Aminex and Solo ink Kiliwani North deal as they await key approvals for gas sales deal

By Amy McLellan

Shares in Aminex plc ticked higher on Tuesday as the London-listed company provided an update on its flagship Kiliwani North gas development in Tanzania. Last year the project was pencilled in for production start-up in early 2015 and it seems this has now slipped to “first half of 2015” as the company awaits final approvals on a long-awaited gas sales agreement.

But the nuts and bolts of the development are making headway: the 2 km pipeline linking the KN-1 well to the new Songo Songo processing plant is expected to complete shortly, with pressure testing set to get underway this business quarter.

The GSA remains the key concern – it has been on the cusp of signing for the best part of a year now as the partners await approvals from the authorities. Aminex this week said it expects the GSA to be signed “prior to any gas being delivered for pressure testing or commissioning”. A spokesman for the company said the delays were not unusual: “It can take a long time,” he said, adding “things are looking positive for the company now, with production due in the first half.”

Importantly, Aminex has now signed the asset sale agreement to sell an initial 6.5 per cent stake in Kiliwani North to AIM-quoted Solo Oil for a cash payment of US$3.5 million. The agreement between the two companies, announced back in October, also gives Solo an option to buy another 6.5 per cent on the same terms within 30 days of the signing of the gas sales agreement. This is an important deal for Aminex as it provides a US$7 million cash sum to pay down debt and help it remain in control of its destiny.

The transaction now only awaits formal approval by the Tanzanian authorities, which the companies say they expect “shortly”. Assuming that Solo elects to take its full 13 per cent, the Kiliwani North equity split will be Aminex with 52 per cent, RAK Gas with 25 per cent, Solo with 13 per cent and Bounty Oil with 10 per cent.

Once onstream the 45 BCF field will pump around 20 million cf/d, putting Aminex on track for much needed production and revenues in the coming months to strengthen the balance sheet. Aminex’s CEO Jay Bhattacherjee said the Board was pleased with progress given the backdrop of wider challenges in the oil and gas sector.

“The Board reaffirms to all shareholders that it is doing everything within its power to progress the GSA and move towards first production in the first half of this year,” said Bhattacherjee.

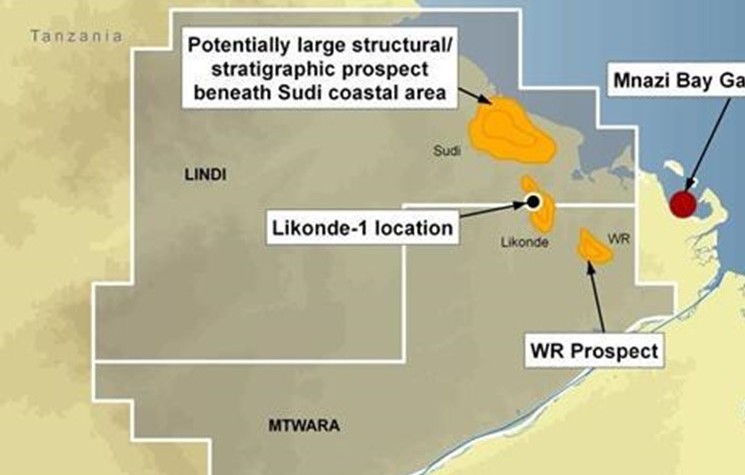

It’s also good news for Solo Oil, giving it a stake in a near-term production project in one of its core areas – it already partners Aminex on the Ruvuma PSA in Tanzania, home to the 2012 Ntorya discovery. For Solo, however, the deal is less binary as it’s portfolio is more diversified, with a stake in the Horse Hill project onshore UK, where US-based NUTECH Ltd has been brought in to help assess the scale of last year’s discovery.

Analyst Barney Gray of Old Park lane Capital said in a note on Solo Oil that the signature of the Kiliwani North GSA is “imminent and will be accelerated upon completion of the connection to the Songo Songo gas processing plant in the next few months”. This will be a key event for both companies, allaying investor jitters about this risk to near-term monetisation of the asset.

Comments (0)