Cub Energy reports production was up in Ukraine in 2014 but the group remains concerned about fiscal terms

By Stewart Dalby

TSX-Venture listed Cub Energy has recently reported on its fourth quarter 2014 output, the numbers for the twelve months of 2014 and the first 20 days of January 2015, from troubled Ukraine where it is entirely focused. In the report the company has said production was ahead for the final quarter 2014 and the whole year but slowed down a bit in January 2015.

Behind the generally positive figures, however, there is continuing concern or rather, as we reported a month ago, deep unhappiness about the less favourable fiscal terms that obtained in Ukraine in 2014, as well as geopolitical worries.

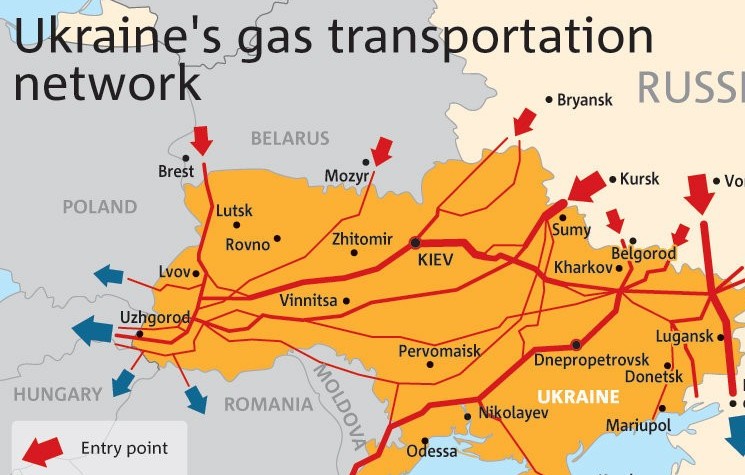

Cub’s update announced fourth quarter production including a 2014 exit rate of 2,407 barrels of oil equivalent a day (boepd) was 16 per cent higher over the company’s,2013 exit rate of 2070 boepd. The update included ongoing operations from the 30 per cent owned KUB-Gas in eastern Ukraine and Tysagaz, Cub’s 100 per cent subsidiary in western Ukraine.

Average production for the fourth quarter was approximately 2,112 boepd representing a 3 per cent decrease from 2,1784 boepd in the third quarter 2014 and a 25 per cent increase over the 2013 fourth quarter production of 1687 boepd. Production for the first 20 days on January has averaged 2.063 boepd.

Production increased in the fourth quarter as a result of the Rusko-Komarovske 23 (RK-23) well in western Ukraine. This well tested gas at a rate of 2.3 million cubic feet per day (mmcf/d) through an eight millimetre choke in November 2014 and was subsequently tied in. The well, which is 100 per cent owned by Cub produced an average of 2.1 mmcf/d during the latter half of the fourth quarter.

Against this, production at KUB-Gas in eastern Ukraine –where most of the unrest in Ukraine has been and where Cub was unable to operate for periods last year– declined by circa 11 per cent in the fourth quarter, substantially due to the existing surface facilities having difficulty meeting sales gas dew point specifications. Some wells were shut in. The positive in this area was the KUB-Gas M-22 well reached TD in late December and logs and drilling data indicate 18 metres of net pay in 2 zones that have not previously been tested. The well also encountered four other zones with aggregate thickness of 22 metres that have resource material. The well has been cased and completion and testing is ongoing.

As we reported early in January, however, the not so good news was the announcement of changes concerning gas prices. Cub CEO Mikhail Afendikov made it obvious last year he was very unhappy with the royalty situation. The temporary increase in royalty rates to 55 per cent impacted on net backs for the Cub to the tune of 50 per cent.

The situation worsened last month. The recent Tax Code amendments meant the royalty were not temporary but had become changes permanent changes; effective January 1, 2015.

Afendikov now says: “As the company previously disclosed, the less favourable fiscal terms in Ukraine will have a bearing on Cub’s 2015 budget. More specifically, the current fiscal regime combined with lower commodity prices will have three primary effects”.

1. While cash flow from existing operations will be materially reduced, it should remain positive

2. Development drilling, recompletion and stimulation will be marginally economic

3. Exploration drilling does not appear to be economically viable.

Afendikov continues: “In the light of these effects, Cub will curtail its capital expenditure programme for 2015. The contemplated 2015 work programme includes: At KUB-Gas (30 per cent) completion, testing and tie-in of the M-22 well which is substantially complete and field compression for the Olgovskoye field. At Tysagaz (100 per cent)one or two workovers to enhance production.

The CEO finishes his update by saying the company and its partners may consider additional capital expenditures subject to keeping such expenditures within operating cash flow and no further material adverse changes in the fiscal terms, or the security situation in and around the eastern Ukraine licences. He says once economic conditions improve in Ukraine, KUB-Gas has a significant inventory of drilling locations and other projects.

Meanwhile the share price is languishing at a 52 week low of C$0.02 against a high of C$0.22.

Comments (0)