Berkeley Energia – Early Fission?

Uranium, as I point out in the upcoming magazine, looks to be a commodity that possibly will recover ahead of the rest.

As it happens, Spanish uranium developer Berkeley Energia (BKY:AIM & ASX) (formerly known as Berkeley Resources) is about to come across private investors’ radars in a presentation this week. It has already flagged itself to institutions, explaining, along with its merits, why the shares have been strong while other junior miners are weak. And as an Australian originated company it feels free of the overweening FCA rules that prohibit UK only companies from publishing analysts’ reports on their websites so that private investors can actually make up their own minds. With Aussie and Canadian brokers often publishing in more detail than their UK counterparts, that helps. However, as readers will see later, each of the Canadian, Australian, and two UK brokers whose reports I digest here use rather different valuation methods and assumptions regarding funding to arrive at their ‘targets’ – all well above the current price – so I will try to steer readers between them. In particular of course, I will endeavour to decide whether those ‘targets’ are bogus or genuine.

As it happens, BKY has, among other heavyweight shareholders, London’s sole streaming company Anglo Pacific (APC), who also has a 1% royalty on BKY’s properties. So maybe it will put in place a funding keystone by way of a streaming deal for BKY’s soon to commence Salamanca uranium project in western Spain, for which BKY has already intimated that an ‘offtake’ is under consideration. Whether a conventional streaming deal is appropriate for uranium however (where customers need exceptionally secure deliveries a long time ahead) has yet to be seen.

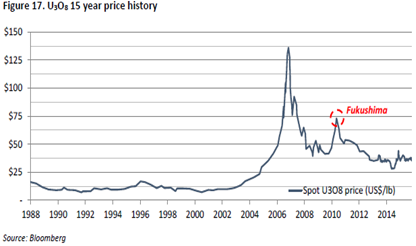

Not that funding should be difficult, because not only is the initial capital requirement a relatively modest $81m (only 20% more than BKY’s current market cap) but the preliminary (+/- 20% accurate) economics look extremely good – with a NPV8 some ten times the initial capex, and an IRR of over 90%. At a higher uranium price that should not be a problem, because with security of supply a major issue beyond 2020 for the 30% of world reactors based in the Eur-atom zone, and because Salamanca will be the only significant European producer, BKY can expect to secure the long term take-off prices which for uranium are significantly higher than today’s unrepresentative $44/lb spot price – depressed as it is following the Fukushima disaster. So those economics assume the $65/lb that is the long term contract expectation, although $44/lb would still produce an after-tax NPV8 five times the initial capex, and an IRR still a well above average 57%.

So my job, as usual, is to help private investors make up their minds despite the smoke and mirrors that sometimes cloak company presentations, as well as some analysts reports (depending how badly they want a share of the necessary fund raising). Not that those strictures apply here, because Aussie and Canadian analysts’ reports are usually more thorough than British ones, and the different methods used still show BKY as one of the few worthwhile mining shares to consider just now.

First however, it should be said that despite what looks a very strong story, funding is still to be put in place for a hoped for construction start in mid 2016, while first significant profits from production won’t be in view until the end of 2018. So, as ever, timing any investment will be crucial. Some investors might be happy to ride out the long term performance and buy now for their bottom drawer. Others might prefer to trade in and out during the mine’s (and therefore, probably, the share price’s) different phases.

The Salamanca project and capex timeline is complex. Rather than one upfront fundraise of the $200m needed to get all three planned pits into production, investment and therefore profits will be staged over the first four years, so that at any given time ‘value’ will look different from a shareholder’s or a funding contributor’s point of view, so the shares could be volatile.

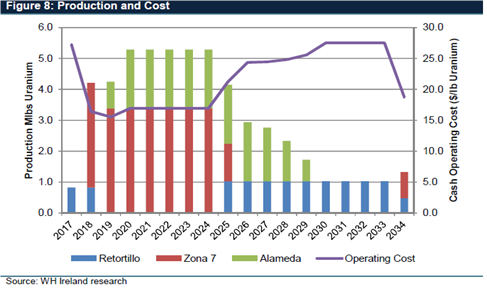

The chart, taken from the company broker’s report, shows the picture. The three pits are of different grades and profitability, with their time-lines combined so that up-front capex on each can be met to some extent from early cash generation. Cash cost varies accordingly, but is always in the lowest quartile of all BKY’s peers world-wide.

A late game-changer

As Berkeley Resources, the company’s Salamanca project was around for some years without generating much excitement, until, in 2014, BKY stumbled across an extensive shallow and high grade deposit just outside the two-pit area it had been planning to develop. ‘Stumbled’ because mineralisation in the area doesn’t produce the sufficiently strong radiometric anomalies that enables geophysics to reliably identify deposits below surface, except that other similarities now raise a strong possibility for yet more discoveries of the same. If these materialise, Salamanca will become even more valuable.

This new ‘Zona 7’ deposit was taken into account for the first time in a Preliminary Feasibility Study published in November 2015, which produced those economics, deriving mostly from its new found ability to develop Zona 7 as a first cheaply mined stage at a preliminary cost of only $81m. The Definitive Feasibility Study around which funding will be arranged however is due this July and, following further work delineating better grades in one of the other deposits, ought to show even better figures.

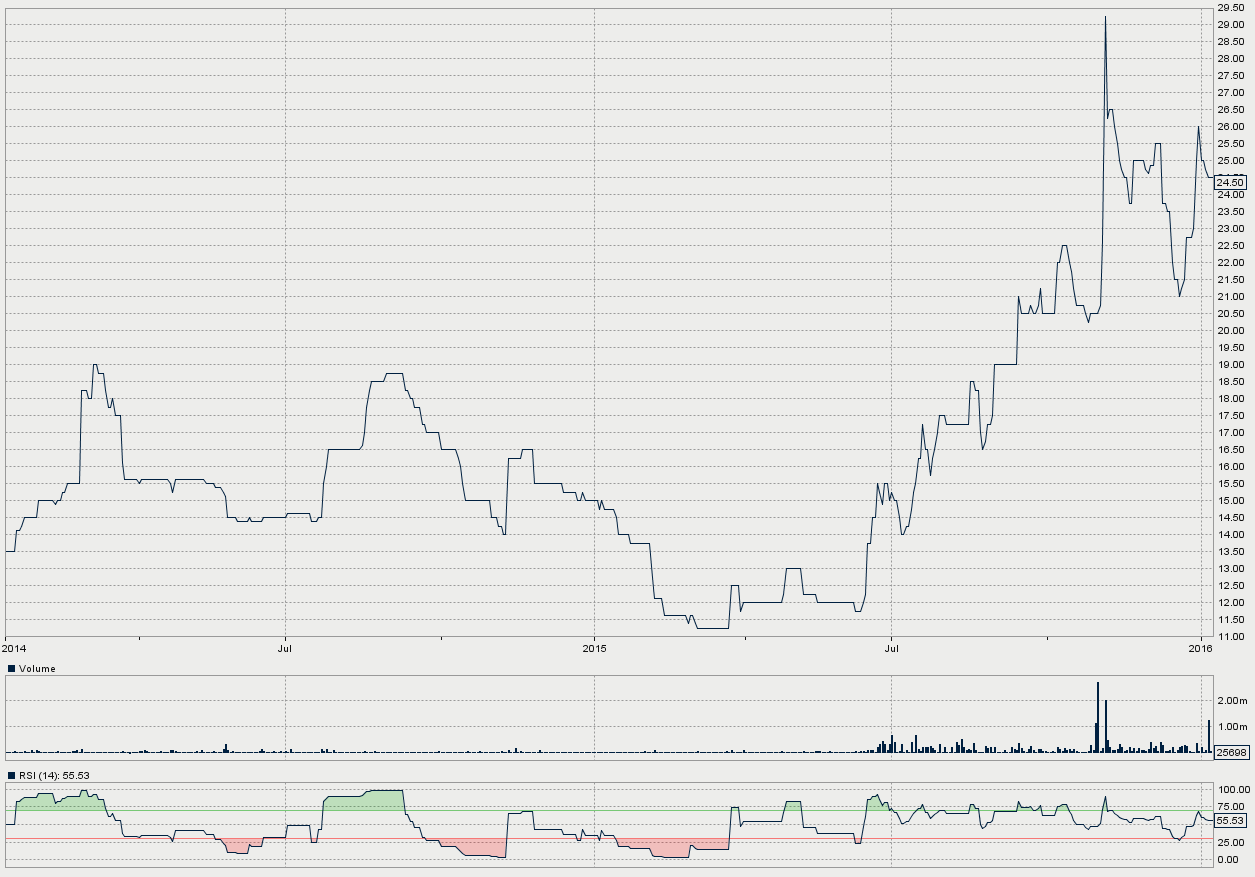

Soon after the Zona 7 announcement in mid 2015, experienced mining engineer and entrepreneur Paul Atherley came on board as Managing Director, obviously attracted by the prospects. That started the shares off on a strong performance which, based on the value now being unearthed, seems to have the legs to keep going in the medium to longer term (if you discount a spike likely to be generated by the current publicity and private investor presentation).

Atherley has already embarked on preliminary talks for funding in China, where the resumed push for nuclear power makes it an obvious candidate as a customer, and where he has long mining and financial experience. Success will enable construction to start soon after the DFS in mid 2016 with first production for a 17 year mine life in late 2017.

As for the uranium price and potential customers, Salamanca – which promises to be one of the world’s lowest cost producers (average ‘cash’ cost is $15.60/lb) – will be strongly positioned to supply customers who, being committed to long life reactors needing matching certainty of supply, are likely to sign up to the longer term contract prices (currently above $55/lb) that are the norm. (There is no recognised ‘market’ price for uranium. The ‘spot’ price – shown in the chart below – is not really representative as it is for small, short term quantities. But it is the only one published.)

Expectations for the uranium price are underpinned by the near-20% additional reactors currently under construction throughout the world and by the ending of nuclear weapons decommissioning by Russia. Proposed reactors would require double the present available supply.

Timing the value

Unlike most companies in the present environment whose ‘presentations’ are falling somewhat flat, BKY’s looks like stimulating more than the usual interest. So what value are investors looking at, bearing in mind it won’t crystallise for at least four years?

Here, readers might need a helping hand through the different valuations currently out there from the four brokers who have published reasonably detailed reports. All use different methods and make different assumptions, and although all arrive at roughly the same conclusion for significant value, some look more or less conservative than others. (I have not run my own ‘model’ at this stage because no sufficient detail has been published regarding the year-by-year operations.) As usual, it is uncertainty about the precise make-up of the necessary project funding and its cost (which won’t be known until mid year), which produces the major differences.

The company’s (UK) broker’s valuation on the surface looks less professional than the others in that it has used the ‘bogus’ method (an NPV or Gross PV divided by current shares without allowance for the necessary equity fundraise) but compensates for that shortcoming by only taking 30% of the project PV (not clear whether net or gross) that it calculates. (As company broker it probably can’t be seen to make precise forecasts about the funding make-up.) It arrives at a ‘target’ of 100p/share on a further assumption that the uranium price achieved will have risen to $65 by 2018. If the achieved uranium price were to be $44/lb (and we have argued that it won’t) its ‘target’ after its discount for dilution would be 32p. (But remember that I have explained elsewhere why such ‘targets’ are not ‘targets’ at all – in the sense that they will ever be reached – but are ‘values’, for which investors will obviously want to underpay.)

A further slight complication arises from the broker’s use of a 10% discount rate whereas others use the 8% that we think is warranted and which would improve the figures (probably by some 15%).

Before worrying about the effect of funding, however, a rough statistic that investors can place more reliance on is the forecast by all four brokers of revenues starting at around $270m in 2018 rising to some $350m by 2020, by when annual net cash generated before further investment will amount to between $150m and $195m, with reported annual net profit of up to $170m.

Out of that will have to be found the stage two and three up-front capital needs (about $120m on top of the c$81m for stage one) less whatever other funding – which by then should be easy to find – comes along, as well as the exploration and drilling costs to achieve the hoped-for further increase in the uranium resource.

Of the other brokers, Canadian Dundee Capital has a 99p ‘NAV’ per share, which is based on its own 10% NPV model assuming that BKY will stage its production and development of the two other deposits to limit the new funds needed from investors, to give average shares in issue (over life of mine – we don’t know how they will be staged and Dundee does not show its detailed workings) of 302m against 181m now. It then applies a risk ‘discount’ of 10% to its ‘valuation’ to produce a ‘target’ of 90p.

UK broker Numis uses a similar method to arrive at its 100p ‘target’, based on its own PV valuation but on present shares in issue. To allow for share dilution it then applies a 50% discount (against the 70% used by the house broker) to arrive at its target.

These methods of course do not give us the detail to calculate what investors would really prefer and understand better than PV based valuations – the yearly earnings and cash flow per share allowing for whatever different funding arrives. Dundee’s assumption is for $90-100m of the three-stage $200m total to be via an equity share issue, so its statement of an increase from 181m shares now to 302m shares implies new shares to be issued at around 50p – i.e. double the present elevated share price – with remaining funding from debt, off-take agreements and cash generated from the first stage of mining.

It is all a bit confusing, especially when Dundee says its NPV10 is $523m pre-financing, and US$431m post-financing. We are not quite sure what ‘financing’ it has assumed, nor whether the figures are a truly Net PV or the Gross PV that we have explained elsewhere is what determines value once the project has been funded.

But no doubt it all seems too academic to worry about at this stage. BKY still looks good so far.

The most thorough research report is from the UK arm of Australian and Canadian broker GMP Securities, who uses a mix of methods to arrive at a 70p ‘target’. (GMP publishes more detail of its calculations, although they are not necessarily any clearer.)

Remember that these brokers all use as a basis the overall (summarised) results of the November PFS, which doesn’t give details of production and profits profiles, and so make their own assumptions about that and about financing (debt/equity and their costs) and other corporate costs to which they apply their own further ‘discounts’ to allow for uncertainty.

GMP does rely on its own internal forecasts for shares in issue and other funding elements (which it doesn’t show) to forecast earnings (which it doesn’t publish) going forward assuming $55/lb. It then calculates a NPV8 of £400m (70% of the company’s PFS project NPV figures at $65/lb but after also allowing for corporate costs) and an IRR of 56% (against the PFS’s 93% at $65/lb).

Then it assumes a 45% equity raise in a range between the current share price, and 60% above, to arrive at eventual shares in issue (not published but I estimate) of between 280m and 340m (compared with 181m now) so that its ‘valuation’ on this ‘correct’ NPV/’correct’ shares in issue becomes about 118p/share (these are approximate – I have also had to adjust for the rise in $/£ since GMP made its forecasts).

So that is one method. GMP then adds a different one – a 7 times multiple of its EBITDA forecast (of $96m) three years from now, which it divides by its forecast of shares in issue after a fundraise at 30% above the current price which, when averaged with the NPV figure, produces a target of 97p per share.

What to conclude?

At this point in Berkeley’s recovery from its 25p low in mid 2015 just before the realisation that the new deposit had changed the game, we can see those ‘targets’ tempting in numerous new investors. But I, personally, wouldn’t buy right now, if only because I try to avoid publicity spikes. Others might have a different strategy, because if this story plays out per the present script the shares should be a few multiples of their present price (assuming no suicidal dilutions meanwhile and provided the contract uranium price begins to match expectations) in three to four years time.

But, then, I said something similar about Paragon Diamonds (which might still be rescued!).

Share Price Catalysts

– H2 2016 – Exploration results targeting further Zona 7 type deposits

– May 2016 – DFS

– 2Q16 – Initial mine build funding

– June 2016 – Mine build commences

– 2H17 – Berkeley target for first production

Comments (0)