Diary of a start-up fund manager

Start-up fund manager Abhinav Shah reveals the trials and tribulations he has experienced while launching his fledgling global equity fund, the Rosevine Capital Global Equity Fund.

“You’re mad.” “It’ll never work.” “Who do you think you are, Terry Smith?” “You’re a smart guy. Just go and work for someone else.”

These are just some of the common refrains that I was greeted with when I decided to launch a global equity fund when I left Barclays in 2017, having spent the majority of my working life and the best part of thirteen years there.

When I joined Barclays in 2004, a bull market was emerging after the dot-com crash, opportunity abounded for the ambitious and it was a truly golden era for investment banks. Barclays had aspirations to take a seat at the top table with other bulge bracket firms and consequently, risk appetite was high, there was ample capital to deploy for profitable investment strategies and there seemed to be almost no ceiling to one’s earning capacity based on the rumoured pay packages and lifestyles of senior executives.

Then came the global financial crisis in 2008 and there followed a completely understandable and much required reset of the activities and risk-taking within investment banks. As scandal after scandal emerged in the press, enhanced regulation and supervision, a reduction in risk appetite and limits on compensation were now the order of the day. During this time and in subsequent years, I kept my head down and gradually worked my way up to become a Managing Director, eventually becoming the head of my own team. I felt proud to have achieved a modicum of professional success but grew increasingly frustrated with the rising levels of bureaucracy and the arguably necessary limits placed on business activity.

Ultimately, I knew the time would come when I would leave the institution that I had committed so much of my working life to. As I contemplated the next stage of my career, I knew that I wanted to be in control of my own destiny as well as leverage the skills that I had developed over many years, rather than seek out a radically different opportunity.

Chasing my dream

Like many individuals who find their way into a career in the financial world, my interest in finance had been kindled as a young teenager when I started buying and selling stocks on behalf of my parents and then myself. Equity investing has always been my primary passion and I decided that I wanted to devote myself to this exclusively, but without the restrictions and lack of individual control that inevitably come from working in a larger organisation. From this thinking was born the idea of launching a global equity fund.

Having finally left Barclays and taken a much-needed break after twenty years of working non-stop, I then spent the best part of six months understanding the legal and regulatory requirements of launching a fund and meeting the various service providers that could enable this. Given that I only had a relatively small amount of personal capital to commit to launching the fund, which nonetheless represented a significant portion of my liquid net worth, several service providers turned me away saying that I needed to have firm commitments of £10m in place before they would contemplate working with me. Without the likes of a Peter Hargreaves backing me, the enormity of the challenge ahead slowly but surely began to dawn on me, but I persevered.

Eventually, I located an Authorised Corporate Director called WAY Fund Managers who had just launched an incubator programme geared towards start-up fund managers. Without the support of WAY Fund Managers, it’s highly unlikely that I would have been able to realise my goal of launching a fund, so I owe them a sincere debt of gratitude for believing in me and my long-term vision. After another six months of intensive work, including seeking approval from the Financial Conduct Authority for the launch of a new fund, the Rosevine Capital Global Equity Fund was officially launched on 6 August 2018.

I’m often asked where the name “Rosevine” comes from. It’s a hamlet on the south coast of Cornwall where I own a small home that I retreat to during the holidays with my wife and young family. A place for contemplation and to escape from the hectic daily routine of a life lived and worked in London.

Coping with corrections

When the fund was launched, I made a conscious decision not to try to raise capital from external investors other than immediate family who had wanted to support me as I sought to develop and grow the fund. In any event, any capital raising efforts would more likely than not have been met with limited interest given that I didn’t have an independent long-term track record of running the proposed investment strategy and that global equities were already looking fully priced in the middle of 2018.

My goal for year one of the fund’s operation was to successfully launch the fund, invest the capital at my disposal and generate a respectable return on both an absolute and relative basis versus other funds in the IA Global Sector. Unfortunately, my worst fears were realised in the fourth quarter of 2018 as global equity markets sold off aggressively as the Federal Reserve sought to tighten monetary policy. I had barely started and, already, I was down almost 16%. It was bad enough losing my own money, but it was utterly gut-wrenching to be losing the hard-earned savings of family members in such a short space of time.

Although I had assigned a low probability to a significant sell off when the fund was launched, I had steeled myself for this possibility and was therefore at least mentally prepared for when stocks began tumbling relentlessly during the month of December 2018. During this challenging time, I elected to do nothing, confident that markets would recover and that the fund’s holdings were now more attractively priced than they had been in some time. Sure enough, markets recovered strongly during the course of 2019 despite the deteriorating trade relationship between the US and China and, on a more domestic front, Brexit.

By the time the one-year anniversary of the fund came around in August 2019, the fund had recovered the losses experienced in 2018 and was slightly in the black from when the fund launched, which at least made any family get-togethers less uncomfortable than they had been. With a year under my belt and the fund performing strongly, I began the process of attempting to raise external capital.

Gaining an “edge”

Initially, I decided to approach a few institutional providers of seed and acceleration capital for emerging fund managers. Unfortunately, there aren’t that many institutions in the business of investing with emerging fund managers and they are invariably searching for a new investment strategy where the fund manager possesses some identifiable and sustainable “edge”. So, if you happen to be investing on a long/short basis in under-researched Eastern European small and mid-caps and can demonstrate a repeatable investment process delivering attractive uncorrelated returns to the market, you’ll likely find some takers. If, like me, you are investing on a long only basis in mid- and large-caps in developed markets with a focus on competitively advantaged, high-quality growth companies, you’ll likely encounter some resistance since there are already so many fund managers covering this same investment universe and running similar investment strategies.

The legitimate pushback will be to question what it is that I’m doing differently than other fund managers with similar mandates and why the results will be meaningfully better. Personally, I’m sceptical that any fundamental investor in public markets can justifiably claim to have an “edge” that allows them to outperform other investors on a consistent basis. My “edge”, if pushed to provide a response to this line of enquiry, is that I don’t restrict myself to a relatively small investment universe as other quality growth fund managers tend to. I’m a firm believer that a fund manager should try to identify businesses that have a durable competitive advantage with a long growth runway ahead of them, buy a share in those businesses at an attractive valuation and hold them for as long as it continues to make sense.

However, I also believe that it pays to be opportunistic in markets. Periodically, very good businesses will be available to buy at incredibly attractive valuations, typically because of some negative event occurring in relation to the company. Identifying and then investing in just one or two of these businesses a year can, in my view, be materially incremental to overall portfolio returns.

So, whilst the fund invests in many of the same businesses that other larger funds are invested in such as Alphabet, Mastercard and Nike – all businesses with exceptional operating margins, superior returns on invested capital, a track record of growing revenues and earnings at double-digit percentages and supported by long term secular trends – the fund is also invested in companies such as Equifax, one of the three large credit reporting agencies, and has been since launch as it navigates its way back from a significant data breach and invests heavily to transform and rebuild the company from the ground up. Many fund managers focused on investing in high-quality growth companies would avoid investing in businesses that are undergoing corporate transformation programmes, but it is in precisely these types of situations that significant opportunity can be found and which will enable me to deliver differentiated and, hopefully, superior returns.

Overcoming the inertia of the fund selection industry

Whilst my search for institutional backing continues, I am also seeking out other opportunities to grow the fund, such as raising capital from friends and family who take an interest in the fund, IFAs and multi-manager funds. Raising money from friends and family presents the very obvious issue that if investment returns are disappointing, it may well damage the relationship irreparably, a risk that I am loathe to take unless the individuals have the capacity, experience and risk appetite to invest in the equity market.

Unfortunately, my personal experience is that IFAs and fund managers of multi-manager funds are reluctant to invest because the fund doesn’t have a three-year track record (although the last eighteen months of market activity has felt more like five years) and is small from an assets-under-management perspective. The most disappointing and surprising aspect I have discovered from marketing the fund to a few IFAs and multi-manager funds, apart from the invariable lack of response to my introductory emails, is that so many of them seem to rely on the longevity of the track record rather than actual performance, and appear to demonstrate limited interest in the investment philosophy and approach of the fund manager. Whilst I have nothing against Neil Woodford, the fact that so many professional investors stuck with him despite his fund’s portfolio raising more than a few eyebrows and performance deteriorating markedly is indicative of the degree of complacency and sheer inertia that pervades much of the fund selection industry.

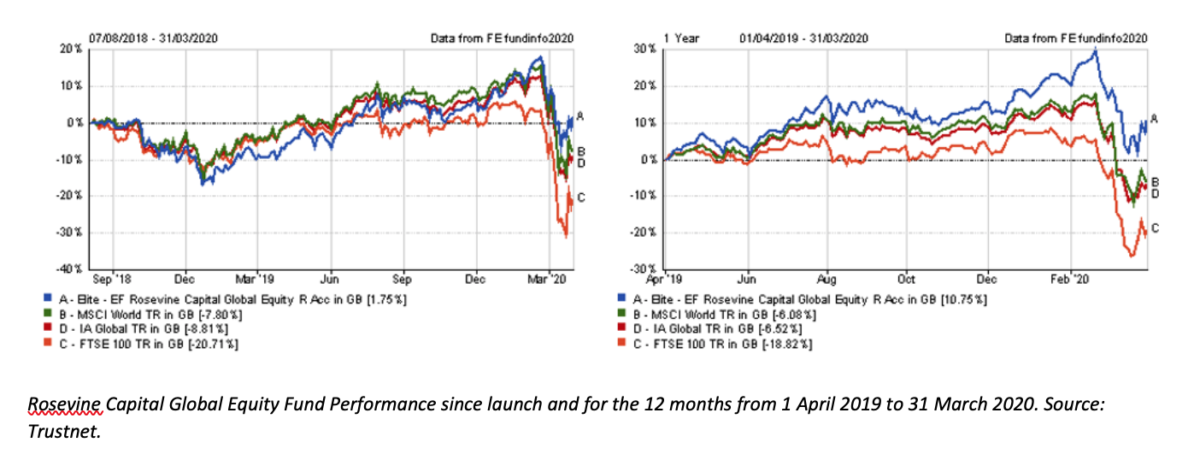

Whilst my fundraising efforts have undoubtedly been frustrating to date, I am at least consoled by the strong performance of the fund after a difficult start. The fund was ranked No. 3 out of 325 funds in the IA Global Sector over twelve months as of 31 March 2020 and remains top decile since inception, over the last twelve months, six months, three months and year to date. I am optimistic that I will be able to maintain the strong relative performance of the fund, notwithstanding the significant impact wrought on global equity markets as a result of COVID-19.

Whilst it is impossible at this stage to discern what the ultimate ramifications will be from the spread of this global pandemic, I am as confident as I can be that the world will recover from this “black swan” and that the current environment will be viewed with hindsight as one of the best opportunities to invest in high-quality growth businesses with durable competitive advantages at some of the most attractive valuations seen in recent years. However, I do not underestimate the challenge ahead in seeking to develop and grow the fund, but I am determined to persist in making my original vision become a reality and am hopeful that others will choose to join me on this journey as well.

About the author

Prior to founding Rosevine, Ab worked at Barclays for 13 years, where he was a Managing Director ultimately responsible for a proprietary investing, lending and trading business operating across both public and private equity and fixed income markets. Prior to joining Barclays, Ab worked at Société Générale. Ab began his career at Arthur Andersen where he qualified as a Chartered Accountant.

Comments (0)