Slimmed down Azonto Petroleum goes all out for Gazelle FID

By Amy McLellan

Two hundred and fifteen is a key year for Azonto Petroleum, with the FID on its Gazelle project in Cote d’Ivoire looming mid-year. The company, which is dual listed on AIM and the ASX, is hunkering down until then, shedding new business initiatives, cutting head count and reducing G&A in order to minimise cash burn until a decision is made on whether to move into full development.

This has been a painful process, admits new boss Grégory Stoupnitzky, with the company headcount shrinking from 19 to 13 and managing director Rob Shepherd and finance director Andrew Rose, who together had done so much to clean-up the troubled company, resigning in January.

“We all had ambitions a year ago that are no longer realisable in the current environment and so we had to refocus virtually all of our efforts to crystallise value from our primary asset in Cote d’Ivoire, and a five man executive team was not necessary for this really concentrated effort,” says former business development director Stoupnitzky, who will now run the company with technical director Jay Smulders, who has an impressive track record of maturing and delivering gas projects for Shell International and Tullow Oil, and general counsel Jeff Durkin.

Stoupnitzky, a former investment banker with 25 years of experience with stints at Bear Stearns, Morgan Stanley and Renaissance Capital, stressed that Shepherd, familiar to many oilbarrel.com regulars for his straight-talking and entertaining presentations at past conferences, and Rose were still shareholders in the group and were working out their notices. “It was very amicable,” he tells oilbarrel.com. “It’s been painful but it provides us with a more nimble G&A budget and gives us runway room within this calendar year.”

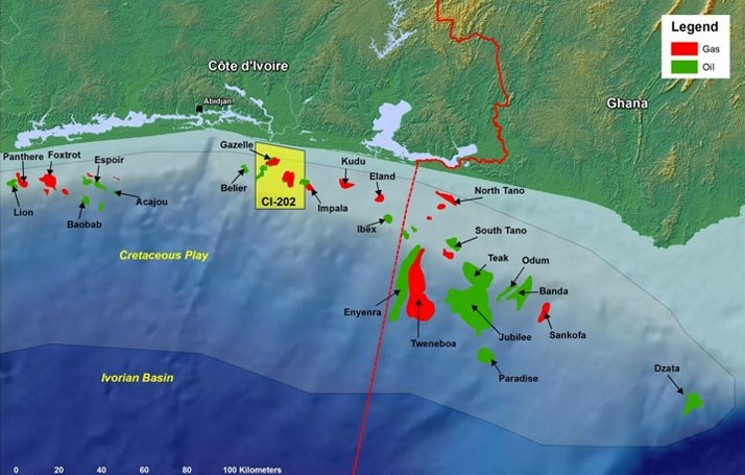

The AIM-quoted company, which had A$7 million in cash at its last quarterly update, has seen its share price under increasing pressure over the last year as oil price woes and ongoing delays at Gazelle took their toll. Azonto has a 35 per cent stake in Vioco Petroleum, which in turn holds an 87 per cent operating working interest in offshore Block CI-202, which hosts Gazelle.

Vioco’s working interest will be reduced to 71 per cent if state-owned Petroci exercises its 16 per cent back-in right, which will be decided in Q2 2015. Vitol E&P Ltd holds the remaining 65 per cent of Vioco.

The field development plan for the field has been approved by the authorities and in December the president of Cote d’Ivoire signed a decree granting a 25-year Exclusive Exploitation Area for Gazelle, a signal that this gas project is being backed at the highest levels.

In parallel, state-owned CI-Energies is working towards project sanction for the planned power plant co-located in Grand Bassam next to Vioco’s onshore gas processing plant. Following project sanction around mid-year, there would be a 15 month construction period to first gas in H2 2016.

“We are continuing our discussions with CI-Energies to finalise the gas sales agreement, which is more or less negotiated and is based on a gas price formula agreed with the Ministry of a 15 per cent return based on our P90,” said Stoupnitzky, stressing that this ensures robust economics even at low oil prices. Indeed, the low oil price environment may yet work in Azonto’s favour as it should reduce the price-tag on the development as the company will be contracting in a soft market.

“Other than the early engineering contracts, we haven’t ordered long lead items so we will really benefit from this opening of the market,” adds Smulders, who left Tullow Oil to sign up for what he calls the “start-up excitement” offered at Azonto. “In the next four weeks we should get a handle on how much costs have gone down on this project.”

Further ahead, there’s upside on the licence, including the nearby Hippo North prospect, just 7 km from Gazelle. This could be drilled as part of the development drilling campaign at Gazelle, although there is no obligation to do so. There are additional prospects and discoveries on the block, as well as on adjacent blocks, which raises the prospect of a wider regional gas play around the hub facilities being installed at Gazelle and onshore at Grand Bassam.

The company is working closely with its state-owned partners in Cote d’Ivoire, ensuring it has French speakers on the ground to help keep the momentum towards FID. “Francophone Africa is culturally different, speaking the language is not an option it’s a requirement,” says Stoupnitzky, a native French speaker. “It’s a mindset. You step into a different world between Nigeria and Cote d’Ivoire.”

Investors in the £2 million market cap company will be keen that this slimmed down, single-focus French-speaking management team now delivers and can get Gazelle up and running.

Comments (0)