Condor Gold: Unlocking value

The Market is beginning to recognise Condor’s value, but its rating is still far behind that of similar gold miners in North America, writes John Cornford.

(Note: even though gold has recently touched $2,000/oz, I base this report on a conservative assumption of a reliable $1,850/oz.)

Even though the market is beginning to recognise Condor Gold‘s (LON:CNR) value – especially now that what appears to be a new $1,850/oz base gold price accords a $4.4bn value to its 2.4M ounces of gold (its silver content would add about 1.5% to that value) delineated so far ‘in the ground’ at its La India project in Nicaragua – its rating is still far behind that of similar gold miners in North America, where Condor has been listed on the TSX since early 2018.

Although the shares are c. 150% ahead of my February recommendation, they still have some way to go, especially now that Condor is getting ready to mine next year.

Condor now has all the necessary permits for construction and operation of a processing plant to extract gold from La India open pit and two satellite feeder pits; it has acquired practically all the land required for the pits, mine and plant (85% now – up from 35% at the beginning of the year); and it has fulfilled most of the conditions to start construction. However, Condor is still finalising studies to enable it to choose between various production options. These include financing without diluting shareholders too much, and phasing the extraction of gold from the three pits for which it has also recently obtained permits to mine.

Because it is still finalising those studies, Condor has not yet updated its 2014 NI43-101 compliant technical report by consultants SRK, so cannot – with its shares listed on Canada’s TSX – go live with any forecasts or estimates of La India’s up-to-date economics. In fact, Condor has to officially say that its 2014 report is still extant.

As a result, all that the wider market (especially investors in N America) have to definitely go on is the minor update to that 2014 report that accompanied Condor’s additional listing on TSX in January 2018, together with a recent – only partially updated – estimate by Condor’s broker SP Angel in May 2020.

However, the company has recently provided more guidance on the impact of the additional two high-grade feeder pits that are now permitted, which I discuss below.

The original plan in the 2014 NI 43-101 compliant PFS was to mine only the economic reserves from the main La India open pit at a rate of 800,000 tonnes of ore per year, to deliver 650,000 gold ounces over 7-8 years. At an initial $110m capital cost, the 8% post-tax NPV at $1,400/oz gold calculated in 2014 by consultants SRK, was $104m, with a 38.8% IRR (internal rate of return).

My own estimate now, for that same 8% NPV at the current $1,850/oz gold price, would be around $250m – ie adding the extra average annual profit after tax and royalties of about $25m per annum which that production would deliver.

However, that does not take account of the optimisation studies that Condor and its consultants conducted subsequently, showing considerable scope to improve that profitability. Their results were announced in January 2016 and showed a 78% increase in the base case NPV and an improved 30% IRR based on a $1,250 gold price. On $1,850/oz, I estimate that IRR would increase to over 50%.

Since those optimisation studies, the possibilities have been widened further with the recent receipt of permits to mine two adjacent satellite pits, America and Mestiza alongside the main La India pit. They have a combined 220,000 oz gold at over 5g/t compared to the 900,000 oz gold at 3g/t gold in the main La India open pit.

Accordingly, in its May 6th 2020 RNS, Condor announced that total permitted open pit mineral resources had now increased to 1.12M oz gold, which could support a 50% increase in open pit production compared to 80,000 oz gold per annum in the PFS, to approximately 120,000 oz gold per annum for seven years. Condor stated in the RNS that the total permitted mill feed combining La India, Mestiza and America open pits would be 8,829Kt at 3.09g/t gold for 847,000 oz gold. Assuming a 92% metallurgical recovery, gold production is estimated to be 779,000 oz gold.

Therefore, because Condor has now quietly permitted production of 120,000 oz gold per annum and has released these thoughts, I assume that this is the new “base case” the company is working towards – and not the 80,000 oz gold per annum in the PFS, or the 100,000 oz gold per annum in the SP Angel note. There would not have been much point in applying for the additional permits, with all the additional paperwork and conditions involved (which Condor has now almost worked through) otherwise.

To match this scenario, Condor has stated that it is examining a plan requiring a considerably lower initial capital cost, combined with a two-stage approach. This starts by targeting the higher grades within the three permitted open pits to produce approximately 50,000 oz gold per annum – increasing capacity in year three or four (funded by the earlier cash flow) to add in the underground resources, so increasing production to about 170,000 oz gold per annum.

However, as explained, Condor has not accompanied these scenarios with any updated financial estimates or economics, and the 2017 updated technical report still stands, against my own estimate that its 8% NPV increases to around $250m now. At the 5% discount rate that most Canadian miners now think is appropriate for a near-term producer, that $250m NPV would increase further to around $300m.

(Note that I try to quote figures to approximate round numbers which are more easily remembered. Mining technical reports at PFS level are only accurate to 25% either way – and BFSs to only 10% – so to quote their exact mathematical results is nonsensical.)

All of which seems to be why Condor’s broker SP Angel (who in my February review I expected would publish a much more up-to-date economic analysis) has not in its May initiating report gone beyond assuming the 2017 plan for just the single La India open pit at a $110m capital cost, although updated for a $1,600/oz gold price.

So potential investors not following developments very thoroughly or doing their calculations will still not appreciate the progress being made towards higher value, and this probably explains why – with different scenarios and none yet confirmed, and with a variety of profit and NPV estimates at various gold prices, not to mention a variety of NPV discount rates – parts of the market (especially in North America) do not yet fully recognise where Condor has got to, or that it is nearly ready to start construction. They will also, of course, be waiting for confirmation of how Condor will finance any of its options, whether initially cheaper, or in line with the original full-scale start-up cost.

The situation is explained in Condor’s August 14th RNS in the Chairman’s comment: “Condor currently has 1.12M oz gold open pit Mineral Resources permitted for extraction(8,583Kt at 3.3g/t gold for 903,000 oz gold in the Indicated category and 1,901Kt at 3.6g/t gold for 220,000 oz gold in the Inferred category) inclusive of a Mineral Reserve of 6.9Mt at 3.0g/t gold for 675,000 oz gold following the grant in May 2020 of Environmental Permits to extract gold from 2 high grade satellite feeder pits, which in aggregate have circa 232,000 oz gold at 5.5 g/t gold. The Company is targeting production of 120,000 oz gold per annum from open pit material for 7 years, which compares to the PFS of 79,300 oz gold p.a. for the same period. The significant underground Mineral Resource of 1.2M oz gold (1.27Mt at a grade of 5.8 g/t gold, for 238,000 oz gold in the Indicated category and 5.47Mt at a grade of 5.1 g/t gold, for 889,000 oz gold in the Inferred category) will be analysed and potentially converted to Mineral Reserves after production from the open pits has started. Condor continues to de-risk the Project by fulfilling conditions of the Environmental Permit to construct and operate a new mine at La India by making significant progress with land acquisition, engineering and other technical studies. The objective remains to commence site preparation and place a deposit on a processing plant by the end of 2020.”

Included among the factors that Condor has to consider that will affect its decision are the availability (and cost) of any cheaper or smaller start-up plant (the company has already made conditional offers for some) and the possibility instead – or simultaneously (which it continues to discuss with nearby gold producer Calibre Mining) – of trucking Condor’s ore to be processed in what is currently under-utilised plant at one of Calibre’s mines. That will entirely avoid the need for plant, with the actual mining being undertaken by contractors. What we do not know of course is the processing cost that will have to be paid to Calibre.

Regardless of which scenario Condor goes for, the results for any of the scenarios look exceptionally good at the current gold price. Especially the returns on investment (IRR) – whose rate well above 50% opens up more options for Condor to obtain loan or similar financing which can be rapidly repaid, and will limit the need for share issues – a main consideration that Mark Child and Jim Mellon as key shareholders have made plain.

So, I think shareholders can take it that Condor will go for an option that minimises shareholder dilution and will deliver early results, even if the full original plan is deferred until later cash flow can fund its higher capital cost.

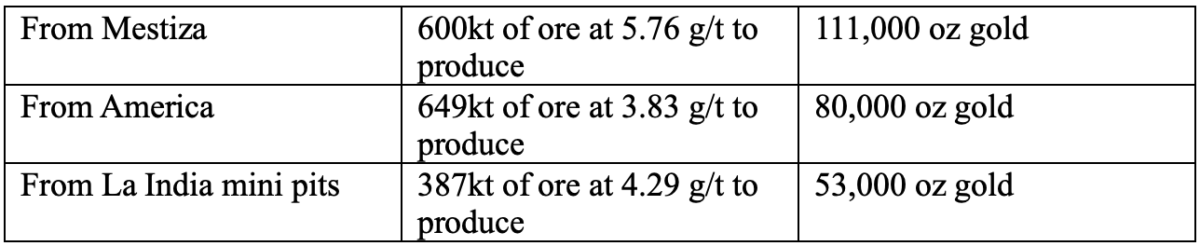

An example of how such an option might work is shown in the table below published by Condor in its March 4th RNS. Instead of fully excavating the main La India pit from the start, with high cost to get to the rich veins at the bottom, this would involve opening ‘mini’ pits’ within it and mixing its selected higher grade ore with the higher grade ore from the satellite pits, to produce the following tonnages and head grades that it can feed to the mill in the first five years, and starting production about a year earlier than in the original, full scale, scenario.

This scenario gives 1.64Mt at an average grade of 4.6 g/t for 245,000 oz gold of mill feed, compared with grades from the full La India pit which would have been 3.0 g/t.

Together with a smaller, cheaper 1,000tpd plant (and even if toll milling the ore is not possible) the higher grades will increase early cash flow, the prospect of which will not only give an earlier boost to the share price, but would make financing much easier via short term loans that reduce the need for equity.

Such short-term loans can come in the form of asset financing (against the plant), and ‘gold loans’ – repaid with gold at a price struck far enough below the going price so as to give the lender a return. Such a loan was struck recently by a Far East investment house to guarantee it an effective 14% interest rate. While that might look high, if repaid within two years such a rate isn’t too onerous in practice.

While the market awaits Condor’s production decision, investors might be wondering about the effect on Condor’s rating and NPV of an initially lower production scenario. But as I have explained elsewhere, I believe NPVs (and values ‘in the ground’) are not a realistic guide to a miner’s share price. Rather, as it approaches production, investors begin to look at earnings and cash flows, which I believe will make Condor’s shares look more compelling than would any other base of valuation.

In the scenario shown above, at a conservative $1,850/oz gold price, and after a conservative $800/oz cash cost (conservative compared with the $690/oz given in the 2014 technical report) 244,000 ounces over five years would deliver annual average cash flow after royalties and tax (which will not be payable initially) of at least $38m, which would repay well within two years any loans needed to start production in a limited way.

Following a £6.6m fund raise in May at 36.5p and some warrant conversions, Condor had £7.5m of net cash at the end of June. Assuming the same rate of £122,000 of monthly admin expenses as in the first half, that should see it through well into 2021 and contribute to whatever extra financing (probably mostly via loans) is needed for construction. Share options, and outstanding warrants that are now ‘in the money’, would raise a further £10.3m, against the issue of another 26.7m shares, when the total diluted shares will be 144m.

On that number of shares, the $38m net income I have speculated above that could result from a limited start scenario, would be 26c/share (21p) and highlight just how cheap the shares would be even at 100p let alone the present 50p. That would only be the initial rating seen by investors. They will have the prospect of production ramping up considerably after only a few years with little or no need for further share issues as the plant is upgraded and funded from cash flow, and as the additional 1Moz or so of underground resource is added.

That, of course, is merely my speculation until Condor decides on a plan. But what one can say at the moment is that, once Condor announces its decision, probably by the end of this year, whether accompanied by an up-to-date technical report and forecast or not, more investors will be drawn in to accord the shares a more appropriate rating.

Looking even further ahead is the prospect which Condor considers is a high possibility, of adding enough resources through drilling its wider exploration area to take it into the 5Moz category of gold miner – one which attracts a higher than average stock-market rating. A realistic market value at that stage (as opposed to an unrealistic NPV based one) of more than $250m would not be out of the question.

Disclaimer: Readers will know that Master Investor’s Chairman, Jim Mellon, is non-executive director of Condor and holds 15.9% of the company’s shares. Master Investor has received payment from Condor Gold for the production of this article. Condor Gold has helped with some factual information, but the opinions expressed here are solely those of the author.

Comments (0)