Frontier Resources International continues to seek partners to fill funding gap

By Amy McLellan

Frontier Resources International has posted its results that show the company urgently needs to tap new sources of funding to progress its portfolio of frontier exploration projects. The AIM-quoted company, which has assets in Oman, Namibia and Zambia, reported a post-tax loss of £1.225 million, narrower than in 2013, and ended 2014 with cash of just US$165,000.

Chairman Neil Herbert said the company needs “substantial financial resources” to develop its assets and was “actively engaged” in seeking industry partners to help move its projects forward. It has opened online data rooms and made presentations to industry. The company reports a “good response to date from potentially interested parties” but discussions are continuing.

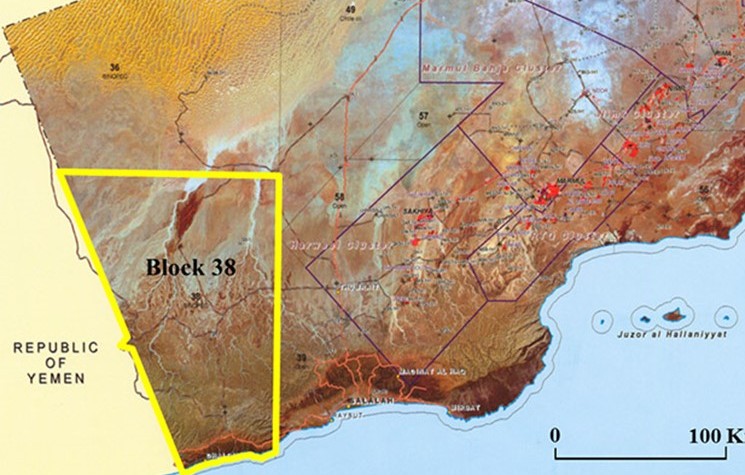

Operationally there has been some progress. In Oman, it has re-processed legacy 2D seismic, which it has been integrated into the overall seismic dataset for Block 38. This, the micro-cap says, will enable it to optimise the location of any future seismic surveys or drilling locations. It has also identified two large structural leads not identified by previous operators.

The next step will be to drill an exploration well into the most advanced of the structural leads. To this end, it recently secured approval from the Ministry of Oil & Gas to exchange the Phase 1 work commitment of a 3D seismic survey for an exploration well and 2D seismic survey. The 100 per cent owned block lies in the Dhofar Region of southwest Oman, covering an area of 17,425 sq km.

Onshore Namibia, Frontier has obtained a two year extension to the licence period so that additional geochemical sampling and seismic acquisition can take place. Frontier has also contracted Earthfield Technology of Houston to perform a depth to magnetic basement study over its blocks, 1717 and 1718, which lie in the Owambo Basin in the north of the country. Frontier operates with a 90 per cent working interest.

In Zambia, the company has been getting to grips with the potential prospectivity of Block 34 in the Kafue Trough. The results and interpretation of gravity profiles combined with the results of source rock analysis on a core sample has greatly improved its understanding of this frontier acreage.

“We are now actively planning the next phase of the exploration programme which may include the acquisition of additional gravity and/or magnetic data and soil gas analysis over the entire Block,” said Herbert.

All this activity requires funding: in March 2015 it landed a conditional share subscription for £1.7 million (US$2.5 million) and interim US$200,000 loan facility with AGR Energy Limited No. II, which is backed by the Assaubayev family, the hugely wealthy Kazakh business dynasty. Whether this will buy enough time to enable the company to secure farm-in partners remains to be seen.

Comments (0)