FTSE 250 – The hidden investment gem

This is the third in a series of seven articles drawn from my new book, 7 Successful Stock Market Strategies. The focus of these strategies is successful long-term UK equity investment.

The FTSE 250 consists of the 250 largest UK companies after the FTSE 100. While the FTSE 100 gets all the attention, the performance of the FTSE 250 considerably outstrips that of its big brother. Since the beginning of 1986, when the FTSE 250 index commenced, the capital value of the FTSE 250 has grown by over 1100%, whereas the capital value of the FTSE 100 has grown by less than 400% (both figures as at the end of July 2015).

The long-term outperformance of the FTSE 250 can be ascribed to the fact that the companies in the FTSE 250 are smaller, more nimble and faster-growing than the dinosaurs of the FTSE 100. The capital values of shares are largely driven by earnings and dividend growth rates. Over the last 30 years the real annual dividend growth rate of the FTSE 250 has been well over double that of the FTSE 100.

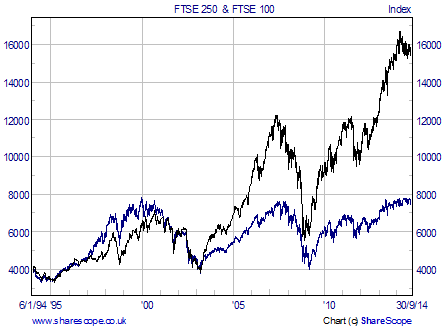

The 2nd strategy in my book exploits the strong performance of the FTSE 250 whilst ensuring that you do not invest when the market price is too expensive. Had you invested in the FTSE 250 at a peak (and very expensive) price of 7150 in September 2000, it would have taken more than 4 years for the market price to recover to your investment price. You can avoid this costly mistake by using the market valuation system described in my book. This system calculates the current intrinsic value of the FTSE 100 to compare with its current market price. If the value is less than the market price, then the market price is expensive. A proven strategy is to buy when the value is at least 105% of the market price and sell when the value falls to 95% of the market price. This FTSE 100 valuation system can be used to time purchases and sales of the FTSE 250 because the market turning points of the two indices are very similar, as can be seen from the chart below:

You can see from the table below that every single buy signal has produced a capital gain on the subsequent sell signal. Conversely prices fell in all but one of the periods out of the market.

| IN THE MARKET | ||||

| BUY DATE | BUY PRICE | SELL DATE | SELL PRICE | GAINS |

| 28/10/1987 | 1959 | 11/07/1989 | 2643 | 684 |

| 09/04/1990 | 2418 | 24/12/1993 | 3773 | 1356 |

| 07/03/1995 | 3330 | 12/10/1995 | 3936 | 607 |

| 11/07/2002 | 5065 | 23/01/2007 | 11102 | 6037 |

| 16/08/2007 | 10463 | 05/10/2007 | 11390 | 928 |

| 19/11/2007 | 10405 | 31/07/2015* | 17667 | 7262 |

| TOTAL GAINS | 16874 | |||

| OUT OF THE MARKET | ||||

| SELL DATE | SELL PRICE | BUY DATE | BUY PRICE | GAINS |

| 11/07/1989 | 2643 | 09/04/1990 | 2418 | -226 |

| 24/12/1993 | 3773 | 07/03/1995 | 3330 | -443 |

| 12/10/1995 | 3936 | 11/07/2002 | 5065 | 1129 |

| 23/01/2007 | 11102 | 16/08/2007 | 10463 | -640 |

| 05/10/2007 | 11390 | 19/11/2007 | 10405 | -986 |

| TOTAL GAINS | -1166 | |||

* Hold date as no sell signal given

The 2nd strategy involves the minimum of effort. You invest in the FTSE 250 when the FTSE 100 valuation is at least 105% and hold your investment long-term, whilst reinvesting the dividends. You can top up your investment periodically, providing the FTSE 100 valuation is at least 105%. Investment should be via a FTSE 250 exchange-traded fund (ETF). Using this strategy, you would have achieved a high long-term annual return of 11.2% from the beginning of 1986 to the end of September 2014. Vanguard introduced a very low cost FTSE 250 ETF last year, which would have boosted the annual return by about 0.3%. A long-term annual return of 11.5% outperforms virtually all UK active equity share funds over the same period.

If you wish to put in slightly more effort, you could boost returns further by buying and selling your FTSE 250 investment according to the market timing signals. I will explain this strategy in a subsequent article.

To purchase 7 Successful Stock Market Strategies by Glenn for the special Master Investor price of £17.50 + P&P (RRP £24.99) for the paperback and £10.50 (RRP £14.99) for the ebook use the following promotional code when checking out at the Harriman House online bookshop: MASTER7SSMS.

Comments (0)