DS Smith packages up its plastics division

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

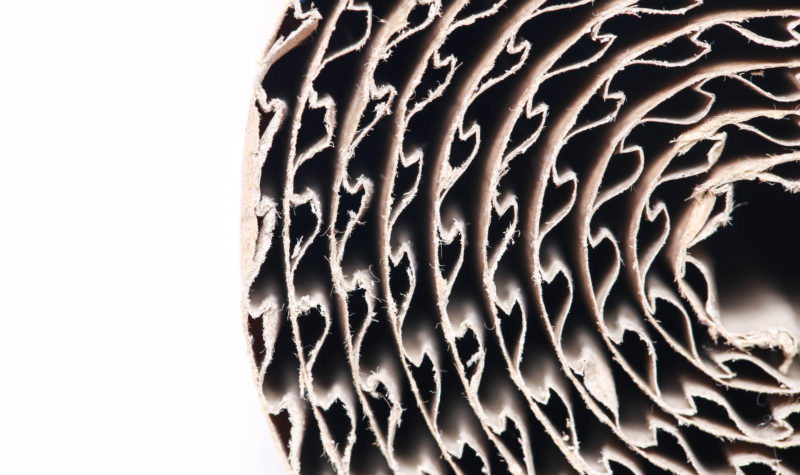

International packaging firm DS Smith (LON:SMDS) has announced the disposal of its plastics business to Olympus Partners for an enterprise value of $585 million, representing a 9.9x multiple of its EBITDA for the last 12 months. Completion is subject to usual closing conditions, including regulatory approval, and is expected to take place during the second half of the year.

Miles Roberts commented: “I am delighted to confirm that we have reached an agreement for the sale of our Plastics division. The transaction is attractive both financially and strategically for DS Smith as, together with the acquisition of Europac, we reinforce our position as a leader in sustainable packaging with a clear focus on our fibre-based business. My colleagues in the Plastics division have worked hard to build the business into the success that it is today, and that quality has been recognised by Olympus Partners.

We are pleased with the performance of the business during the second half of the year. While macroeconomic conditions remain uncertain, we are confident of continued strong demand for our innovative and high quality sustainable packaging and the resilience of our FMCG-focussed customer base. At the same time, the sale announced today will further strengthen our robust balance sheet and the Board continues to view the prospects for the business with confidence“.

Comments (0)