Taipan Resources spuds Badada-1 in Kenya’s Anza Basin

By Amy McLellan

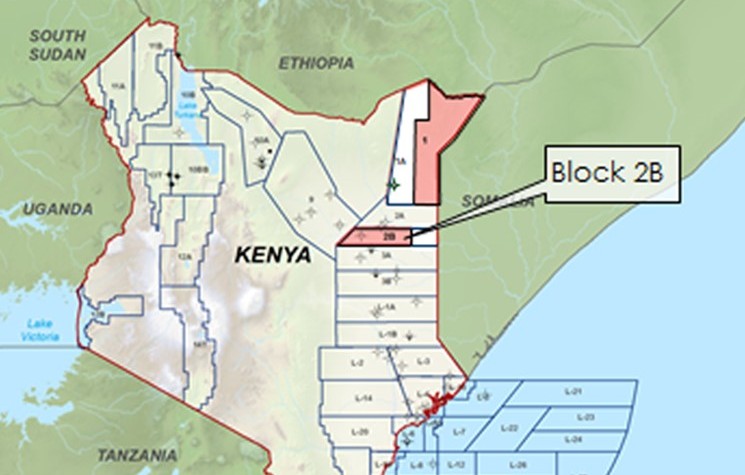

The highly anticipated Badada-1 wildcat in Block 2B in Kenya’s Anza Basin has spudded, a potential play-opener that will be closely watched by shareholders in Canada’s Taipan Resources and AIM-quoted Tower Resources. Legal wrangles had threatened to delay the drill in November but, as predicted by the parties involved, an injunction was quickly overturned and the well has spudded in line with the original timetable. The well will drill to a TD of between 3,000 and 4,000 metres and should take up to 70 days to complete.

This is a big well, targeting gross mean unrisked recoverable resources of 251 million barrels of oil equivalent mboe in Tertiary age reservoirs; dependent upon results, the well will also test a secondary objective in upper Cretaceous age reservoirs. These Tertiary reservoirs are believed to be analogous to those in the Lokichar Basin where in recent years Tullow Oil and Africa Oil have made a run of breakthrough discoveries, putting Kenya on track to join Africa’s club of oil producers in the not too distant future.

Taipan is keen to show that Block 2B can play a role in Kenya’s fledgling oil industry. This is a big well for the TSX Venture-quoted explorer, which secured its acreage when it acquired Lion Petroleum in 2012 and then worked up the Badada prospect using vintage data and newly acquired seismic. Taipan then brought in London-listed Premier Oil in 2013 to hold 55 per cent and AIM’s Tower Resources joined in April 2014 to hold 15 per cent. These deals helped Taipan fund this US$20-US$25 million frontier drill – Premier paid back costs of US$1 million and agreed an exploration carry of up to US$13.75 million; Tower paid US$4.5 million in cash plus 9 million shares – while still leaving the Canadian small cap with a material 30 per cent stake in this exciting exploration project.

Taipan CEO Max Birley said the spudding of the well was “an important milestone” for the company, adding it could generate “considerable upside from a follow-on exploration programme.” Graeme Thomson, CEO of Tower Resources, echoed this, saying success at Badada would de-risk other prospects and leads in Block-2B for follow-up in 2016/17.

There is no doubt this is a high risk drill. There has been previous drilling in the Anza Basin – last year Africa Oil made a gas discovery in the Cretaceous at Sala-1, along with significant oil shows, although a follow-up, Sala-2, was unsuccessful – but it remains largely unexplored, making this real wildcat territory. One thing is certain: the well will be carefully watched by Taipan’s shareholders as a key test of the company’s long held belief in the potential of the Anza Basin. With regular updates promised from both small cap co-venturers, this should ensure a steady stream of newsflow for investors over the first couple of months of the year.

Comments (0)