Why and how to invest in India

Summary

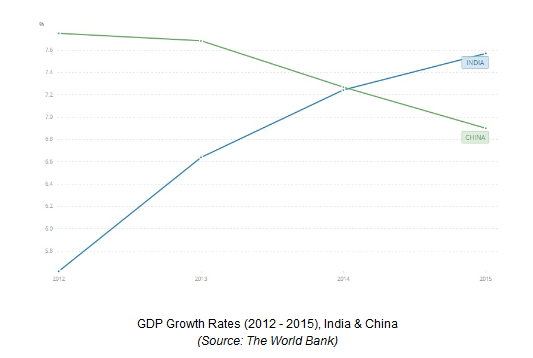

– India is starting to represent the new breed of high-growth emerging market, as Indian GDP grew by 7.5% in 2015, outpacing Chinese GDP growth (6.0%) for the first time.

– While China has spent the past several years developing infrastructure and reaping the economic growth benefits of an emerging middle class, it is now slowing down. India, on the other hand, has much work to do in terms of infrastructure projects, and its middle class is only starting to flourish. However, Indian markets have been driven up by recent monetary policy changes and relaxed investment regulations.

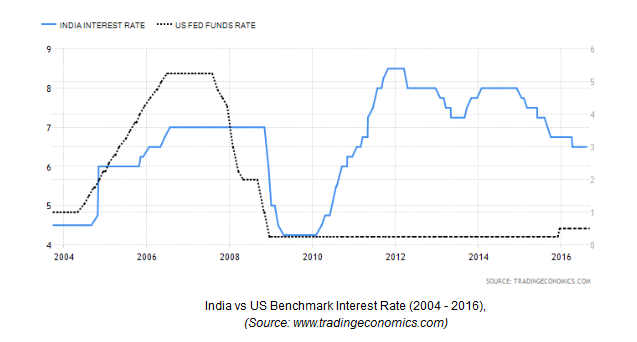

– Globally high valuations have caused a dark cloud to loom over investors who recall that market crashes are never far away once market valuations reach a certain point. India, however, has had a relatively tight monetary policy throughout the recession and therefore is better positioned to respond to a global recession than other countries.

– Naturally, India has inherent risks given its status as an emerging market. Investor sentiment can drive markets downwards, especially if investors believe that India truly has no more room left for growth. This may drive investors to sell their India investments, in search of ‘safe-havens’ in traditionally secure assets such as Gold and the USD. Political scams, reduced transparency and credit risk all come into play when considering an investment in a foreign emerging market. However, overall I believe that the potential returns far outweigh the potential risks.

– Foreign investors are not entirely excluded from accessing these potential returns, as ADRs, GDRs, ETFs and mutual funds allow for investment in Indian companies from abroad, in many markets across the globe. You can track real-time, comprehensive and personalised news for these ADRs on CityFALCON.

– Therefore, it is truly a question of how much risk an investor is willing to expose themselves to, and whether they truly believe in the India investment thesis as described below.

Born and brought up in India, and now a British citizen, I keep a tab of developments and changes on the ground in India every time I visit. Visitors will be pleasantly surprised by the pace of development, yet less impressed with the increasing income inequality and wealth gap. I am going to focus on India as an investment opportunity and explain how the average investor outside of India can get exposure, and could generate a good return over the medium to long term.

Since February, the Indian market has been advancing at a constant pace as Indian companies thrive under a more-favourable investment climate locally and a lot of liquidity globally. The Indian Government has recently adopted a pro-investment stance when tackling economic issues, and has implemented many initiatives to improve investment accessibility in India and reduce economic burdens faced by companies operating in India. On June 20th, 2016, the government announced sweeping reforms to rules on Foreign Direct Investment (FDI), opening up its defence and civil aviation sectors to complete outside ownership and, for example, clearing the way for Apple to open stores in the country. This pro-investment stance has been emphasised repeatedly over the past year, as the government claims that it wishes to make the Indian economy “the most open in the world.”

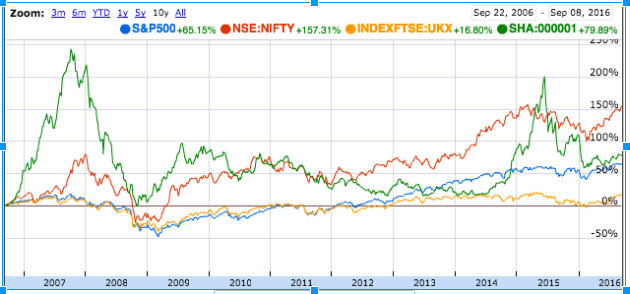

As you can see in the graph below, the main Indian Index, NSE Nifty, has significantly outperformed the S&P 500, FTSE 100, and China’s composite in terms of overall return. Similarly, you can see the reduced volatility of Indian markets when compared to those of other emerging markets, such as China.

Why India still remains exciting even after the recent runup

Big consumer market, GDP growth, opening up of the economy

India is one of the two largest developing nations in the world. With a population just shy of 1.3 billion people, its path to becoming a fully developed economy is likely to be paved with explosive growth and economic prosperity. India also has a significant middle class, a large English-speaking population, and hosts a stable democracy which has recently put a pro-business party into the majority seat of government. All of these factors point to the continuation of an attractive investment era for India – more so than in previous years where poor infrastructure, arbitrary taxation and significant government interference tended to put off investors. In 2015, the Indian economy expanded by 7.5%, outpacing China for the first time, which grew by 6.9%. This fast-paced GDP growth is nothing new: in-fact, since 2010 India has expanded GDP by >4% every year – an impressive record even for a developing nation. A massive population, rapidly growing middle class, and large backlog of infrastructure projects has allowed India to maintain its high GDP growth rate over recent years. Unfortunately, many issues still exist in Indian society. Poor infrastructure continues to be an issue, especially in rural areas, where poor road access, limited access to water, and poor sanitation are sadly the day-to-day reality. These are also opportunities for construction and other infrastructure companies.

Relatively tight monetary policy

While many developed markets have been aggressively reducing interest rates, and pumping money into the system – which has lead to a broad rally in the prices of assets, and in some cases may have created bubbles – India has been more sensible in its monetary policy. India still maintains one of the highest benchmark interest rates across the globe. India maintains higher inflation, but it is stable and is representative of a fast-growing emerging economy. India has defied the conventional wisdom of QE, which believes that growth is best derived from lower rates. Over the past year, the Indian benchmark interest rate has been cut from 7.25% to 6.5% and it will be incumbent upon the new governor of RBI to decide whether to continue this recent trend or not. With a benchmark rate of 6.5% in July 2016, India still has ample room for further cuts if necessary, and therefore is much-better positioned to weather a global recession than most other nations, which have already cut interest rates to the point of ‘no return.’

India still has risks which need to be considered

Valuation and recent upmove

Valuations in emerging markets are generally more attractive than they are in developed markets, such as the United States and the UK, given the perceived risks in investing in emerging markets. In India, we have seen the markets appreciate substantially over the past 6-7 months, driven largely by the efforts of the Indian Government to drive investment growth within the nation. With BSE SENSEX topping ~28,000, many now fear the rally is over, and investors wait patiently to see how the incoming Governor of the Reserve Bank of India, Urjit Patel, will respond going forward.

Flight to safety in USD and Gold in case of a crash

Given the high valuation of many global markets, investors are now concerning themselves with the possibility of an overdue ‘correction’ in the markets. Emerging markets, in particular, are considered inherently risky, and therefore there is naturally even greater concern surrounding the idea of a market crash. In case of any global meltdown, many investors may seek a “flight to safety” in stable assets such as Gold, the USD, or Bonds. If we begin to see investor sentiment turn, it may drive a mass selloff that could cause substantial investor losses. Usually buying small portions regularly in the market can work better than buying in one go.

Scams by Promoters and Governments

In the past, the Indian government has been at the heart of some of the largest corruption scandals in the country, which adds risk to any investment in Indian markets. Even as recent as this year, government officials have been accused of unfair benefits given to their friends in the industrial sector, the misallocation of government resources, and other meddling that disrupts the competitiveness of Indian markets. This is a broad and general risk that tends to exist in emerging markets; however investors should always be aware that this factor could affect the performance of their Indian investments.

FX fluctuations

Foreign currency fluctuations are one of the biggest risks when investing in emerging markets. Many in India are confident that the new Governor, Patel, will work to maintain interest rates, given the healthy economic growth over the past few quarters. Any subsequent depreciation in the Indian rupee as a result of the rate cuts would provide foreign investors with an opportunity to invest in India at a discount, somewhat offsetting the relatively high valuations within the country. Therefore, not only is India poised for continued economic growth as a result of recent rate cuts and a trend of high, yet stable, inflation; it also maintains a high enough benchmark rate to provide risk-averse investors with the peace of mind that in the event of a global recession, it has room to spur further growth by making additional cuts. This is the core of our India investment thesis, and we will now shift to discussing how foreign investors can gain access to these lucrative markets.

How to Invest in India from Abroad

Unless you are an Indian Resident or Overseas Citizen of India, you are bound by strict Foreign Investment regulations which will inhibit your ability to invest in the nation. The effort involved in seeking the required government approval in order to make the same investments as an Indian Citizen is often not worth it. Therefore we recommend one of the alternative investment vehicles available to foreign investors, which capture the trend of Indian growth, all while remaining completely legal in the eyes of the Indian Government.

American Depository Receipts, or “ADRs” is a certificate issued by a non-Indian bank in the United States, which represents a predetermined number of shares in an Indian company, traded on a US market. The ADR itself is denominated in US Dollars, while the underlying security is denominated in Rupees, and all capital gains and dividends are returned to the investor in USD. These ADRs are typically found on the NYSE, Nasdaq or AMEX, and they represent an excellent vehicle for American and global investors looking to take advantage of India’s positioning for rapid growth in the years to come. Some of the most popular Indian ADRs include:

– WIPRO Limited (NYSE: WIT)

– INFOSYS Limited (NYSE: INFY)

– TATA Motors Limited (NYSE: TTM)

– Vedanta Limited (NYSE: VEDL)

– WNS Holdings (NYSE: WNS)

– HDFC Bank Limited (NYSE: HDB)

– MakeMyTrip Limited (NASDAQ: MMYT)

– SIFY Technologies Limited (NASDAQ: SIFY)

– Dr. Reddy’s Laboratories Limited (NYSE: RDY)

– ICICI Bank Limited (NASDAQ: IBN)

Only a select number of Indian companies are approved for ADR trading on US markets. While this proves to be restrictive, it also provides foreign investors with an extra layer of assurance, given that strict regulatory procedures and screening is mandated before any company can be listed on the NYSE or NASDAQ. This greatly reduces the chance of fraud or inaccurate representations by companies to a greater extent, and is perceived by many investors to be a much ‘safer’ route to India than seeking FDI.

A Global Deposit Receipt, or “GDR”, is the international equivalent of the original “ADR” upon which they are based. Typically issued by global banks in the various developed nations in which they operate, GDRs work in the exact same way as an ADR does, representing one share of an Indian company denominated in whichever currency is used by the country in-which it was issued. There is a much larger number of Indian companies represented by GDRs than there are ADRs, simply because of the differing regulations which allow Indian companies to issue on some global markets, but not others. In Europe in particular, there are over 100 Indian GDRs, most of which trade on the Luxembourg Stock Exchange. Like ADRs, GDRs represent possibly the easiest route for foreign investors to invest in India. Some Indian GDRs include:

– Crompton Greaves (LSE:CGVD)

– EIH (LSE:EIHD)

– Tata Steel (LSE:TTST)

– Subex (LSE:SUBX)

– State Bank of India (LSE:SBID)

– Rolta India (LSE:RTI)

– Reliance Infrastructure (LSE:RIFS)

– Rei Agro (LSE:REA)

– Hiran Orgochem (LX:HO)

– Hinduja Foundries (LX:HVLX)

For investors unfamiliar with the intricate Indian investment landscape, ETFs and Mutual Funds represent a less risky alternative to direct investment in specific Indian companies through ADRs and GDRs. An ETF is a marketed financial asset, which is composed of a basket of smaller assets; similar to an index fund. Many ETFs now exist designed to capture the growth offered by emerging markets such as India, and they are popular with investors who have a general thesis regarding India’s growth, but do not have enough insight on the individual companies. Mutual Funds are similar to ETFs, and provide roughly the same opportunity for returns; however they are actively managed and therefore come with higher fees and stricter capital requirements. ETFs also tend to have greater liquidity than Mutual Funds, making them a more popular choice with risk-averse investors. Some examples of ETFs that currently exist and are designed to trace Indian growth include:

– iShares MSCI India ETF (INDA)

– India Earnings Fund (EPI)

– iShares India 50 ETF (INDY)

– PowerShares India Portfolio ETF (PIN)

– iPath MSCI India Index ETN (INP)

– VanEck Vectors India Small-Cap Index ETF (SCIF)

– Direxion Daily India Bull 3x Shares ETF (INDL)

– EGShares India Consumer ETF (INCO)

– iShares MSCI India Small-Cap ETF (SMIN)

Whether you feel confident enough to pick individual Indian companies poised for growth, or whether you just feel that investing in India as a whole is a good play at the moment, financial institutions have worked extensively to provide foreign investors with the tools they need to gain exposure to these lucrative new markets.

About the author

Ruzbeh Bacha is the founder and CEO of CityFALCON. He has been investing and trading in the markets for the last 15 years, is a qualified accountant and has an MBA from University of Oxford. CityFALCON is raising their equity crowdfunding round on Seedrs.

Disclosure: The author is long Indian securities

Well explained, very informative.

Thank You