw, which is the share price at which NCCL will have to raise its up to £75 million contribution (after receiving perhaps £25m in repayment by CMEC for NCCL’s past spending on planning the project). Broker Cannacord (not NCCL’s official broker) rather shot it in the foot by suggesting this would be at only 4.5p – against its 13p ‘target price’ for the shares. Somewhat confusing for investors, therefore, especially as I and they have always thought the capital raise should be a lot higher. I still think it will be, and will place a value on the shares above 10p, but it will be some time before we know. But expect more interest in the shares over the next few months before financial close (hopefully) in Q1 next year.

Hi John- Thanks for the regular updates. Just as a correction, AAL bought SXX (not BHP). Best wishes.